Murray Math Lines 05.08.2011 (GPB/CHF, USD/CHF, GPB/JPY)

05.08.2011

Analysis for August 5th, 2011

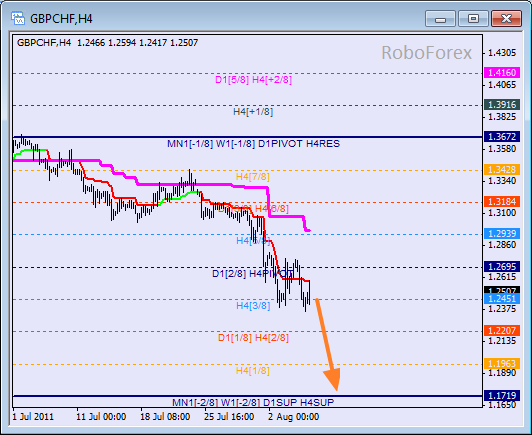

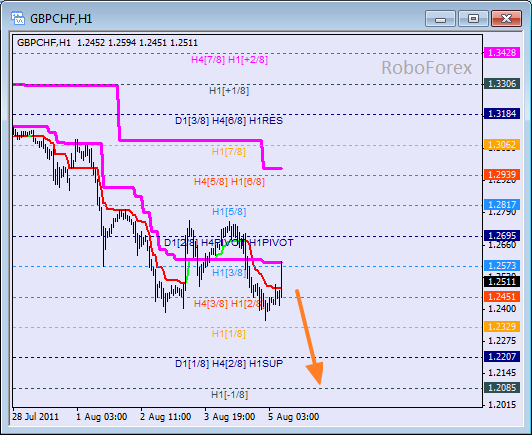

GBP/CHF

In case of the GPB/CHF currency pair we can see that down-trend continues, bears are supported by H4 Super Trend. The market is trying to break the 3/8 level. If the price is able to fix itself below this level, it will continue moving downwards to the 0/8 level.

At the H1 chart we can see that Super Trends made “Dead Cross”. Most likely, the price will reach new maximum again and the 0/8 level as well. Taking into consideration the targets at the H4 chart, we may assume that this level will be broken.

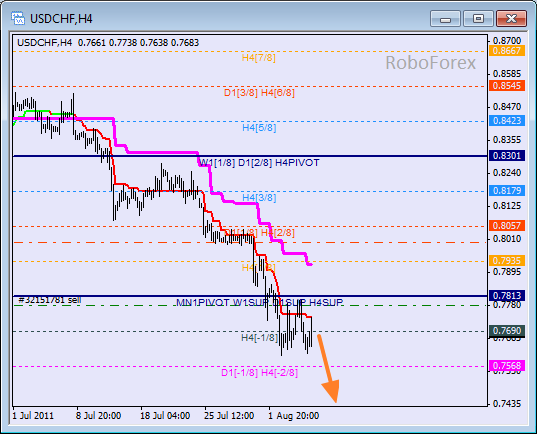

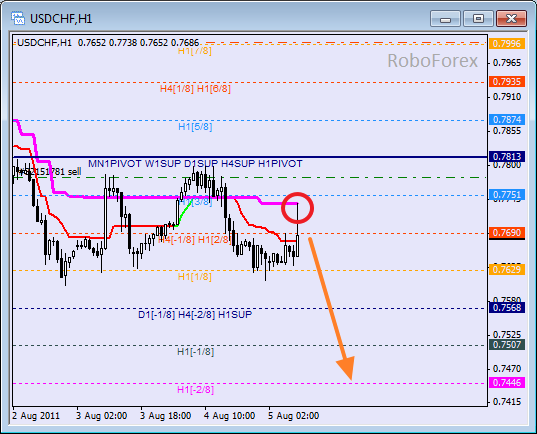

USD/CHF

Franc still hasn’t left oversold zone. The price rebounded from H4 Super Trend several times, which is a good signal that down-trend will continue. After the price breaks the -2/8 level, the lines will be redrawn.

The situation at the H1 chart is even more bearish. After the price has rebounded from Super Trend, the only scenario which is left is the continuation of down-trend. The forecast on Franc remains negative.

GBP/JPY

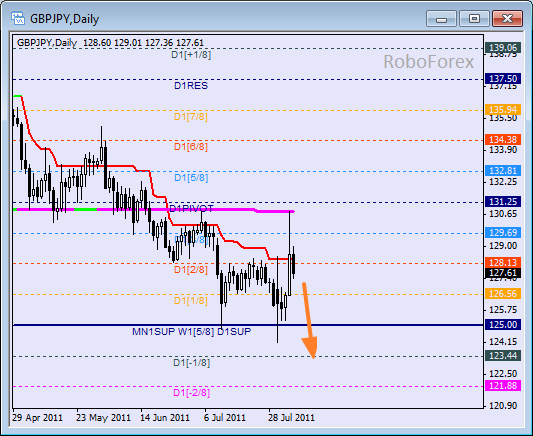

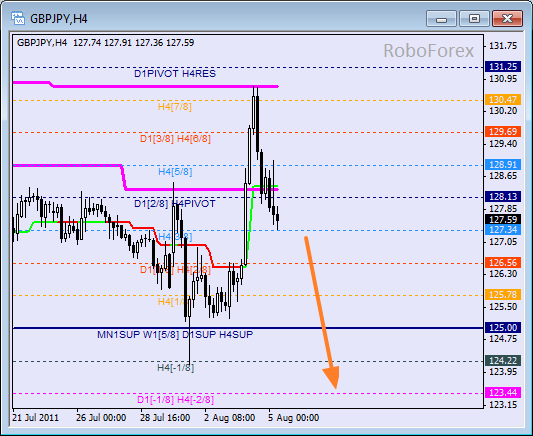

Bulls weren’t able to break weekly Super Trend’s line and the price rebounded from it, thus giving us a signal that down-trend may continue. The market may try to test the -1/8 level during the several next days.

The price went back below daily and H4 Super Trends, the market may continue moving downwards to the -2/8 level. If the price breaks this level (taking into consideration a strong rebound from weekly Super Trend, we may assume that it’s a very possible scenario), the lines at the chart will be redrawn.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.