Fibonacci Retracements Analysis 12.07.2017 (EUR/USD, USD/JPY)

EUR USD, “Euro vs US Dollar”

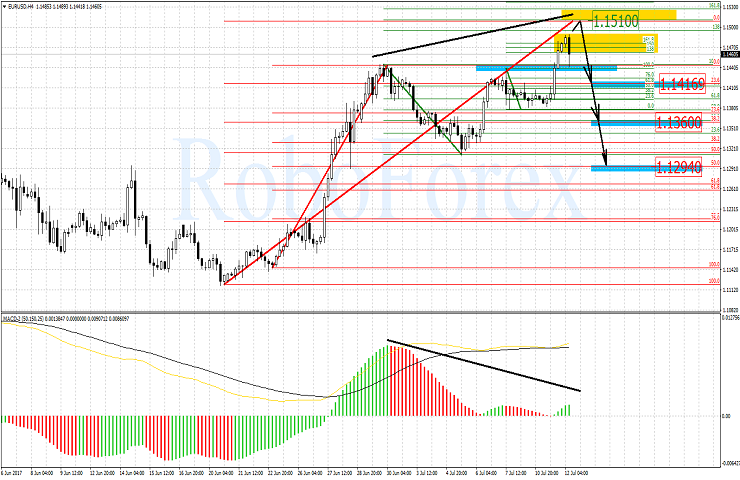

At the H4 chart, the ascending tendency continues, but the pair is starting to form the divergence reversal signal. The main target of the current growth may remain at 1.1510. After reaching it, the price may be corrected to the downside with the targets at the retracements of 23.6%, 38.2%, and 50.0% at 1.1416, 1.1360, and 1.1294 respectively. If the pair fixes between 1.1416 and 1.1360, the dominant tendency may change.

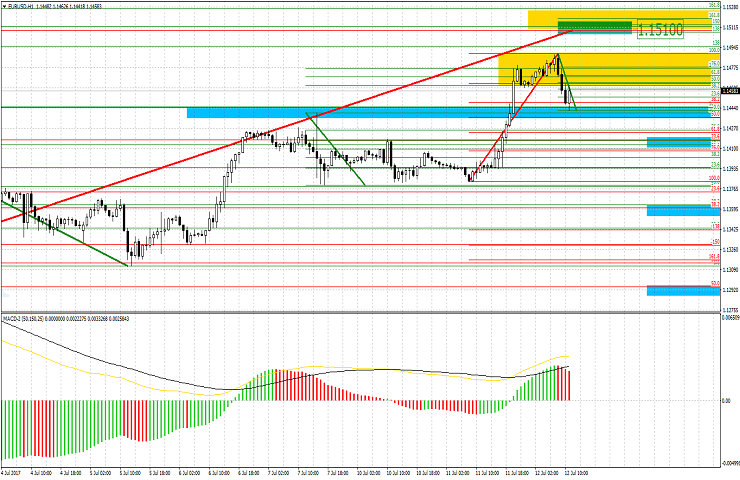

As we can see at the H1 chart, after a short sideways correction, the pair formed the ascending impulse and reached the retracement of 161.8%. By now, the previous ascending impulse has been corrected by 38.2%. if the pair finishes such correction and resumes growing, the closest target will be at 1.1510, which is the extension by 150.0%.

USD JPY, “US Dollar vs. Japanese Yen”

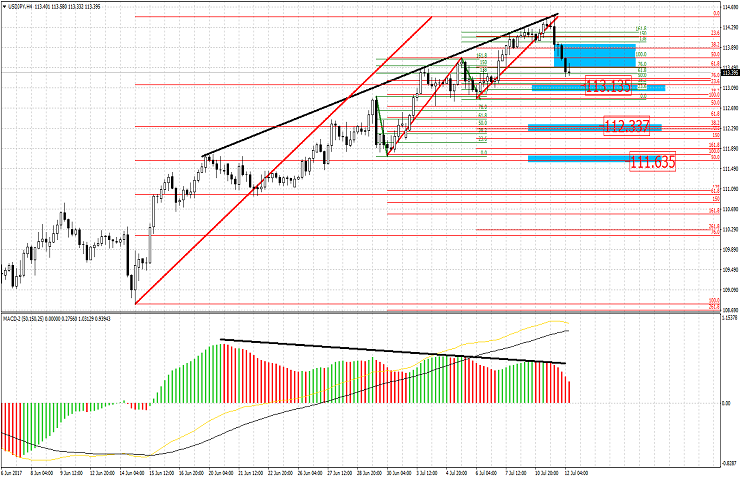

At the H4 chart of USD JPY, the price is correcting the uptrend, which may complete soon, but hasn’t completed yet. The signal that implies a possible reverse is the divergence. The closest downside targets are at the retracements of 23.6%, 38.2%, and 50.0% at 113.13, 112.33, and 111.63 respectively. If the pair fixes between 113.13 and 112.33, the current tendency may change.

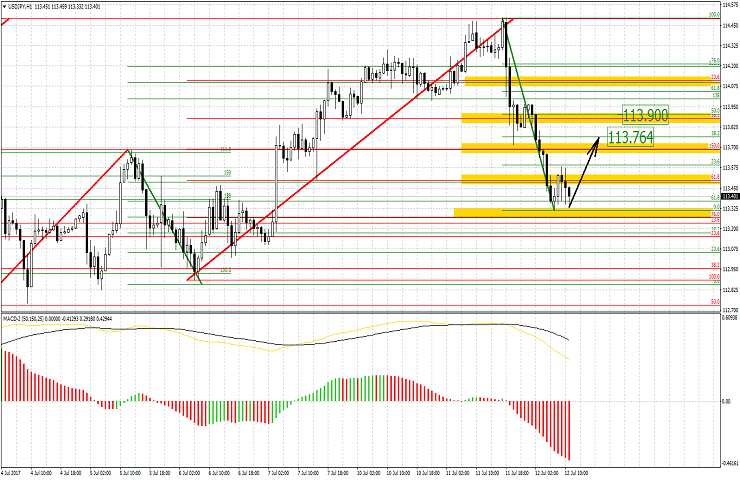

As we can see at the H1 chart, the previous uptrend was corrected by almost 76%. Possibly, in the near future the pair may be corrected to the upside. The most possible target of this pullback is at 113.76, which is the retracement of 38.2%. in addition to that, the next target of the pullback may be at 113.90, which is the retracement of 50.0%.

RoboForex Analytical Department

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.