Fibonacci Retracements Analysis 26.03.2021 (AUDUSD, USDCAD)

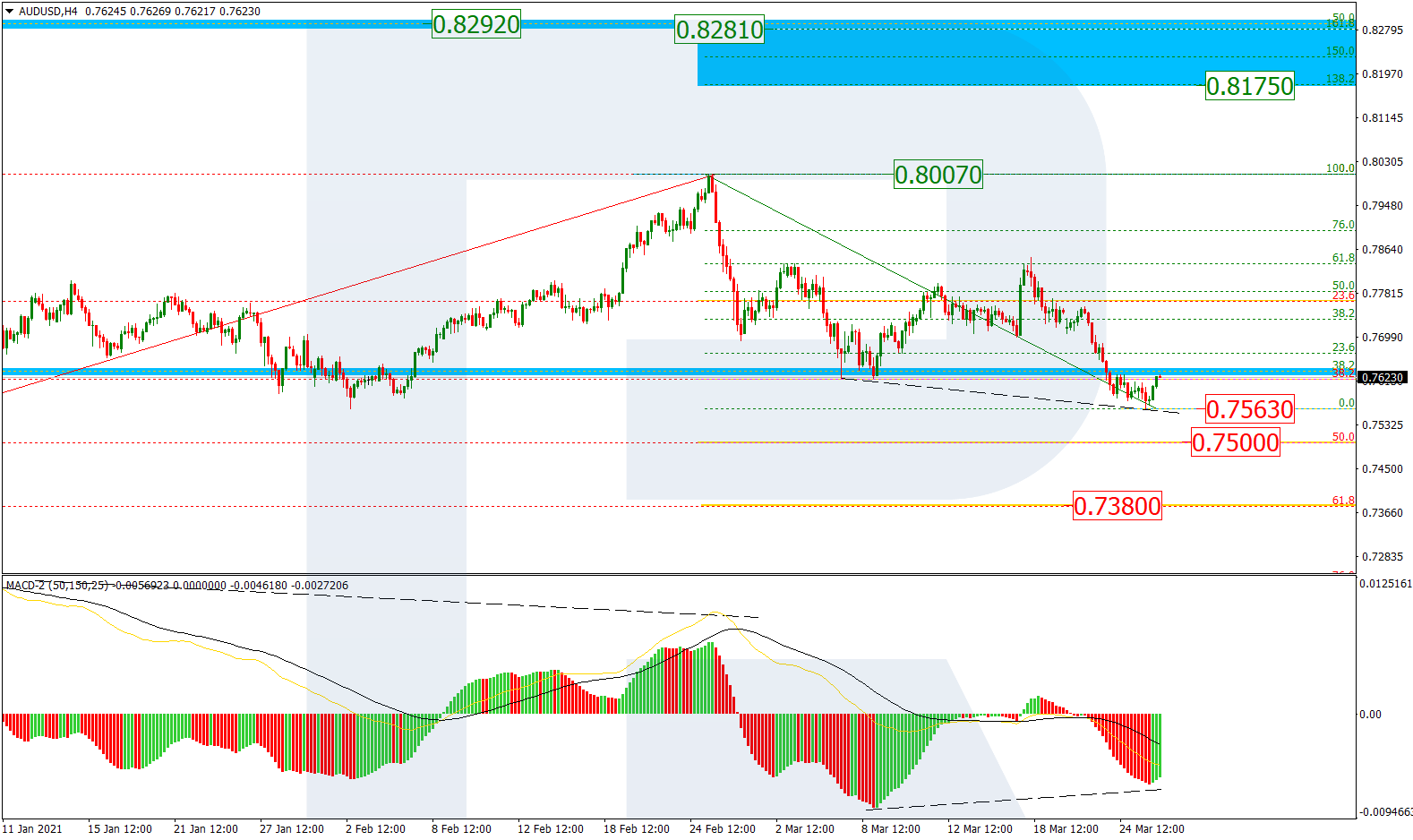

AUDUSD, “Australian Dollar vs US Dollar”

As we can see in the H4 chart, after breaking 38.2% fibo, the “bearish” correctional wave has failed to reach 50.0% fibo at 0.7500. At the same time, there is a local divergence on MACD, which may indicate a possible reversal and a new ascending movement towards the high at 0.8007 and the post-correctional extension area between 138.2% and 161.8% fibo at 0.8175 and 0.8281 respectively. On the other hand, if the price fails to break the high, the instrument may start a new descending wave to reach 50.0% and 61.8% fibo at 0.7500 and 0.7380 respectively.

The H1 chart shows a more detailed structure of the current ascending correction after a convergence with the targets at 23.6%, 38.2%, 50.0%, 61.8%, an 76.0% fibo at 0.7668, 0.7732, 0.7785, 0.7837, and 0.7900 respectively. A breakout of the support at 0.7563 will lead to a further mid-term downtrend.

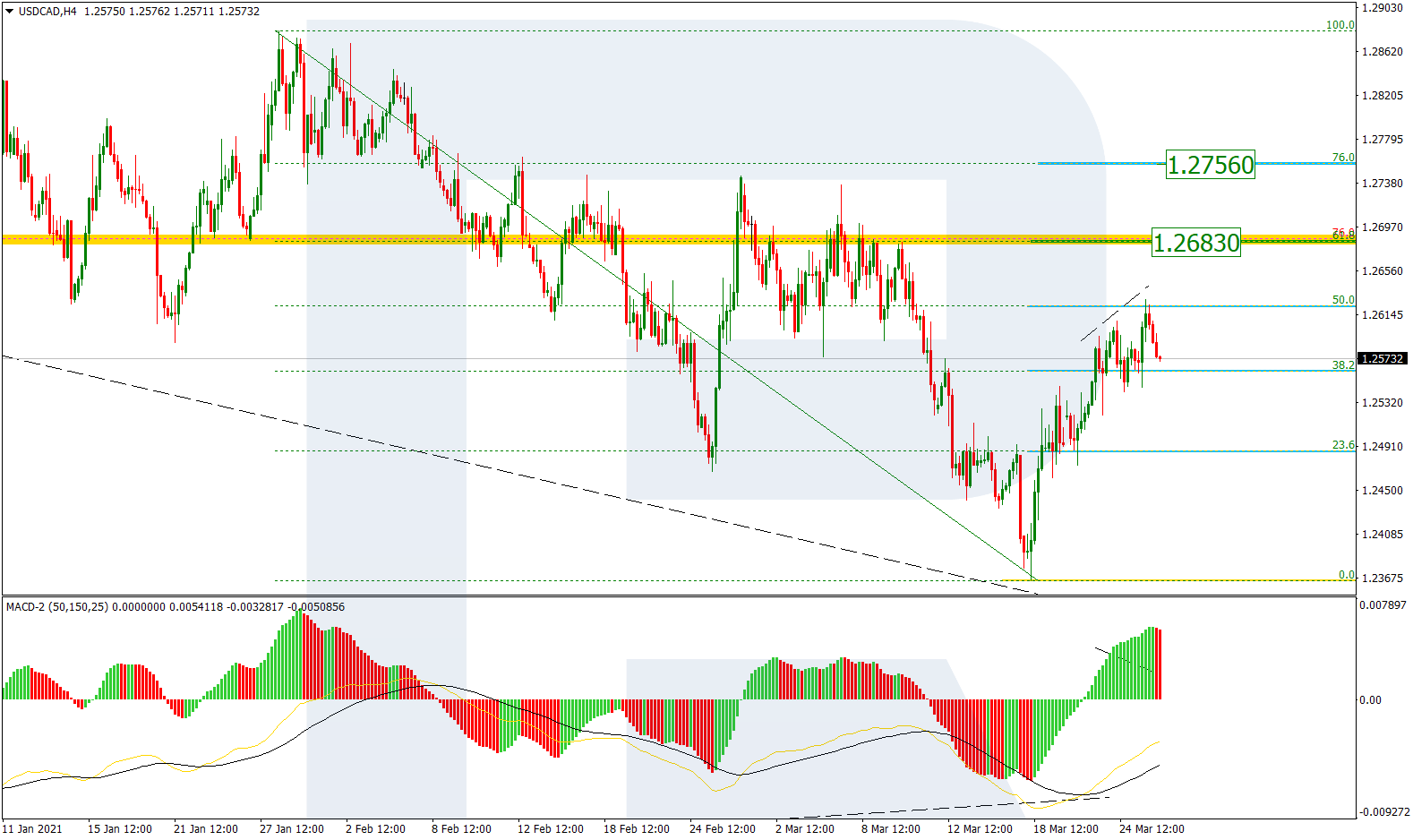

USDCAD, “US Dollar vs Canadian Dollar”

In the H4 chart, USDCAD is correcting upwards after completing another wave to the downside. After reaching 50.0% fibo, the pair has reversed but may soon resume growing towards 50.0% and 61.8% fibo at 1.2683 and 1.2756. respectively.

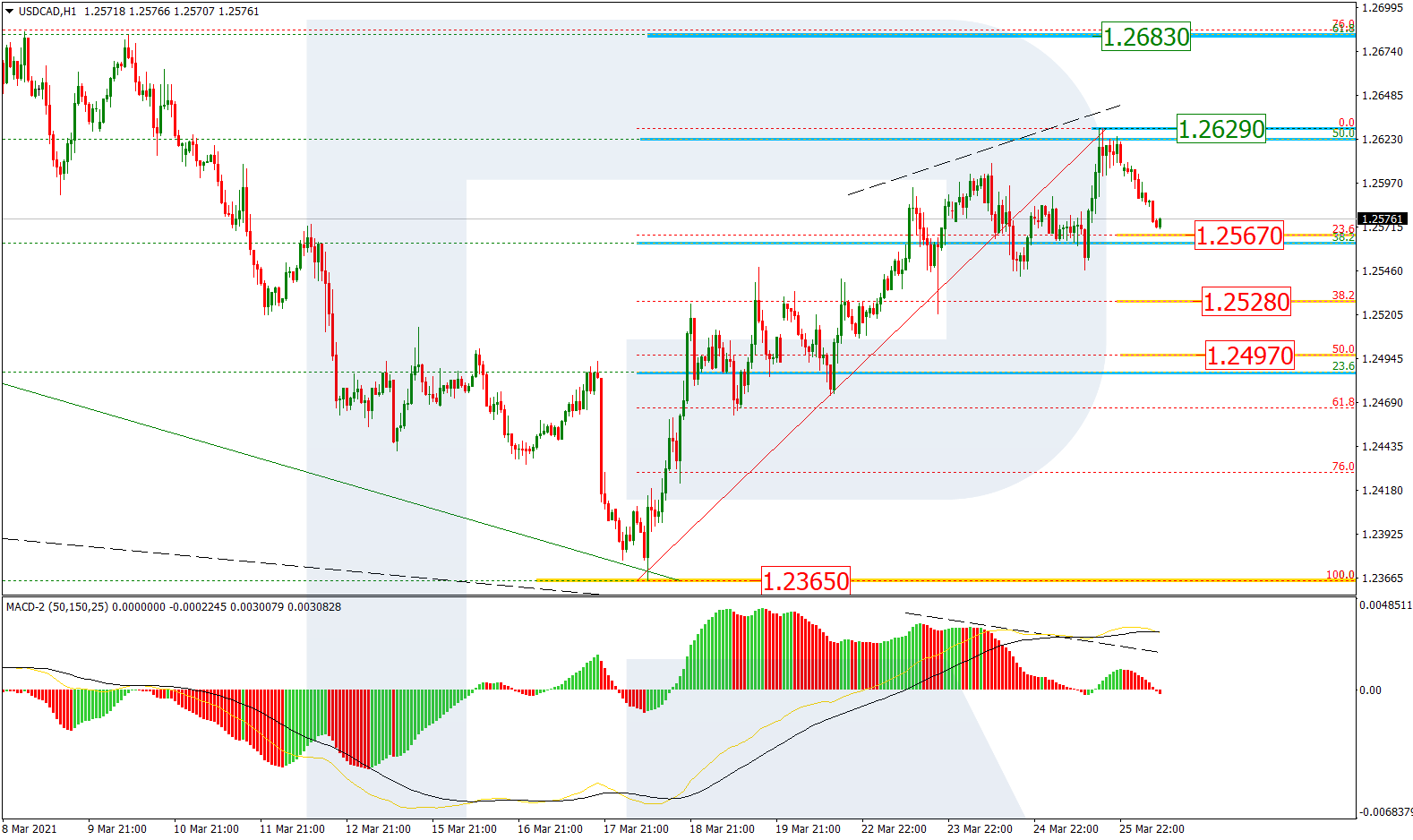

The H1 chart shows a short-term correctional downtrend after the rising wave, which is approaching 23.6% fibo at 1.2567 and may later continue towards 38.2% and 50.0% fibo at 1.2528 and 1.2497 respectively. The key support is the low at 1.2365, while the resistance is the high at 1.2629.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.