Murray Math Lines 04.08.2011 (GPB/JPY, USD/CHF, GOLD)

04.08.2011

Analysis for August 4th, 2011

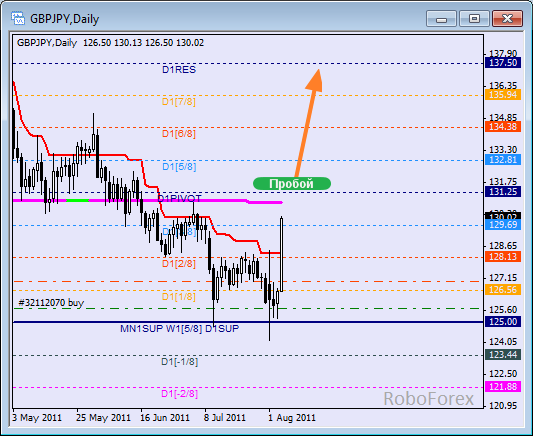

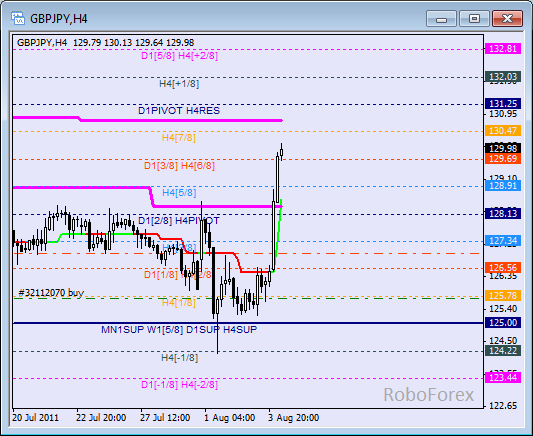

GBP/JPY

The cross exceeded the target from our last forecast several times. Daily Super Trend, which has been supporting the price for the last several months, has been broken. Weekly Super Trend is next. If it isn’t able to slow down bulls, the price may continue growing up to the 8/8 level.

H4 and daily Super Trends are trying to make “Gold Cross”. There is a possibility that the correction will start from the 8/8 level and weekly Super Trend, and most likely the market will try to break these levels after it.

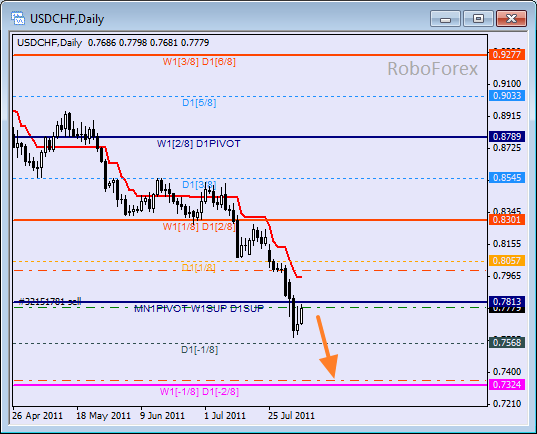

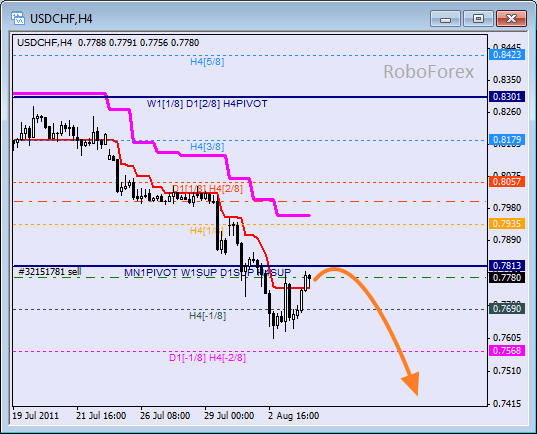

USD/CHF

The market hasn’t been able to leave an oversold zone yet, the main scenario is still the continuation of down-trend. There is a possibility that the price will reach the -2/8 level within the next several days. If this level is broken, the lines will be redrawn.

The price is consolidating below the 8/8 level. If the market rebounds from this level, the price may continue moving downwards. Today I’ve decided to open a sell order and placed the stop above daily Super Trend, because if the price breaks this level, the correction will start.

GOLD

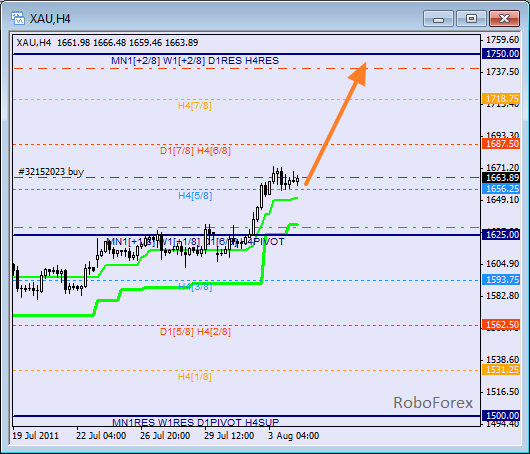

The price is consolidating between the 5/8 level and H4 Super Trend and getting ready to continue moving upwards. I’ve decided to use this correction to enter the market and placed the stop below daily Super Trend. The target of this order is the 8/8 level, however, Take Profit is a bit away from it.

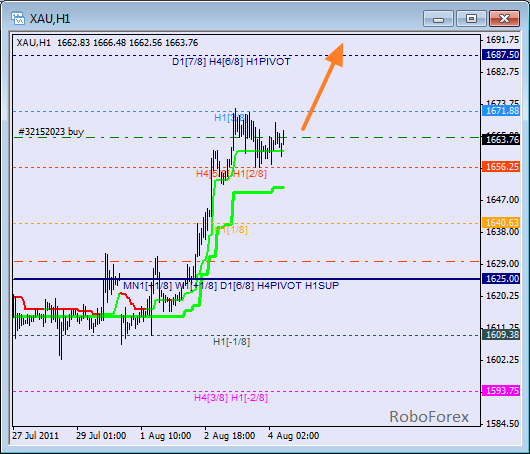

At the H1 chart we can see that the price is one level away from the 4/8 one. If it is broken, up trend will resume its movement. After the price leaves the channel and moves up, I’ll move the stop on buy order to the level where I’ve opened it, i.e. into the black.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.