Murray Math Lines 11.07.2013 (AUD/USD, GBP/CHF, AUD/JPY)

11.07.2013

Analysis for July 11th, 2013

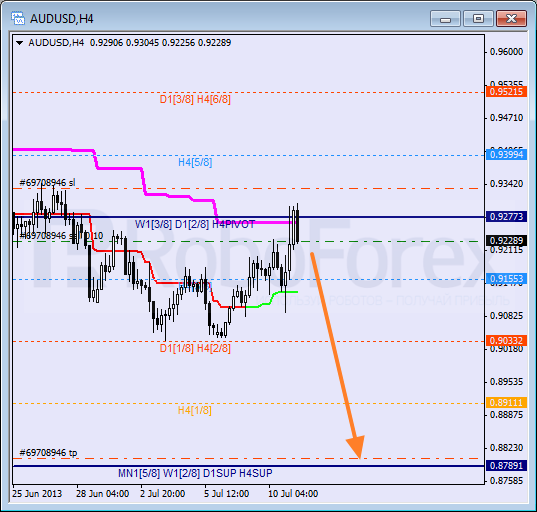

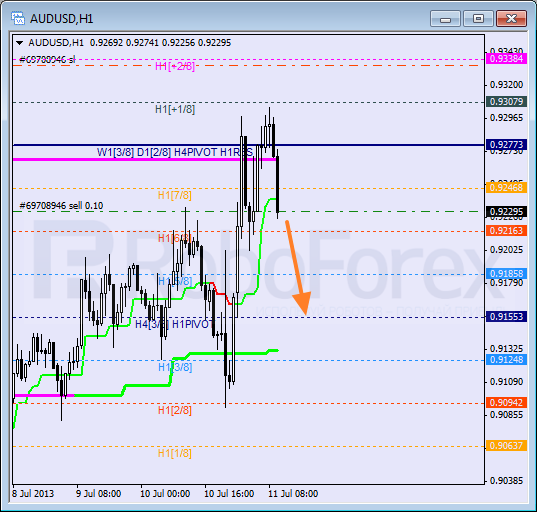

AUD/USD

Australian Dollar is trying to rebound from the 4/8 level and the daily Super Trend’s line. If the pair succeeds, the bears will start a new descending movement. In this case, the target will be at the 0/8 level.

At the H1 chart, the pair rebounded from the 8/8 level twice; the buyers weren’t able to keep the price inside an “overbought zone”. Most likely, in the nearest future the market will fall down towards the 4/8 level.

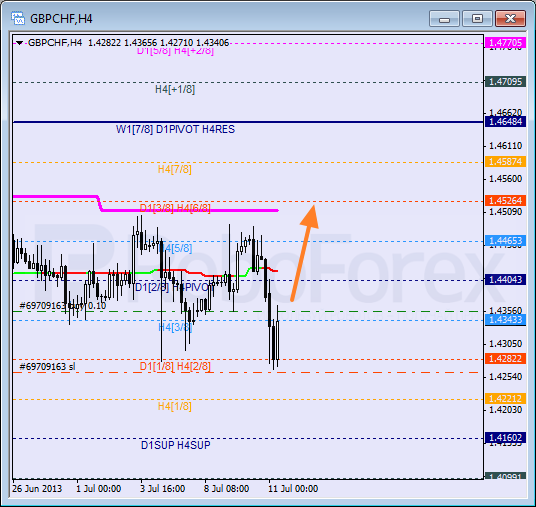

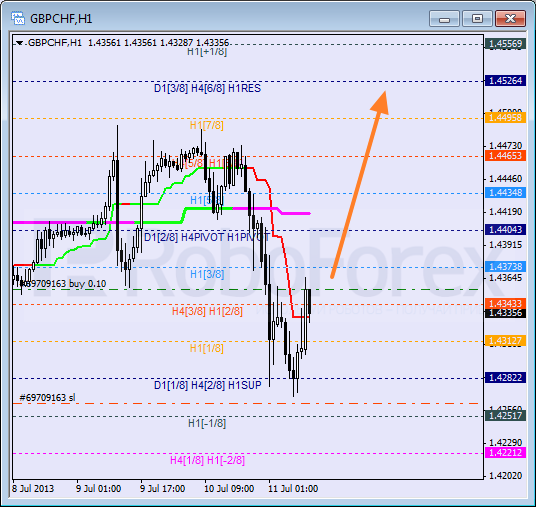

GBP/CHF

The pair rebounded from the 2/8 level once again. We can’t exclude a possibility that the price may start a correction during the next several days. If the pair breaks the daily Super Trend’s line, it will continue growing up.

At the H1 chart, the pair rebounded from the 0/8 level. The short-term target is at the 8/8 level, but in order to reach it, the bulls must break the Super Trends’ lines and the 5/8 level, and then stay above them. The situation is risky, that’s why I’ll move the stop into the black as soon as possible.

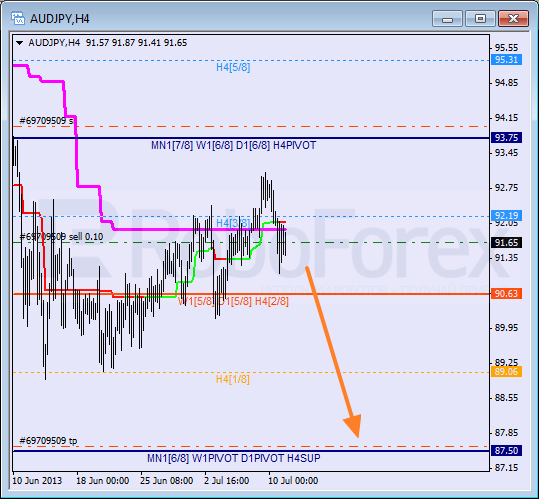

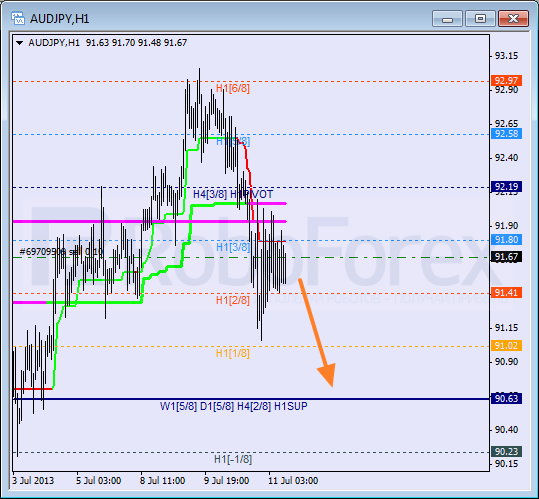

AUD/JPY

The pair wasn’t able to stay above the daily Super Trend’s line and right now the price is below it again. The pair is already moving below the 3/8 level, which means that it may continue falling down towards the 0/8 one.

At the H1 chart, the Super Trends’ lines formed “bearish cross”. There is a possibility that the 0/8 level may be reached during the day. If the price breaks this level, the pair will continue moving downwards.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.