Murray Math Lines 22.07.2011 (GBP/JPY, NZD/USD, GOLD)

22.07.2011

Analysis for July 22nd, 2011

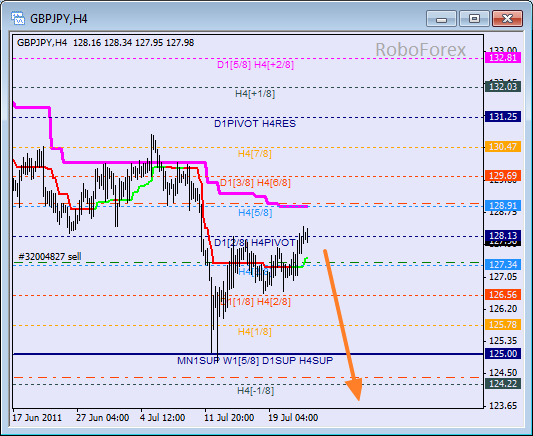

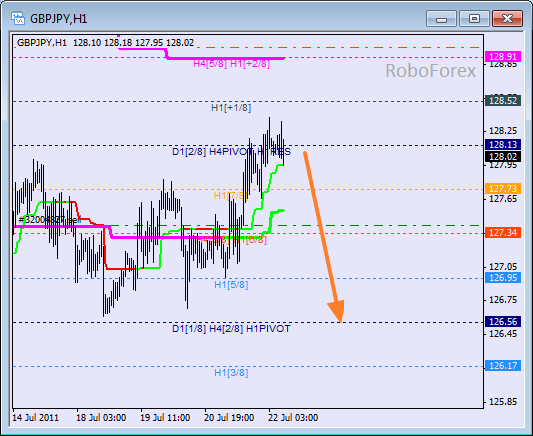

GBP/JPY

The price is testing the 4/8 level again. If the market fails to break and rebounds from it, the price will be able to move downwards to the 0/8 level or even lower. The bearish forecast remains in effect so far, but if the price breaks daily Super Trend, we’ll be forced to change it.

At the H1 chart the price has reached the 8/8 level. If the market breaks H1 Super Trend and fixes itself below it, down-trend may resume its movement. Аthe market passes the 6/8 level, the price will be able to continue falling down up to the 4/8 level.

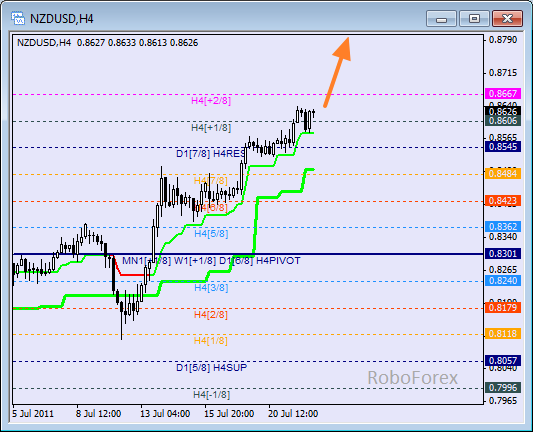

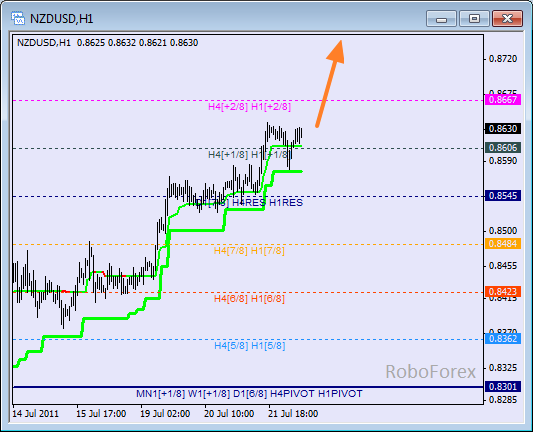

NZD/USD

The price is in overbought zone. After rebounding from H4 Super Trend, it is trying to fix itself above the +1/8 level. It may continue growing even higher. If the market breaks the +2/8 level, the lines will be redrawn.

The lines at the H1 chart are the same as H4, the market is moving to the +2/8 level. After the lines are redrawn, we’ll have new targets. I remind you that the 8/8 level (1.8789) of the daily chart is very strong and can slow down the price movement.

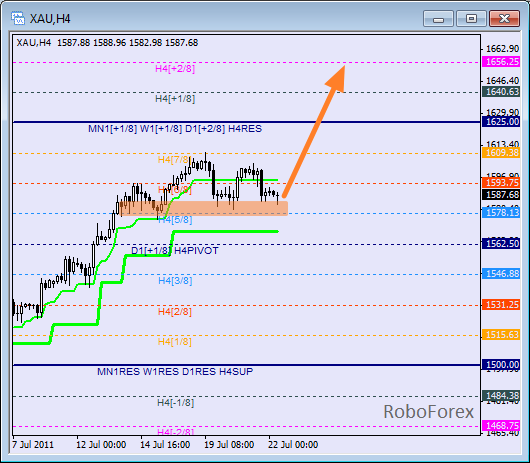

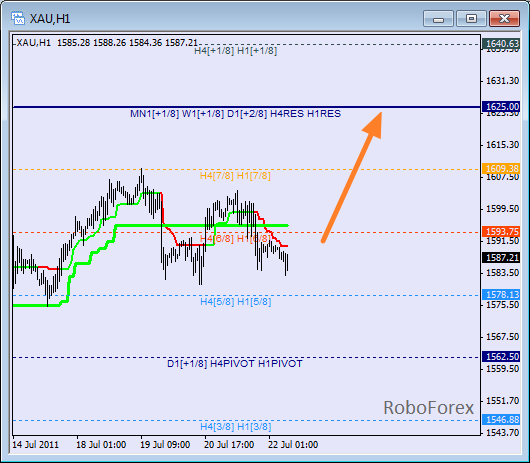

GOLD

The correction continues and is supported by the 5/8 level, the price isn’t able to get close to this level. If the price leaves this channel, it may continue growing up to the +2/8 level.

The lines at the H1 chart are the same as H4. The price is being corrected, H1 Super Trend is following it. This consolidation may take the form of Flag or Triangle patterns from classical technical analysis, thus indicating a possible continuation of the trend.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.