Palantir combines rapid growth with record margins – but the market has already priced in a perfect scenario

Palantir Technologies continues to demonstrate strong growth and exceptionally high profitability, underpinned by robust demand for its artificial intelligence solutions. However, elevated valuation multiples suggest that a correction may occur before the next stage of the uptrend.

Palantir Technologies Inc. (NASDAQ: PLTR) delivered an exceptionally strong Q3 2025 report, significantly exceeding market expectations: revenue came in at 1.18 billion USD (+63% y/y) versus a consensus estimate of 1.09 billion USD, and adjusted earnings per share (non-GAAP EPS) reached 0.21 USD, ahead of forecasts at 0.17 USD. The company beat expectations on both revenue and profit.

On a non-GAAP basis, Palantir achieved impressive profitability: adjusted operating income reached 601 million USD (a margin of 51%), adjusted net income stood at 529 million USD, and adjusted free cash flow totalled 540 million USD, with an FCF margin of around 46%. The strongest growth came from the US Commercial business, where revenue more than doubled year-on-year. Both the overall commercial segment and government contracts also posted robust expansion, indicating broad demand for the company’s solutions.

Management raised its outlook for Q4 2025 and the full year. For the fourth quarter, Palantir expects revenue of approximately 1.33 billion USD and further growth in adjusted operating profit. The full-year revenue forecast has been raised to 4.4 billion USD (around +50% year-on-year), with a strong adjusted margin. The company emphasised that the main growth driver remains its AIP platform and strong demand for AI and analytics solutions from both commercial and government clients.

Overall, the report highlights that Palantir is in a phase of rapid expansion, with already high profitability and strong cash generation. Management expects these robust growth trends to continue into next year, although the company has not yet provided a precise quantitative forecast for 2026.

This article examines Palantir Technologies Inc., outlines its key revenue sources, reviews the company’s quarterly reports, and provides a fundamental analysis of PLTR. It also presents expert forecasts for Palantir shares in 2026 and analyses the PLTR stock performance, forming the basis for the Palantir Technologies Inc. share price forecast for 2026.

About Palantir Technologies Inc.

Palantir Technologies was founded in 2003 by Peter Thiel, Alexander Karp, Joseph Lonsdale, Stephen Cohen, and Nathan Gеttings. The company went public on 30 September 2020 on the New York Stock Exchange under the PLTR ticker symbol.

Palantir specialises in developing software for big data analysis, including Gotham, designed for national security and intelligence agencies; Foundry, for the corporate sector; and Apollo, for deploying software releases. These products are available to both government and private clients, providing software solutions for data management and analysis, and emphasising privacy and security.

Image of the company name Palantir Technologies Inc.Palantir Technologies Inc.’s main financial flows

Palantir’s revenue primarily comes from the sale of licences for its software products and the provision of related services. The main revenue streams are listed below:

- Licence fees: companies and government agencies purchase licences to use Palantir platforms (Gotham, Foundry).

- Subscriptions and services: in addition to initial licences, Palantir offers subscriptions for technical support as well as upgrades and services for program implementation, customisation, and personnel training.

- Professional services: provision of highly qualified services, including data analysis, development of tailored solutions, and assistance with system integration.

- Government contracts: a significant share of revenue is derived from agreements with government agencies, which use the purchased technologies for data analysis in security, intelligence, and other governmental domains.

- Corporate sector: in recent years, the company has been actively expanding its presence in the commercial market, where it offers its analytical solutions to large corporations to optimise their business processes, manage risks, and process statistical data.

As a result, Palantir’s total revenue is generated through a combination of licensed software sales, subscriptions, professional services, and long-term contracts with government and private clients.

Palantir Technologies Inc. Q3 2024 results

Palantir Technologies released its Q3 2024 data on 4 November 2024. The key report highlights are outlined below:

- Revenue: 726.5 million USD (+30%)

- Net income: 149.3 million USD (+103%)

- Earnings per share: 0.06 USD (+100%)

Revenue by segment and region:

- US: 498.9 million USD (+45%)

- UK: 69.5 million USD (+10%)

- Other countries: 157.0 million USD (+21%)

- Government: 408.3 million USD (+33%)

- Commercial revenue: 317.5 million USD (+27%)

- US government revenue: 319.8 million USD (+39%)

- US commercial Revenue: 179.1 million USD (+34%)

The report indicates that the US government remains Palantir Technologies’ primary source of revenue, contributing nearly half of the company’s total revenue. Palantir forecasted revenue of 767.0–771.0 million USD in Q4 2024, representing a 5-6% increase compared to the previous quarter.

Palantir Technologies Inc. Q4 2024 results

Palantir Technologies released its Q4 2024 results on 3 February 2025. The key report highlights are as follows:

- Revenue: 827.5 million USD (+36%)

- Net income: 76.9 million USD (–21%)

- Earnings per share: 0.03 USD (–25%)

Revenue by segment:

- Commercial revenue: 372.5 million USD (+31%)

- US government revenue: 343.0 million USD (+45%)

- US commercial revenue: 214.0 million USD (+64%)

Palantir’s CEO, Alexander Karp, noted that the Q4 results continued to impress, emphasising that the company’s early assumptions about the widespread adoption and accessibility of large language models had proven correct and contributed to substantial growth. He also described the results as part of a long-term vision, stating that Palantir is in the early stages of a multi-year revolution for which the company has been preparing for over two decades.

For 2025, Palantir issued an optimistic forecast, expecting revenue in the range of 3.74–3.76 billion USD, which is equivalent to a year-on-year growth of approximately 31%. This guidance significantly exceeded analysts’ consensus estimates, reflecting confidence in the steady demand for the company’s AI platforms and software.

US commercial revenue was projected to reach 1.07 billion USD, representing a 54% increase compared with 2024. In addition, management forecast adjusted operating profit in the range of 1.55–1.57 billion USD and adjusted free cash flow of 1.05–1.70 billion USD. They also forecast to maintain both GAAP operating profit and net income in each quarter of 2025.

For Q1 2025, revenue is projected in the range of 858– 862 million USD, with adjusted operating profit between 354 and 358 million USD, setting new targets for the year ahead.

Despite Palantir’s positive outlook, recent reports of potential cuts to the US defence budget have raised concerns among investors, as over 40% of Palantir’s Q4 revenue came from US government contracts.

Palantir Technologies Inc. Q1 2025 results

On 5 May 2025, Palantir Technologies published its Q1 2025 financial results, covering the quarter ended 31 March. The key figures are as follows:

- Revenue: 883.9 million USD (+39%)

- Net income: 214.0 million USD (+24%)

- Earnings per share (non-GAAP): 0.13 USD (+62%)

Revenue by segment:

- Commercial revenue: 396.8 million USD (+33%)

- Government revenue: 486.9 million USD (+45%)

- US government revenue: 373.0 million USD (+45%)

- US commercial revenue: 255.0 million USD (+71%)

The Q1 2025 earnings report reflected Palantir’s continued growth and strengthened position in the AI solutions market. Revenue rose 39% year-on-year and was in line with analysts’ consensus forecasts, underlining the company’s strong business momentum. A major driver of growth was the US commercial segment, where revenue increased by 71%.

The quarterly data pointed to progress in diversifying revenue streams. Palantir continues to reduce its reliance on government contracts by increasing the share of commercial clients. The client base is also expanding, with the number of customers up 39% year-on-year and 8% quarter-on-quarter.

During the reporting period, Palantir closed 139 deals, each worth at least 1 million USD, including 51 above 5 million USD, and 31 exceeding 10 million USD. These figures underscore the rising demand for Palantir’s products among large corporate clients.

Profitability indicators were also impressive. Operating income totalled 176 million USD, with a 20% margin, and free cash flow amounted to 370 million USD. The Rule of 40, which is the sum of revenue growth and operating margin, stood at 83%, demonstrating a healthy balance between growth and efficiency.

Palantir maintains a confident outlook. Its full-year 2025 revenue forecast has been raised to a range of 3.89-3.90 billion USD, reflecting expectations of continued strong performance driven by its AIP platform and expanding partnerships in the commercial sector. The Q2 2025 forecast includes revenue in the range of 934–938 million USD and operating income of 401–405 million USD.

Despite the positive earnings report, Palantir’s shares fell by 11% following publication due to concerns about high valuation multiples – specifically, a P/E ratio of 536 compared with the software industry average of 42. However, PLTR’s share price rebounded the following day, suggesting that investors remain willing to accept risk in anticipation of outstanding results from Palantir Technologies.

Palantir Technologies Inc. Q2 2025 results

On 4 August 2025, Palantir Technologies published its Q2 2025 financial results for the quarter ending 30 June. Key highlights are as follows:

- Revenue: 1.00 billion USD (+48%)

- Net income: 326.72 million USD (+33%)

- Earnings per share (non-GAAP): 0.16 USD (+100%)

Revenue by segment:

- Commercial revenue: 450.7 million USD (+47%)

- Government revenue: 552.9 million USD (+49%)

- US government revenue: 426.1 million USD (+53%)

- US commercial revenue: 306.5 million USD (+93%)

Palantir demonstrated strong growth in Q2 2025. Revenue reached 1.00 billion USD, up 48% year-on-year and 14% quarter-on-quarter. Growth was driven primarily by two segments: the Government segment contributed 553 million USD (+49% y/y), while the Commercial business generated 451 million USD (+47% y/y). Geographically, the US remained the main growth driver, generating revenue of 733 million USD (+68% y/y and +17% q/q). Outside the US, revenue totalled 271 million USD (+12% y/y).

Profitability improved in Q2. The gross margin stood at approximately 80.8%, representing the portion of revenue retained after direct product servicing costs. GAAP operating margin reached 27%, while net margin was 32.6%, reflecting substantial net profit relative to revenue. On a non-GAAP basis, which excludes certain non-operational items, the operating margin was 46%. Margin expansion was supported by operational leverage, with expenses growing more slowly than revenue.

Earnings per share were 0.13 USD on a GAAP basis and 0.16 USD on a non-GAAP basis. The difference is attributable to stock-based compensation and related employer taxes.

Management raised guidance for Q3 2025, expecting revenue of 1.083–1.087 billion USD and adjusted operating income of 493–497 million USD. For the full year 2025, the company forecasts revenue of 4.142–4.150 billion USD (around +45% y/y), adjusted operating income of 1.912–1.920 billion USD, and adjusted free cash flow of 1.8–2.0 billion USD. The company also highlighted the acceleration of the US commercial segment, which is projected to exceed 1.302 billion USD over the year.

Palantir Technologies Inc. Q3 2025 results

On 3 November 2025, Palantir Technologies released its results for Q3 of fiscal year 2025, which ended on 30 September. The key figures are as follows:

- Revenue: 1.18 billion USD (+63%)

- Net income (non-GAAP): 528.71 million USD (+119%)

- Earnings per share (non-GAAP): 0.21 USD (+110%)

Revenue by segment:

- Commercial Revenue: 548.42 million USD (+73%)

- Government Revenue: 632.68 million USD (+55%)

- US Government Revenue: 485.90 million USD (+52%)

- US Commercial Revenue: 396.70 million USD (+121%)

Palantir delivered exceptionally strong Q3 2025 results, significantly exceeding market expectations. Revenue grew by 63% year-on-year, around 8% above consensus, while adjusted earnings per share (non-GAAP EPS) reached 0.21 USD versus forecasts of about 0.17 USD.

On a non-GAAP basis, the company now operates like a mature, high-margin software business. Adjusted operating profit came in at 601 million USD with a margin of 51%, adjusted net profit at 529 million USD, and adjusted free cash flow at 540 million USD (a margin of 46%) – meaning that more than half of revenue is converted into cash.

Growth is being driven not only by new clients but also by expanding existing contracts: the net dollar retention rate reached 134%, meaning that existing customers are increasing their spending with Palantir by roughly 34% per year. The total contract value rose by 151% to 2.8 billion USD.

The business mix has also shifted in favour of the commercial segment. Commercial revenue rose 73% year-on-year, while US Commercial revenue jumped 121% to 397 million USD. Government revenue increased 55% year-on-year. The US market now accounts for around 75% of total revenue, with the number of large deals continuing to grow – 204 contracts worth over 1 million USD during the quarter, including 53 exceeding 10 million USD.

Management raised its full-year 2025 guidance: expected revenue is now 4.396–4.400 billion USD (+53% y/y), adjusted operating profit is projected at 2.151–2.155 billion USD, and adjusted free cash flow at 1.9–2.1 billion USD. For Q4 2025, the company expects revenue of around 1.33 billion USD and further margin expansion.

In this configuration, Palantir is simultaneously delivering rapid revenue growth and very high non-GAAP profitability, expanding its corporate client base and contract portfolio, and funding its expansion through internal cash generation rather than debt. However, the stock trades at elevated valuation multiples, keeping the debate around it alive. Fundamentally, the business remains strong and financially sound. Nevertheless, many analysts believe that a significant portion of future growth is already factored into the stock’s valuation.

Fundamental analysis of Palantir Technologies Inc.

Below is the fundamental analysis of PLTR based on Q3 2025 results:

- Liquidity and balance sheet: as of the end of Q3 2025, Palantir held around 1.6 billion USD in cash and 4.8 billion USD in Treasury securities and other liquid instruments – a total of 6.4 billion USD in highly liquid assets. Total assets amounted to 8.1 billion USD, liabilities to 1.4 billion USD, and shareholders’ equity to 6.7 billion USD, indicating that over 80% of the balance sheet is financed by equity. Total debt (short- and long-term) stood at 235 million USD, leaving a net cash position of about 6.2 billion USD, with debt-to-assets at only 3%. Interest expense on long-term debt over the past 12 months was immaterial, so debt service does not create any strain. Overall, the balance sheet is highly conservative – low leverage, a large cash and securities reserve, and very low solvency risk.

- Profitability and earnings quality: revenue for Q3 2025 totalled 1.181 billion USD (+63% y/y), with growth also accelerating from the previous quarter. Adjusted operating profit (non-GAAP) was 601 million USD, with a margin of 51%; adjusted net profit was 529 million USD, translating into a net margin of about 45%. Gross margin remains near 80%, typical for a software model with low cost of sales.

The revenue structure is robust: commercial revenue reached 548 million USD (+73% y/y), government revenue 633 million USD (+55% y/y), and US revenue in total around 883 million USD (+77% y/y), with US Commercial up 121% y/y. The client base expanded to 911 customers (+45% y/y). This indicates that revenue growth stems not from one-off deals but from contract expansion and steady new-client inflows. At the same time, the business remains consistently profitable on both a GAAP and non-GAAP basis.

- Cash flows: operating cash flow for Q3 2025 was about 508 million USD, roughly 43% of quarterly revenue. Adjusted free cash flow reached 540 million USD (margin ≈ 46%), while over the past 12 months, adjusted FCF totalled around 2.0 billion USD, with a margin of about 51%. Over the first nine months of 2025, Palantir generated more than 1.35 billion USD in operating cash, with low capital expenditure and an asset-light business model. The company relies very little on borrowing, and internal cash flow comfortably exceeds all interest obligations. The share-buyback program remains limited (around 0.1 million shares repurchased during the quarter for 19 million USD, with roughly 880 million USD remaining under the approved plan), meaning most cash is retained within the company for reinvestment.

Fundamental analysis of PLTR – conclusion:

Palantir appears financially very strong as of Q3 2025. The company holds substantial cash and liquid assets, maintains a net cash position, carries minimal debt, and faces no meaningful interest burden. It delivers high non-GAAP profitability, with an operating margin of nearly 50% and a net margin of around 45%. Revenue growth above 60% is supported by strong customer retention metrics and contract expansion rather than one-off events.

Free cash flow is consistently positive and sizeable relative to revenue, enabling Palantir to finance growth entirely through internal resources. From a financial stability standpoint, risks remain low. Even in the event of a slowdown in growth or a correction in valuation multiples, the company’s balance sheet and liquidity provide a significant safety cushion. The key question for investors is no longer about solvency but whether Palantir can sustain the pace of revenue and margin expansion currently implied in its market valuation.

Analysis of key valuation multiples for Palantir Technologies Inc.

Below are the main valuation multiples for Palantir Technologies Inc. for Q3 of the fiscal year 2026, calculated at a share price of 178 USD:

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 416 | ⬤ Extremely expensive: investors are paying more than 400 times annual earnings at the current level of profitability. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 108 | ⬤ Exceptionally high price-to-sales ratio – even for a fast-growing software company, this reflects clear market euphoria. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 107 | ⬤ The business is valued at more than 100 times annual revenue – an extremely elevated level. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 236 | ⬤ Even on a cash-flow basis, the company appears highly overvalued, trading at over 200 times annual free cash flow. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 0.42% | ⬤ Free cash flow yields less than 1% relative to market capitalisation – a pure play on continued rapid growth. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 477 | ⬤ A very high multiple: the market is paying hundreds of times annual EBITDA – a clear sign of overextension and excessive expectations. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 496 | ⬤ The market is paying almost 500 times annual operating profit – any slowdown in growth would be severely punished in PLTR’s share price. |

| P/B | Price to book value | 64 | ⬤ An extreme premium to book value, reflecting highly elevated expectations. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | –7.4 | ⬤ Strong liquidity position – the company holds significant net cash. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | n/a | ⬤ Interest expenses are effectively non-existent. |

Valuation analysis of Palantir Technologies Inc. – conclusion

Palantir is already a profitable and fast-growing company with high free cash flow and a large cash reserve, while carrying no debt. Financially, the business appears very strong.

However, at 178 USD, the stock appears extremely expensive: all key valuation multiples (P/E, P/S, EV/Sales, P/FCF, EV/EBITDA, EV/EBIT) are at levels that can only be justified if flawless growth were to continue for several more years. In short, Palantir is an excellent business, but at this price, it represents a bet on a perfect future rather than an investment with a margin of safety.

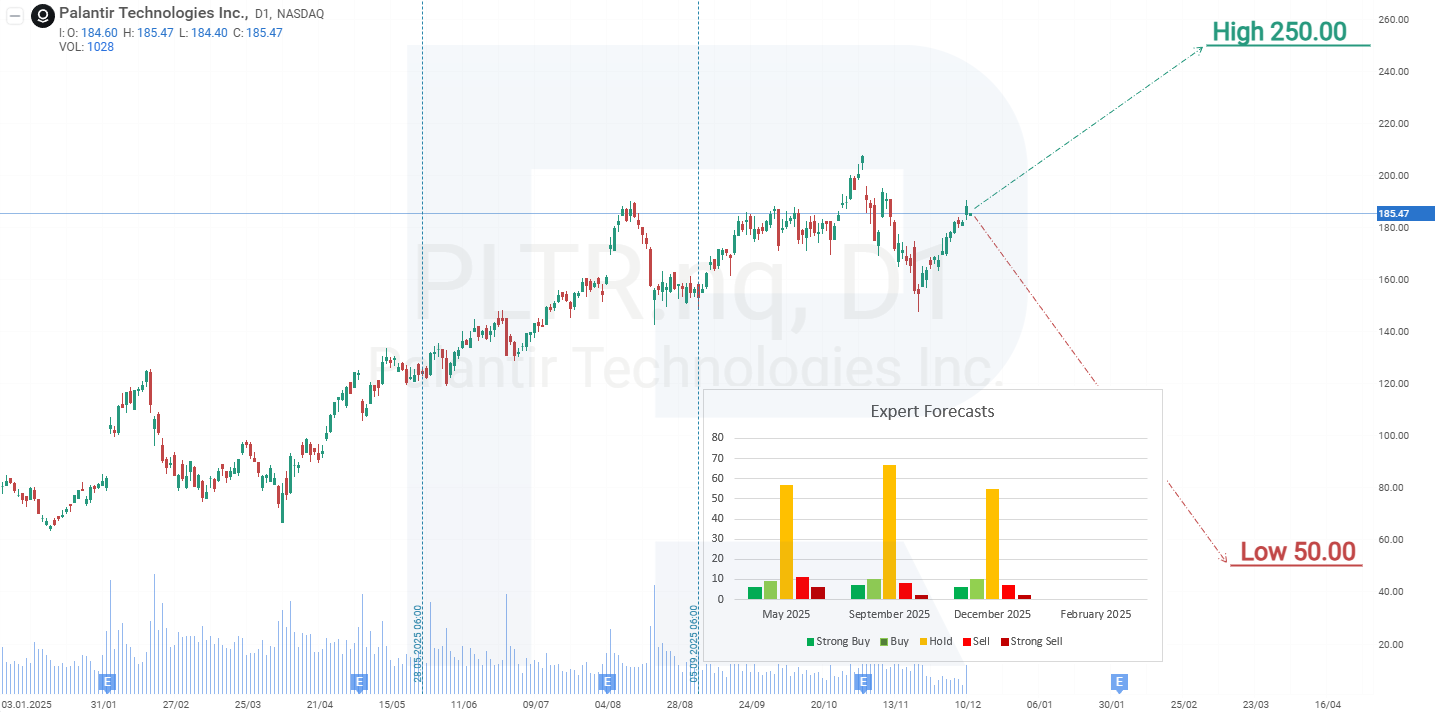

Expert forecasts for Palantir Technologies Inc.’s stock

- Barchart: 4 out of 21 analysts rated Palantir Technologies shares as a Strong Buy, 14 as Hold, 1 as Sell, and 2 as Strong Sell. The upper-end forecast is at 255 USD, while the lower-end forecast is at 50 USD.

- MarketBeat: 4 out of 24 analysts assigned the stock a Buy rating, 18 recommended Hold, and 2 advised Sell. The upper-end forecast is at 255 USD, while the lower-end is at 18 USD.

- TipRanks: 3 out of 16 analysts rated the stock as Buy, 11 as Hold, and 2 as Sell. The top-end forecast is at 255 USD, while the lower-end forecast is at 50 USD.

- Stock Analysis: 2 out of 19 experts rated the stock as a Strong Buy, 3 as Buy, 12 as Hold, and 2 as Sell. The upper-end forecast is at 255 USD, while the lower-end forecast is at 50 USD.

Palantir Technologies Inc. stock price forecast for 2026

On the daily chart, Palantir shares are trading within an upward channel. The release of a strong quarterly report failed to spark further buying interest due to the stock’s elevated valuation multiples; in fact, the solid results prompted profit-taking instead. As a result, the share price declined sharply, falling by around 27% by 20 November. At the 150 USD level, investor interest in Palantir shares returned, and the price began to recover, reaching resistance around 190 USD.

Based on the current performance of Palantir Technologies’ share price, the potential scenarios for 2026 are as follows.

The base-case forecast for Palantir Technologies shares anticipates another correction towards the trendline at 160 USD. At this level, renewed buying interest from investors is expected, which could trigger a fresh upward wave, potentially pushing the price towards the upper boundary of the channel at 250 USD.

The alternative forecast for Palantir Technologies stock should be considered if the shares break out above resistance at 190 USD. In this scenario, the price could quickly rise towards the upper boundary of the channel around 230 USD, which represents a strong resistance level. However, such a rapid rally could exacerbate the stock’s overvaluation and prompt investors to take profits, which in turn could trigger a deeper correction, bringing PLTR back down towards the trendline near 160 USD.

Palantir Technologies Inc. stock analysis and forecast for 2026Risks of investing in Palantir Technologies Inc. stock

Investing in Palantir’s stock in 2026 involves certain risks that may impact the company’s earnings. Below are potential risks and factors that could negatively affect its revenue:

- Pressure from high valuation: as of December 2025, Palantir shares are trading at extremely high multiples – for example, the Price-to-Sales (P/S) ratio exceeds 108 based on expected revenue, while the Price-to-Earnings (P/E) ratio is above 400 based on expected earnings. If the company fails to deliver sufficient growth to justify these valuations, investor sentiment could shift, leading to a sharp decline in its stock price. A correction may occur if revenue growth falls short of the expected 25–30% yearly growth rate.

- Reliance on government contracts: a sizeable portion of Palantir’s revenue comes from government clients, particularly US defence and intelligence agencies. Reductions in federal budgets, policy shifts under a new administration, or the non-renewal of key contracts could substantially impact revenue. Political instability or cuts in defence spending would heighten this risk.

- Commercial sector challenges: although Palantir’s Commercial revenue is growing, it still constitutes a smaller share of total revenue. The company struggles to scale due to elevated costs, making it less attractive to small and medium-sized enterprises. If the Commercial sector growth slows or fails to offset potential declines in its government revenue, overall revenue may suffer.

- Rising competition: Palantir faces competition from tech giants like Microsoft (NASDAQ: MSFT), which may integrate AI and analytics into broader offerings, as well as from specialised companies. If competitors offer cheaper or more affordable alternative solutions, Palantir risks losing its market share (especially in the commercial sector), which would negatively impact the company’s financial position.

- Regulatory and AI risks: tighter regulation of AI and data analytics, especially in the US and globally, could limit Palantir’s capabilities or increase compliance costs. Concerns over privacy or misuse of its tools (for example, in surveillance) could damage the company’s reputation, therefy deterring clients and reducing revenue.

- Share capital dilution due to stock compensation: Palantir actively uses company shares for compensation, reducing their value for shareholders. If this practice continues without corresponding revenue growth, it could undermine investor confidence and put pressure on the stock price, raising doubts about the stability of future revenue.

- Stock sales by insiders: in 2024, the company’s insiders, including CEO Alex Karp and co-founder Peter Thiel, actively sold significant portions of their personal holdings, with Thiel divesting a third of his stake during this period. In February 2025, it was announced that Karp had applied to sell an additional 1.00 billion worth of shares. Such insider activity may negatively impact the market price of the shares and investor sentiment.

All these factors reduce confidence in Palantir’s ability to maintain its projected growth trajectory and revenue streams in 2025, making investment in its stock highly risky.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.