Murray Math Lines 26.04.2012 (USD/CAD, EUR/GBP, GBP/CHF)

26.04.2012

Analysis for April 26th, 2012

USD/CAD

Canadian Dollar continues moving downwards quite fast. The market is moving below the 3/8 level, thus indicating that it may continue falling down towards the 0/8 level. We can’t exclude a possibility that the market may reach the target level by the end of the week.

The lines at the H1 and the H4 charts are completely the same. The descending movement of the price is supported by the Super Trends’ lines. In the near term, we can expect the price to continue moving towards the 0/8 level.

EUR/GBP

The bulls’ attempt to start an active correction failed, and the pair returned to the H4 Super Trend’s line. If the bears break the line backwards, the price will start moving downwards again. The sort-term target is at the 4/8 level.

The descending trend is still very strong. The market couldn’t move higher than the 6/8 level, at the moment we can expect the descending trend to continue. The future scenario depends on how the price will move at the -2/8 level.

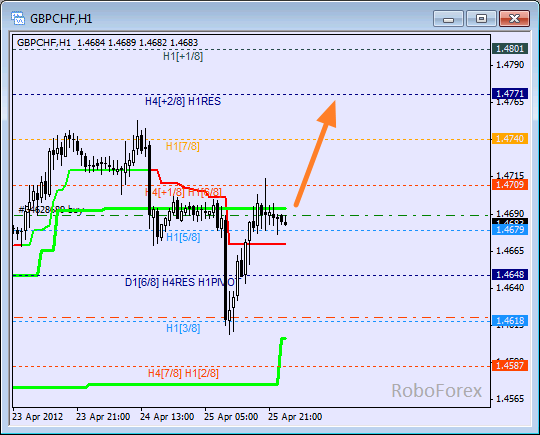

GBP/CHF

Yesterday the bulls survived the bears’ attack and now the main scenario implies that the price will continues moving upwards. It looks like the market is going to break the +2/8 level, and the lines at the chart will be redrawn. I’ve opened a short-term buy order, and will move the stop into the black as soon as possible.

At the H1 chart the pair is moving above the 5/8 level. Now the bulls have to break the Super Trend’s line and then they can move towards new maximums. If the buyers break the 8/8 level, the price will continue growing up.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.