Murray Math Lines 28.07.2011 (USD/CHF, GBP/JPY, GOLD)

28.07.2011

Analysis for July 28th, 2011

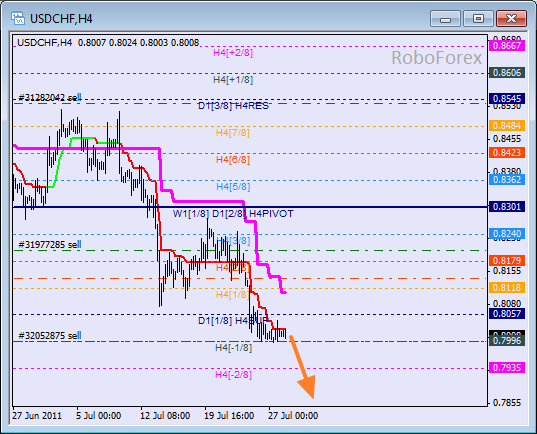

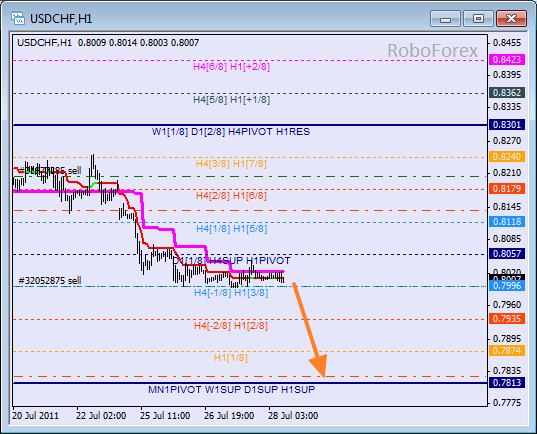

USD/CHF

The price wasn’t able to break the -1/8 level at the H4 chart. However, if we take into account the lines at the daily chart, continuation of down-trend will be the main scenario for the USD/CHF currency pair. If the price breaks the -2/8 level, the lines will be redrawn.

The price is consolidating below Super Trends’ lines, between the 3/8 and 4/8 levels. If the price breaks the 3/8 level and fixes itself below it, bearish trend will continue. The target is the 0/8 level where Take Profit on sell orders is.

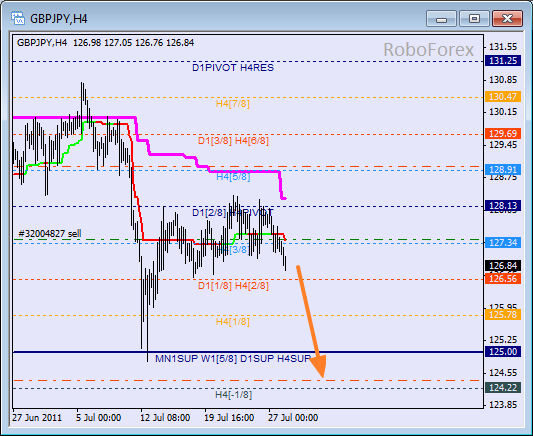

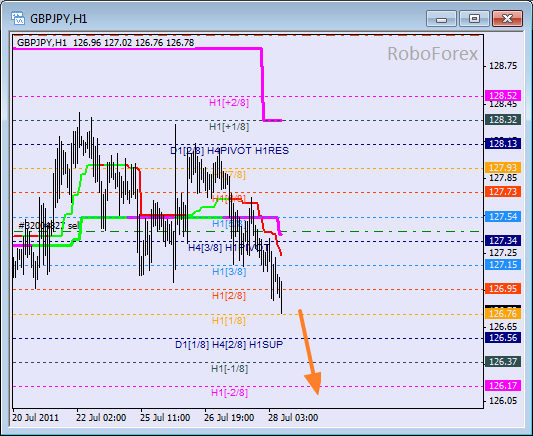

GBP/JPY

The price keeps falling down, the 3/8 level has been broken. Continuation of down-trend still remains the main scenario for the pair. Most likely the price will reach new minimum within a week or two. If the price continues falling down, I will move stop on sell order into the black.

The market keeps moving to the lower levels of the chart. H1 and H4 Super Trends have made bearish crossing, thus indicating that the price may continue moving downwards. After the -2/8 level is broken, the lines will be redrawn.

GOLD

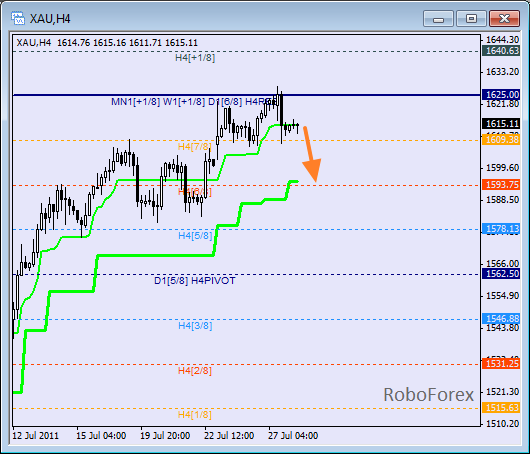

The price rebounded from the 8/8 level and is consolidating at the moment. Now the first target is the 6/8 level, as it can stop the correction if not broken by the market. The 6/8 level also matches daily Super Trend’s line, and this match makes the level even stronger.

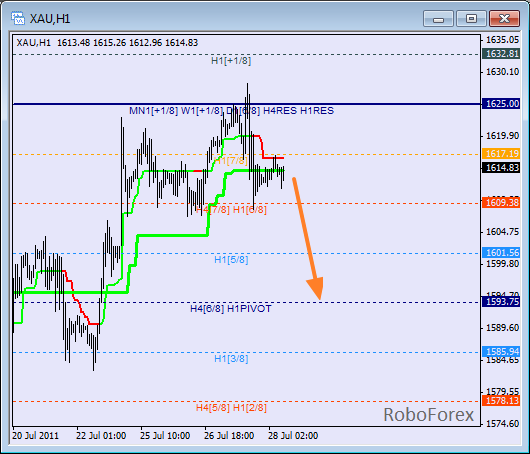

At the H1 chart the price rebounded from the 6/8 level and now is being corrected. Taking into account the lines at the H4 chart, the 4/8 level here is the same as the 6/8 level at the H4 chart. The way the price is moving at this level will tell us whether it is going to be corrected or continue growing.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.