Fibonacci Retracement Analysis 10.11.2021 (GBPUSD, EURJPY)

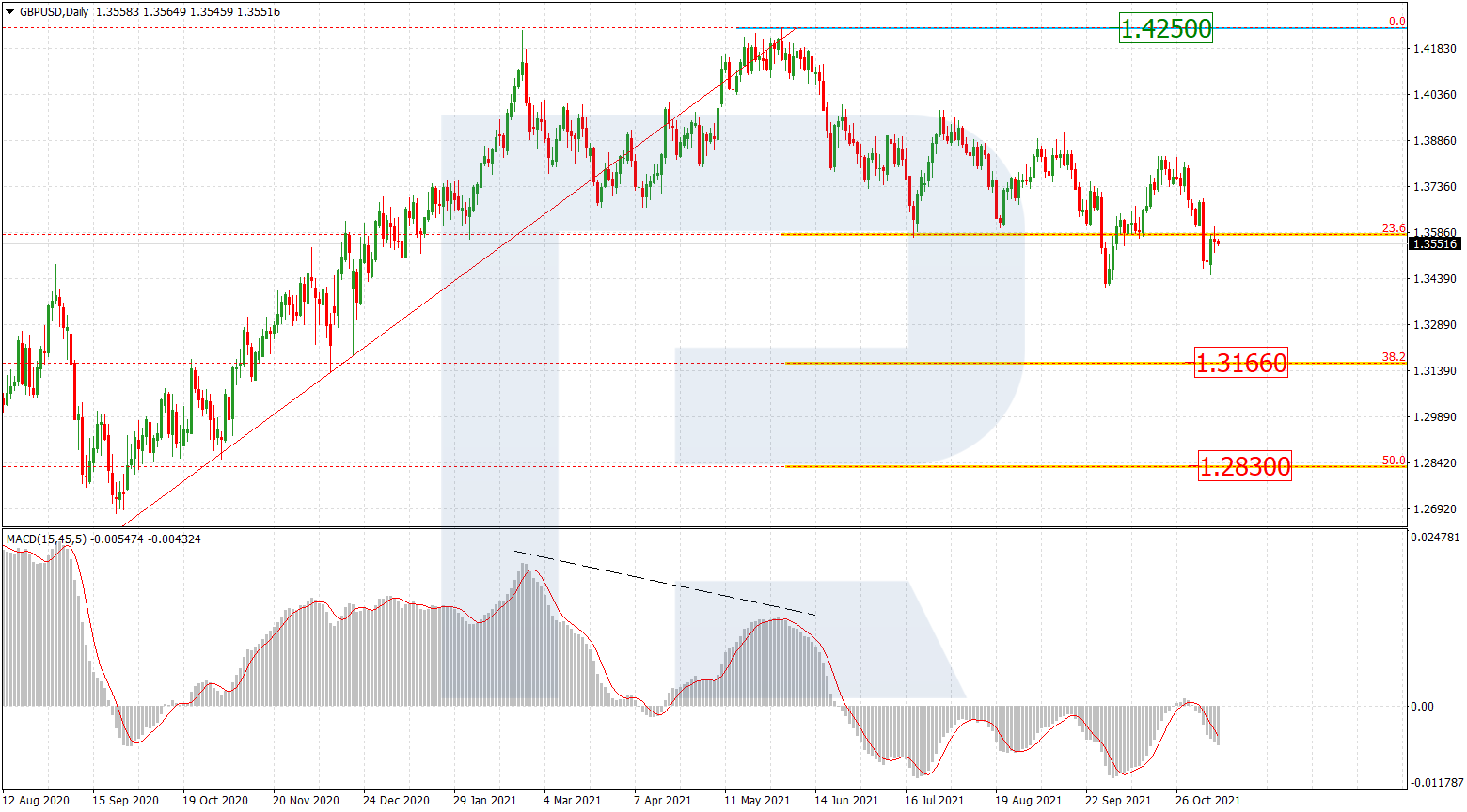

GBPUSD, “Great Britain Pound vs US Dollar”

On D1, the pair is developing a wave of decline, breaking through 23.6% Fibo. The next medium-term goals of the decline will be 38.2% (1.3166) and 50.0% (1.2830). The main resistance level is the high of 1.4250.

On H1, there is correctional growth. The pullback has reached 38.2% Fibo and is ready to proceed to 50.0% (1.3629) and 61.8% (1.3677). A breakaway of the local low of 1.3424 will signal about further development of the downtrend.

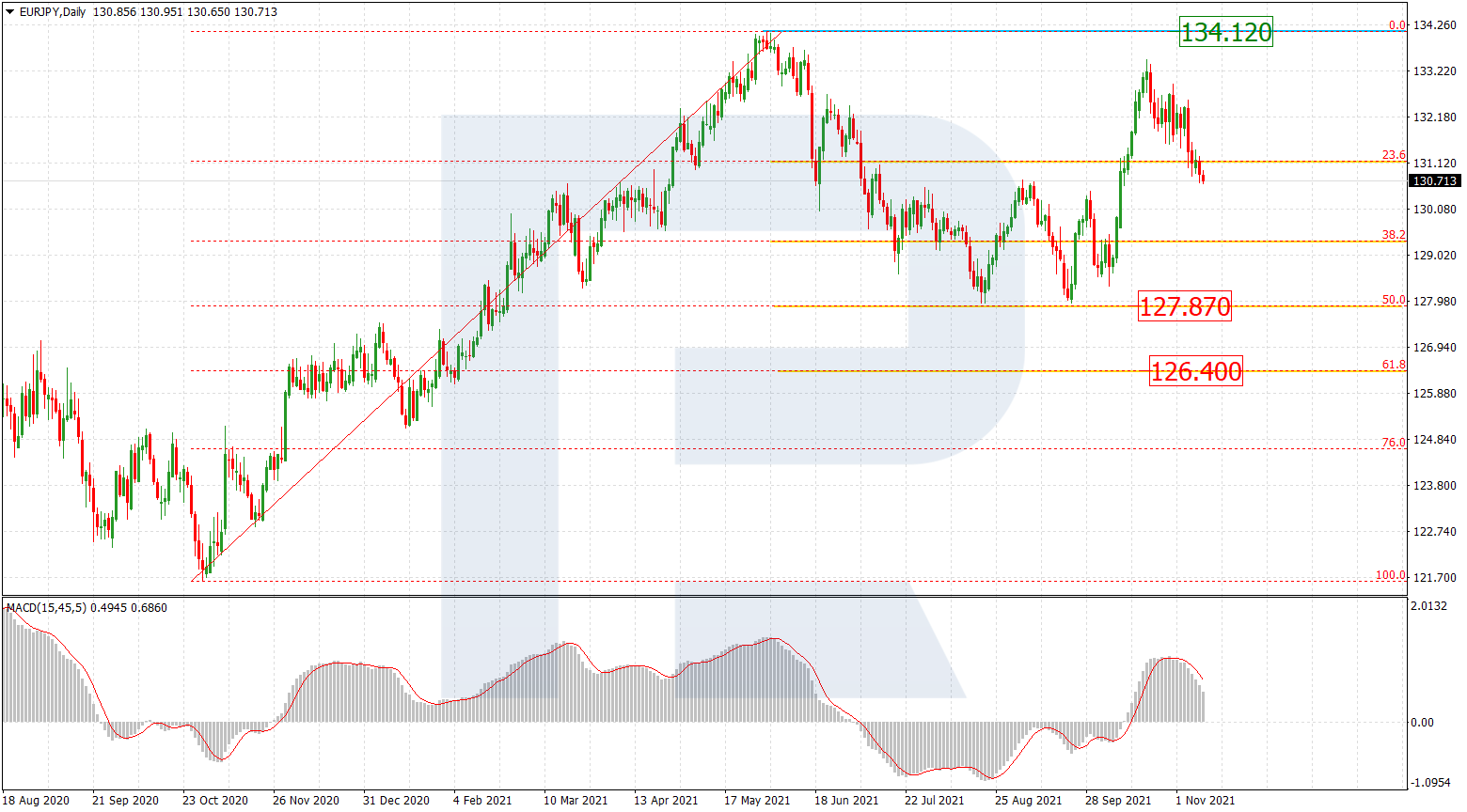

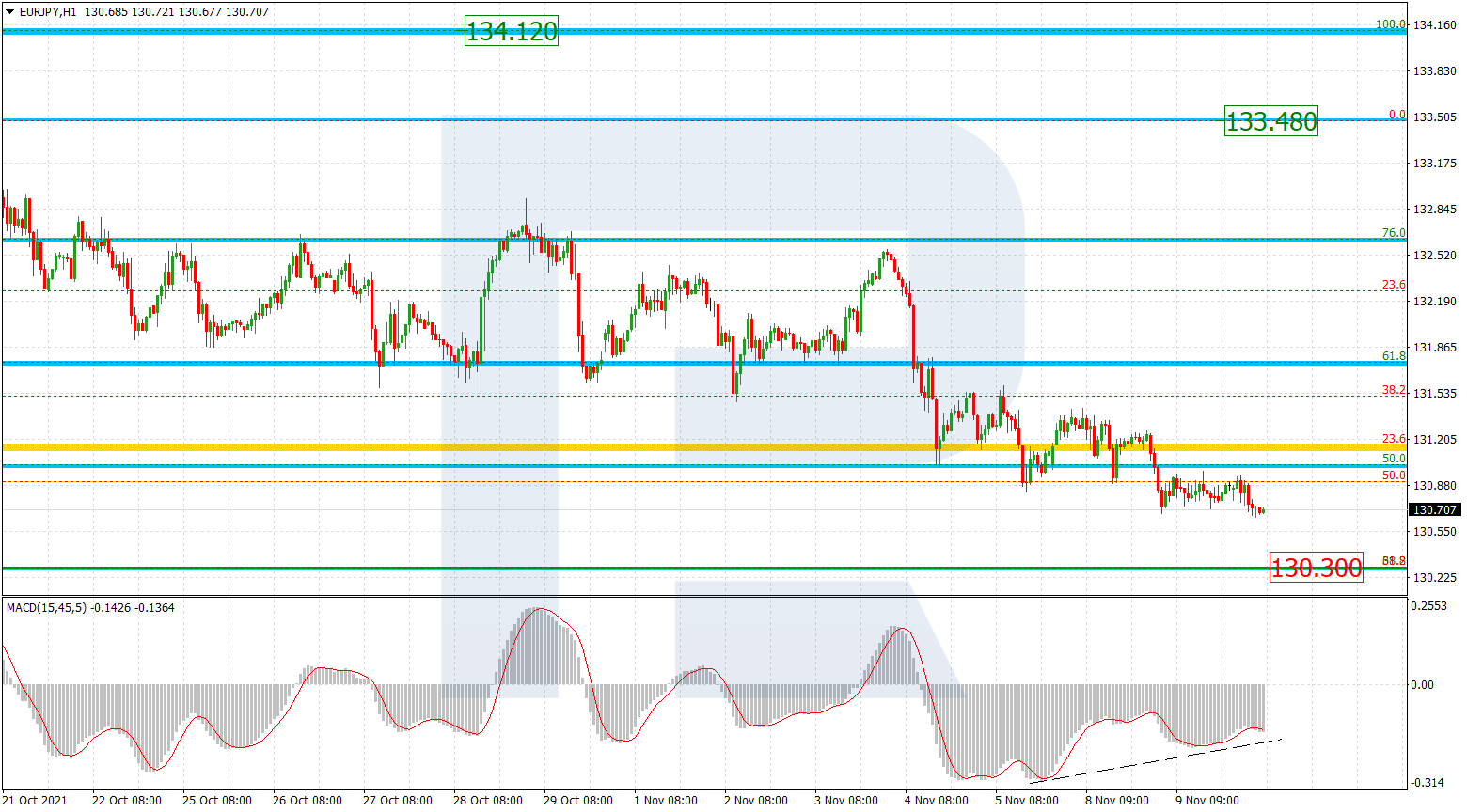

EURJPY, “Euro vs Japanese Yen”

On D1, the last impulse of growth failed to test the area of the high at 134.12. The current decline can be either a pullback after growth or the beginning of a wave of decline to 50.0% (127.87) and 61.8% (126.40) Fibo. A breakaway of the high can open a pathway to the post-correctional extension area of 138.2-161.8% (136.46-137.92).

On H1, there is a decline as a correction of the preceding wave of growth. The quotations are over 50.0% and are heading for 61.8% (130.30). However, note a local convergence forming on the MACD, which might mean an approaching reversal upwards, to the resistance level of 133.48.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.