Murray Math Lines 26.11.2013 (AUD/USD, CAD/JPY, SILVER)

26.11.2013

Analysis for November 26th, 2013

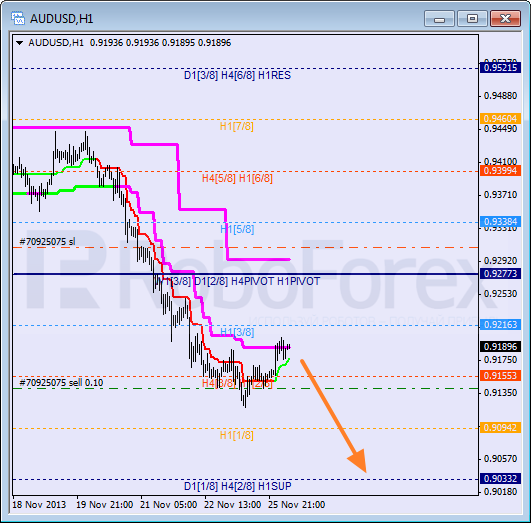

AUD/USD

Australian Dollar is still being controlled by bears. Current ascending movement may be considered as correctional, so we can expect pair to start moving downwards again quite soon. If later price is able to stay below the 3/8 level, market will continue falling down towards the 0/8 one.

At H1 chart, pair rebounded from the 2/8 level. Reverses hardly ever occur here, that’s why price may start new descending movement, in case it rebounds from Super Trend. Closest target for bears is at the 0/8 level.

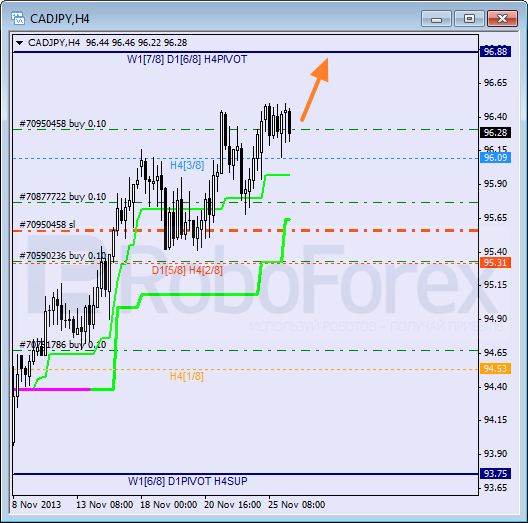

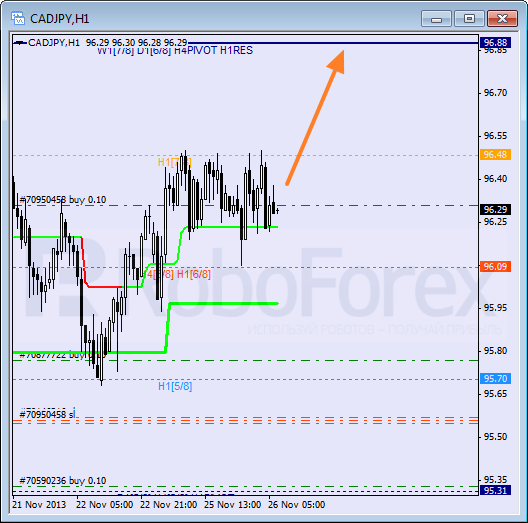

CAD/JPY

After rebounding from H4 Super Trend, pair reached new maximum. During local correction, I opened another buy order. In the future, price is expected to reach the 4/8 level and even break it.

At H1 chart, pair is moving in its upper part. Despite several rebounds from the 7/8 level, Super Trends prevents price from starting deeper and serious correction. Possibly, pair may test the 8/8 level during the day.

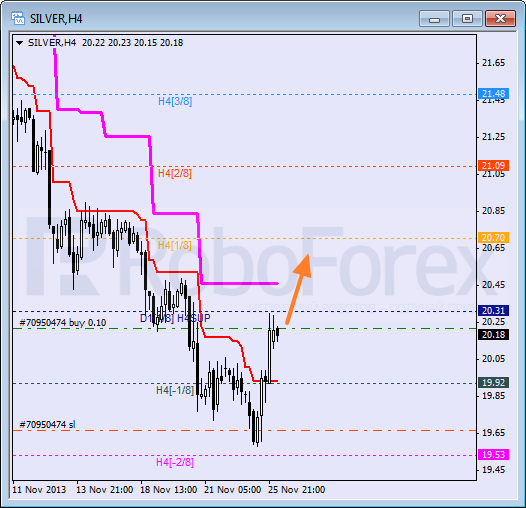

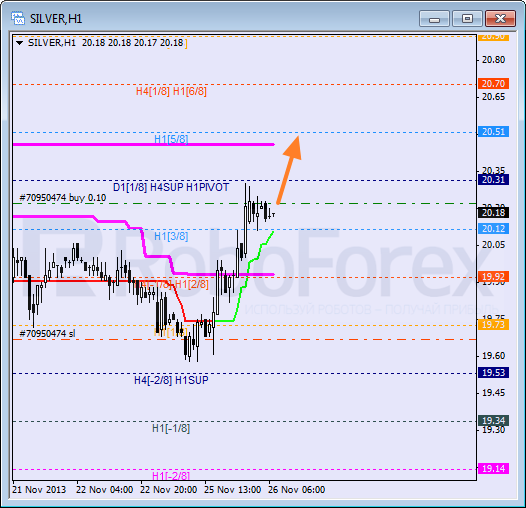

SILVER

Silver was just several pips shy to reach the -2/8 level, when market started new and fast ascending movement, which may be a sign of new serious correction, at least. That’s why, I’ve already closed my sell order and opened buy one. I’m planning to move stop into the black as soon as instrument reaches new local maximum.

At H1 chart, we can see that Super Trends have already formed “bullish cross”. Now bulls have to keep price above the 5/8 level. After that, they will be able to continue pushing it upwards.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.