Fibonacci Retracements Analysis 24.07.2017 (EUR/USD, USD/JPY)

EUR/USD

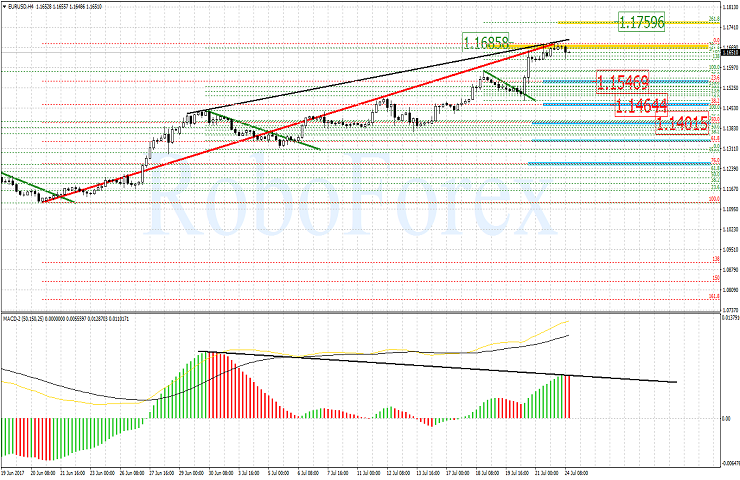

The EUR/USD pair has completed a rise towards the intermediate elongation Fibo level 261.8% (1.1685). The 1.1759 mark can act as the next target for the current upward move. That said, a divergence is being formed at the moment which points to a possible rebound or reversal. The most probable targets for a possible downward correction move are Fibo levels 23,6% (1.1546), 38.2% (1.1464) and 50.0% (1.1405).

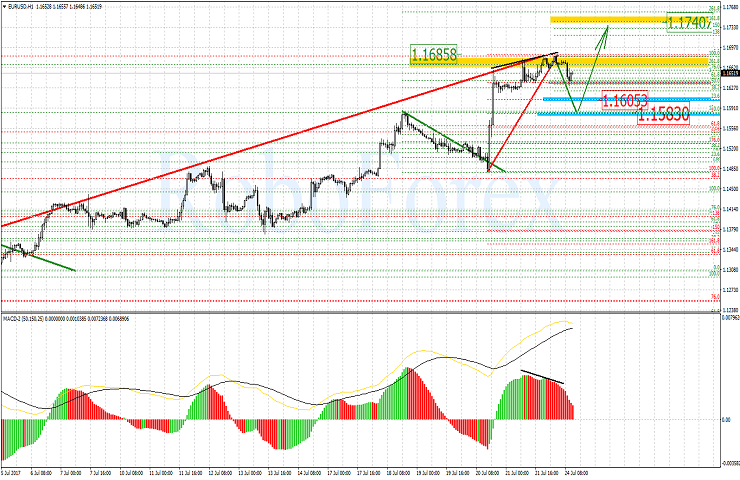

The H1-chart of EUR/USD shows a divergence which suggests a possible correction move. The correction move has brought the pair to 23.6% Fibo level. The next nearest targets for the pair are 1,1605 and 1,1583 markets (38.2% and 50% Fibo levels correspondingly).

USD/JPY

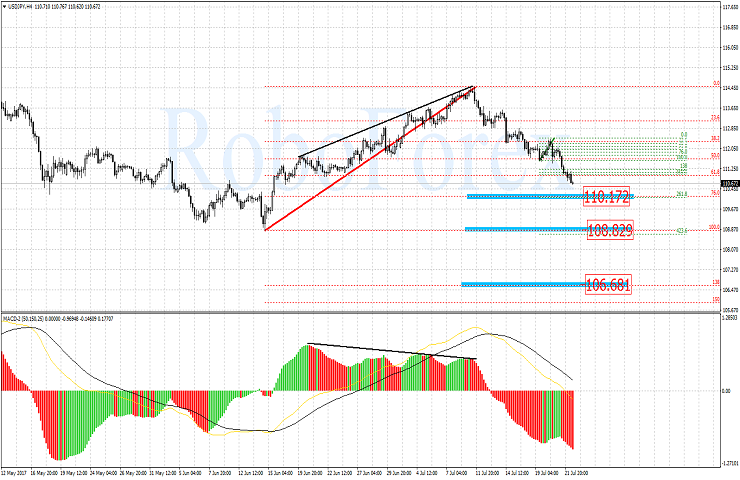

The H4-chart of USD/JPY shows the descending move is still in force. After the pair reached 50% and 61.8% Fibo levels, it reversed back to 76.0% (110.17). But the most significant target is the local low at 108.82 and 106.68 mark (138.2% elongation level).

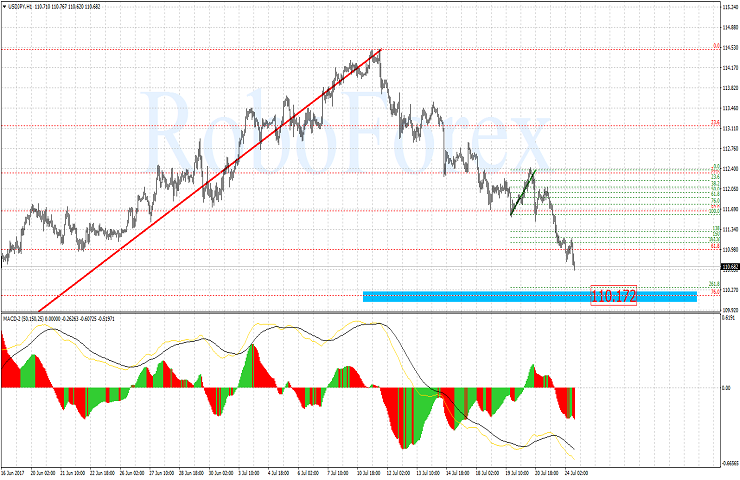

The H1-chart of USD/JPY pair confirms the senior timeframe's picture.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.