Murray Math Lines 02.08.2011 (AUD/USD, GBP/JPY, USD/CHF)

02.08.2011

Analysis for August 2nd, 2011

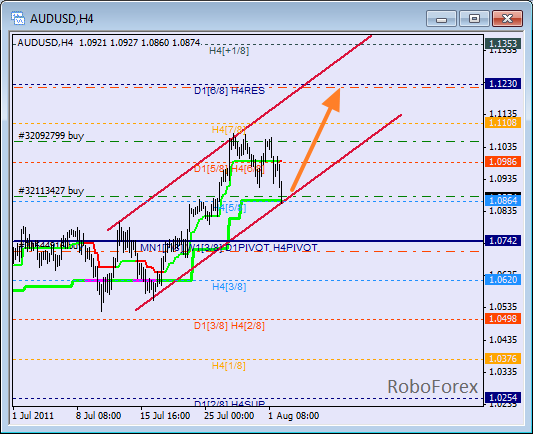

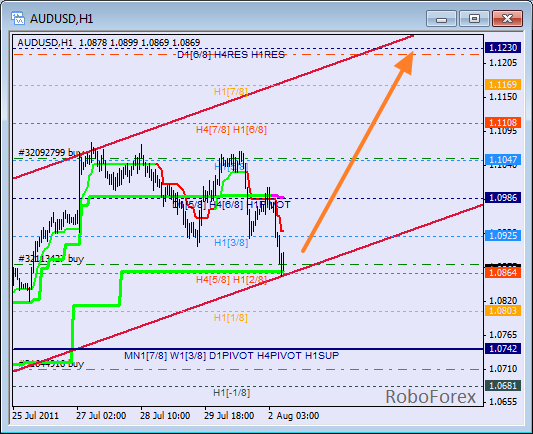

AUD/USD

The correction continues. Bears are slowed down by daily Super Trend and the channel’s lower border. If the price rebounds from these levels, up-trend will be able to continue its movement. The target is still the 8/8 level.

At the H1 chart the price is trying to rebound from the 2/8 level and daily Super Trend. If it succeeds, the market will grow to the 8/8 level. But if it breaks these levels, our scenario will be cancelled.

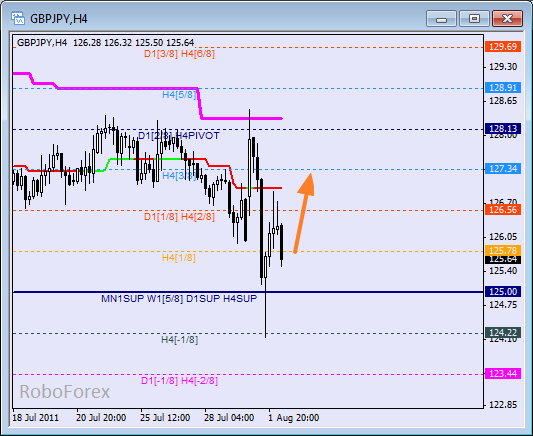

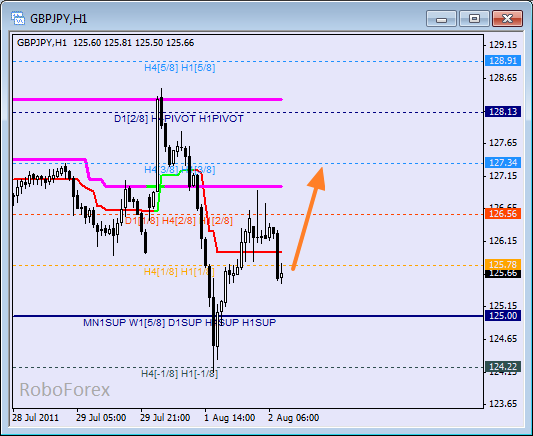

GBP/JPY

This cross has been very volatile recently. During the market trading opening on Monday, the price made a significant growth, but daily Super trend slowed down bulls and the price rebounded from the indicator’s line. The market went down, passing more than 400 pips in few hours. Bears stepped back from the -1/8 level, and now the correction may take place. In the near term, we can expect the price to grow to the 3/8 level.

The price growing from the -1/8 level doesn’t look like a normal correction, that’s why is expect it to continue. The price may grow to the 3/8 level during the day. If the market is able to fix itself above H4 Super Trend, the correction may move even higher.

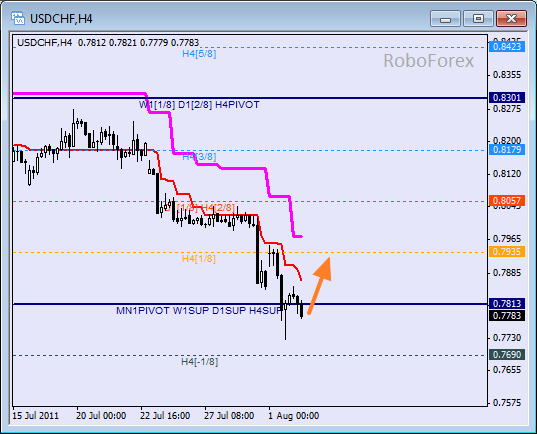

USD/CHF

The market has reached the 0/8 level, as we predicted. Yesterday the price tried to move even lower, but didn’t succeed, that’s why we can see some kind of “tail” right now. There is a possibility that the price will rebound from the 0/8 level today. It will allow the market to move to the 1/8 level and daily Super Trend’s line.

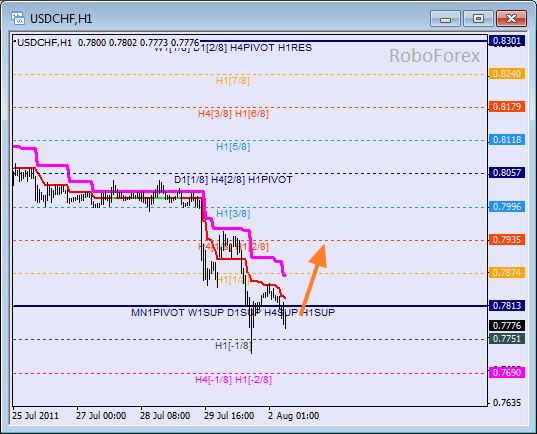

The price rebounded from the -1/8 level, however, H1 Super Trend didn’t allow the correction to continue and now Franc is again below the 0/8 level. If the price is able to fix itself above the 0/8 level, it may grow up to the 2/8 one.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.