Murray Math Lines 24.04.2012 (GBP/JPY, EUR/GBP, AUD/JPY)

24.04.2012

Analysis for April 24th, 2012

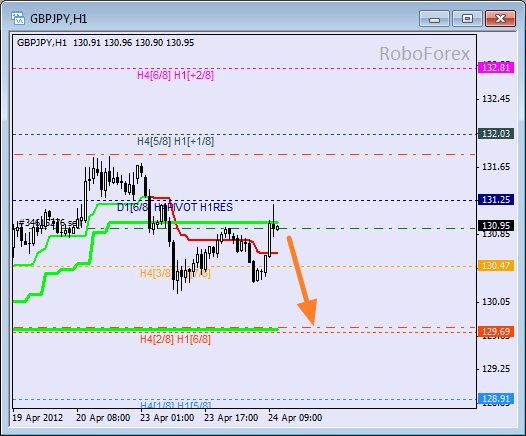

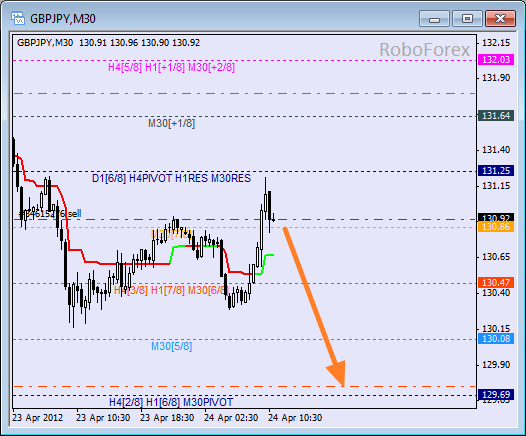

GBP/JPY

At the H1 chart the price has left an “overbought zone”, but currently the market is again testing the 8/8 level and the H4 Super Trend’s line. It looks like the market is going to rebound from these levels. If it does, the correction may continue up to the 6/8 level, where Take Profit on short-term sell order is placed.

At the M30 chart the lines are a bit different. If the price rebounds from the 8/8 level, the pair will fall down towards the 4/8 one. If this level is strong enough to resist and the market rebounds from it, the price may start growing up again.

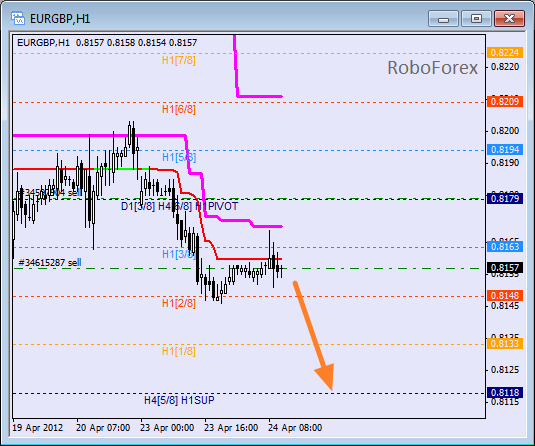

EUR/GBP

The EUR/GBP currency pair is being corrected below the H4 Super Trend. Most likely, this movement is just another consolidation inside the current down-trend, that’s why I’ve decided to open one more sell order. The target for the bears for the next several days is the 4/8 level.

At the H1 chart the price is moving below the 3/8 level towards the 0/8 one. The bears are supported by the Super Trends’ lines. Most likely, the price will start falling down again in the nearest future.

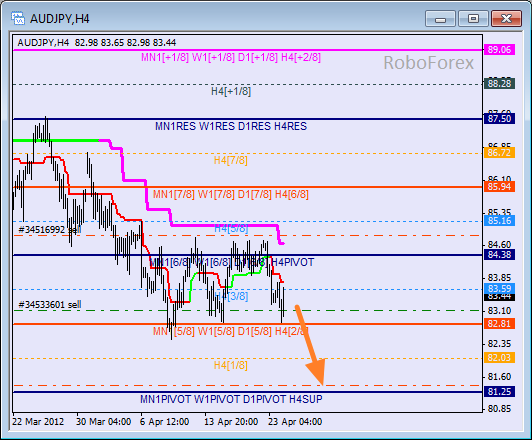

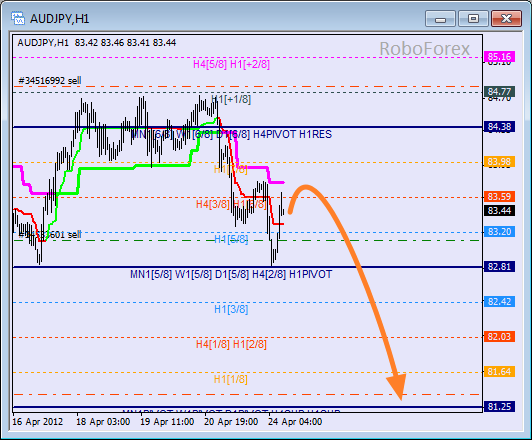

AUD/JPY

The 4/8 level turned out to be too strong for the bulls to break and the price rebounded from it. Taking into consideration the fact that the market is moving below the 3/8 level, we can expect it to continue falling down towards the 0/8 one, where Take Profit on sell orders is placed.

At the H1 chart the correction started from the 4/8 level. The price is unlikely to move lower than The H4 Super Trend. The main target is still at the 0/8 level. If the pair is able to stay below the 3/8 level, the bears will continue pushing the market towards their target, the 0/8 one.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.