Fibonacci Retracements Analysis 15.12.2020 (EURUSD, USDJPY)

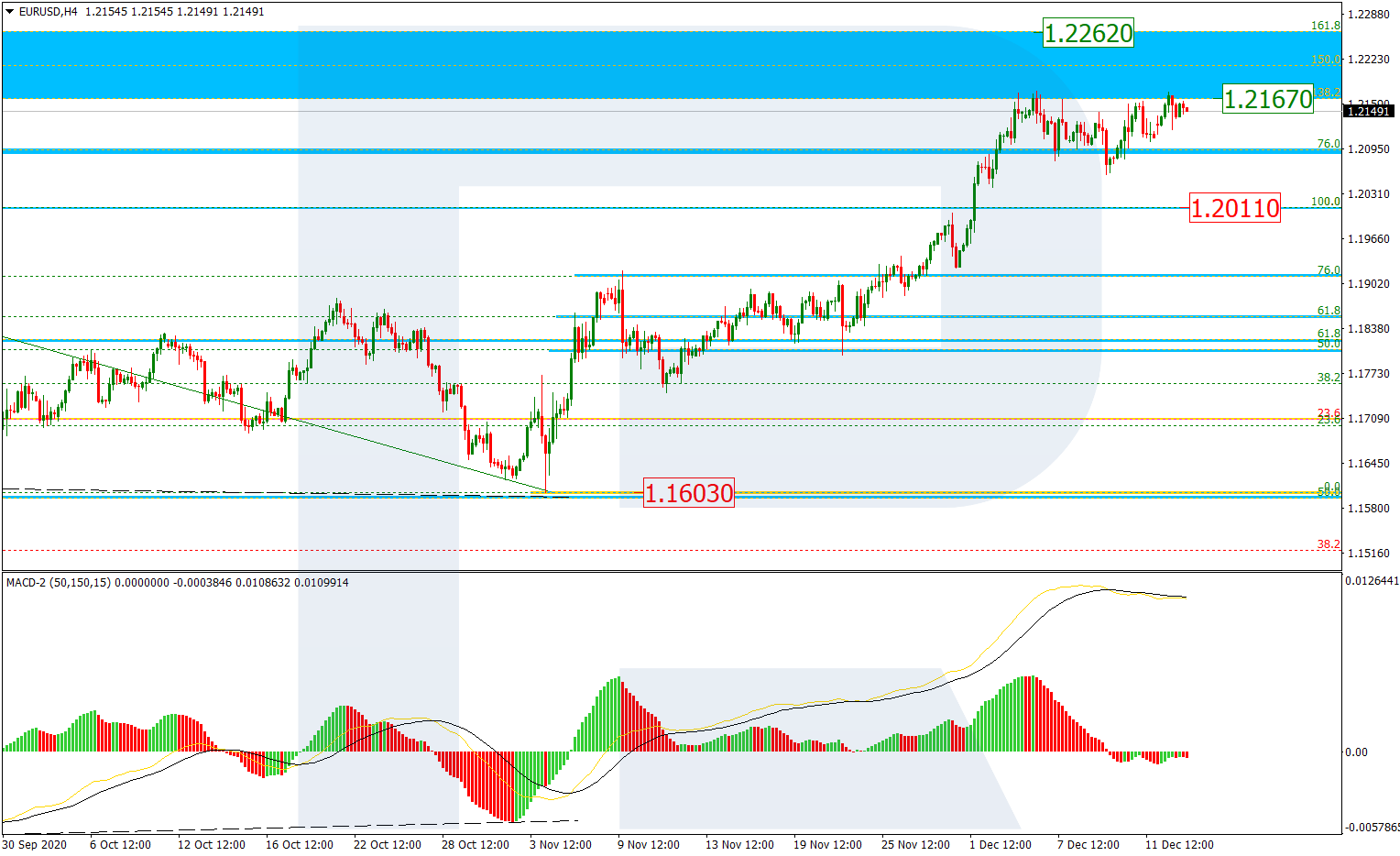

EURUSD, “Euro vs US Dollar”

As we can see in the H4 chart, after completing a short-term pullback, EURUSD is moving towards the high to break it. The next rising wave will be heading to reach the post-correctional extension area between 138.2% and 161.8% fibo at 1.2167 and 1.2262 respectively. The key support is the fractal at 1.1603, while the short-term one is at 1.2011.

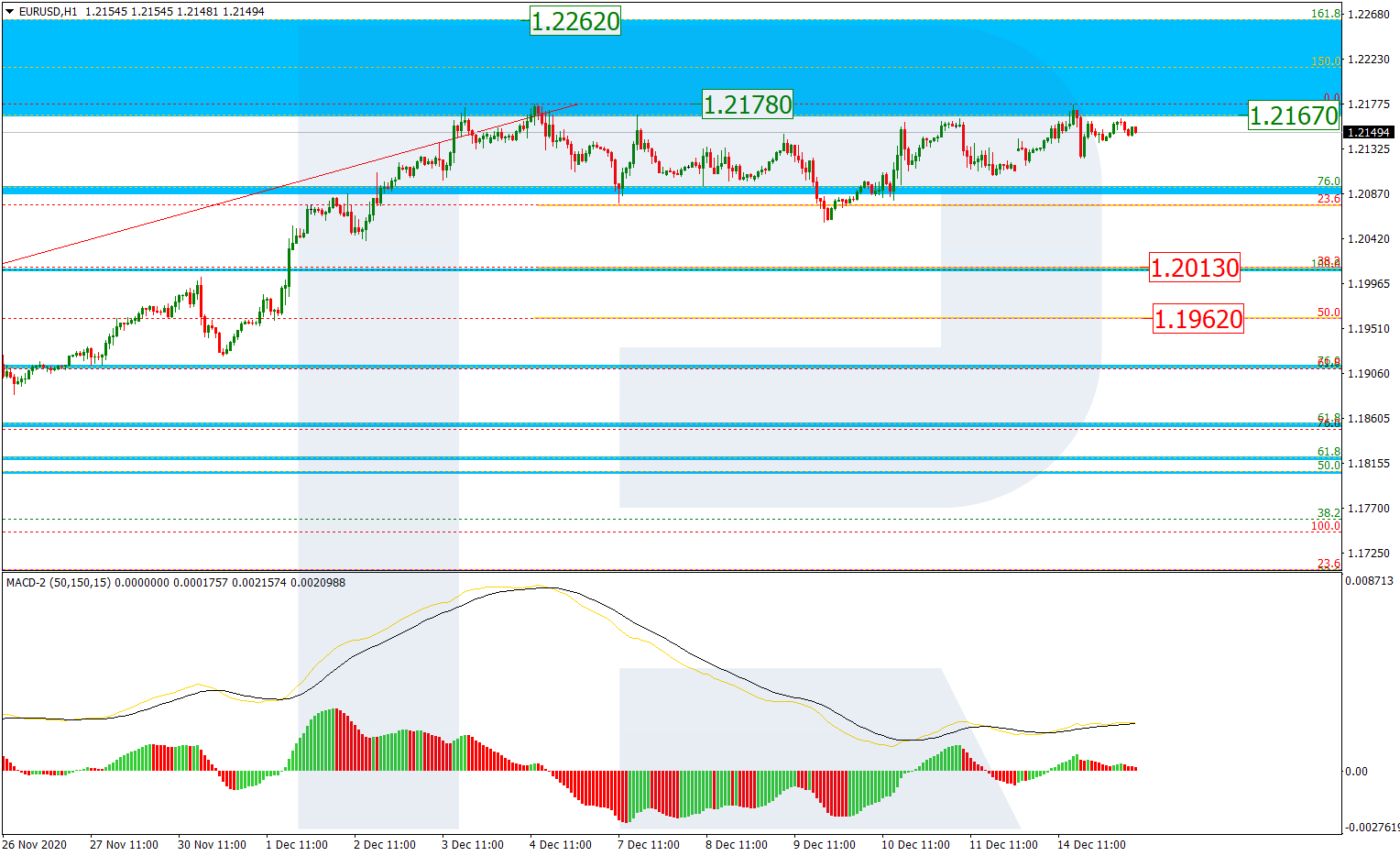

The H1 chart shows that the pair is approaching the high at 1.2178 after finishing the correctional downtrend at 23.6% fibo. The most probable scenario implies a breakout of the high but a rebound is also possible. In the latter case, the asset may start a new decline towards 23.8% and 50.0% fibo at 1.2013 and 1.1962 respectively.

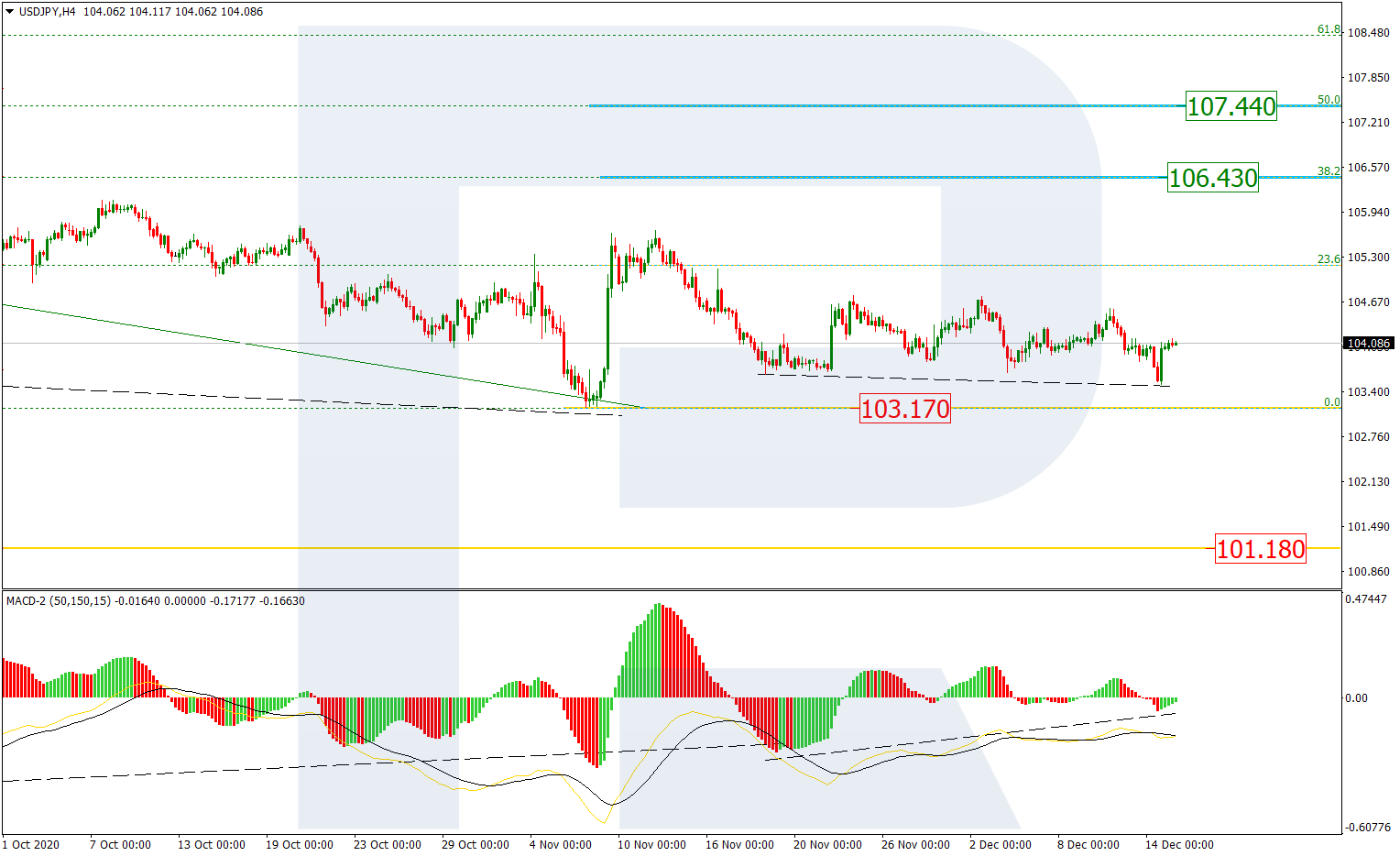

USDJPY, “US Dollar vs. Japanese Yen”

As we can see in the H4 chart, USDJPY is moving inside the same consolidation range and has slightly updated the local low. Considering a convergence on MACD, one may assume that the pair is about to start a new rising wave towards 38.2% and 50.0% at 106.43 and 107.44 respectively. The key support is the low at 103.17, a breakout of which will hint at further decline towards the fractal low at 101.18.

In the H1 chart, a convergence made the pair rebound from the local low after updating it. By now, the first ascending impulse has reached 23.6% fibo and may later continue towards 38.2% and 50.0% fibo at 104.34 and 104.59 respectively. A breakout of the support at 103.51 will indicate further long-term downtrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.