Murray Math Lines 18.11.2013 (AUD/USD, EUR/JPY, SILVER)

18.11.2013

Analysis for November 18th, 2013

AUD/USD

Australian Dollar is still being corrected; price has already reached upper border of descending channel. If pair rebounds from the 2/8 level, instrument continue moving downwards and reach the -2/8 one.

At H1 chart, pair has already reached the 4/8 level and formed bearish Wolfe wave, which means that bears may return to market quite soon. If pair breaks Super Trends, it will start new descending movement.

EUR/JPY

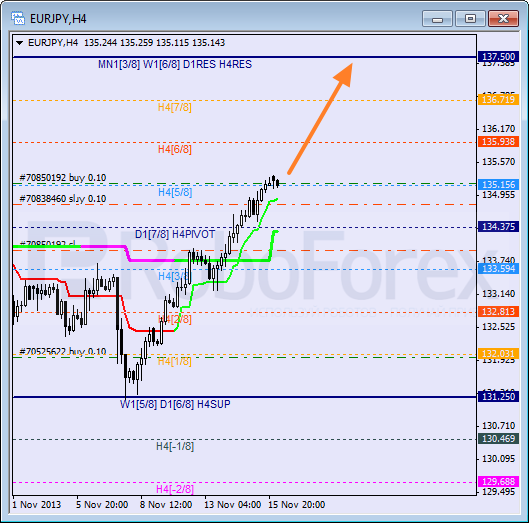

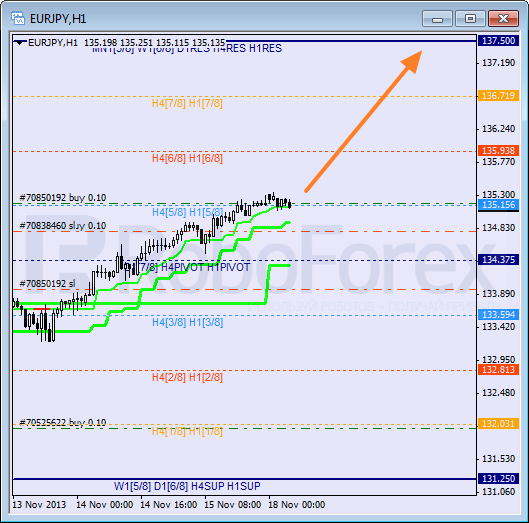

Pair continues growing up quite fast; earlier Super Trend formed “bullish cross”. I have three buy orders. If later bulls are able to keep price above the 5/8 level, market will continue growing up towards the 8/8 one.

Levels at H4 and H1 charts are completely the same. Current correction is supported by Super Trend; pair may rebound from it during the day. I’ll move my stops higher as soon as pair breaks its maximum.

SILVER

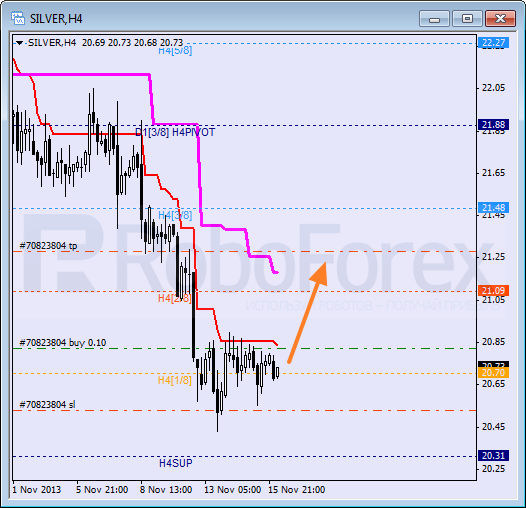

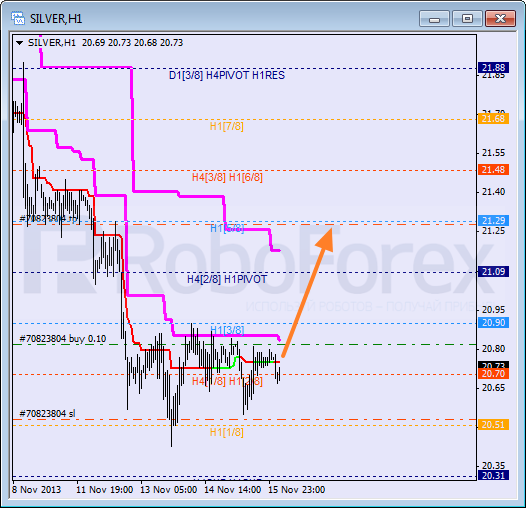

Silver is trading near the 1/8 level. It looks like price is making a pause before starting new correction. I’m keeping my buy order and planning to move stop into the black as soon as instrument breaks Super Trend.

At H1 chart, market is consolidating; price has already rebounded from the 1/8 level three times. Most likely, instrument will break Super Trends during Monday. Short-term target is at the 5/8 level.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.