Brent fell below 75.00 USD, with the decline likely to continue

Brent’s price dipped below 75.00 USD, with the downward momentum likely to continue after a small correction. The market will focus on US data today: the EIA oil stock change and the ADP employment statistics. Find out more in our Brent analysis for today, 5 September 2024.

Brent forecast: key trading points

- US data: the market awaits the EIA oil stock statistics and US ADP employment market data today

- Current trend: there is a downtrend

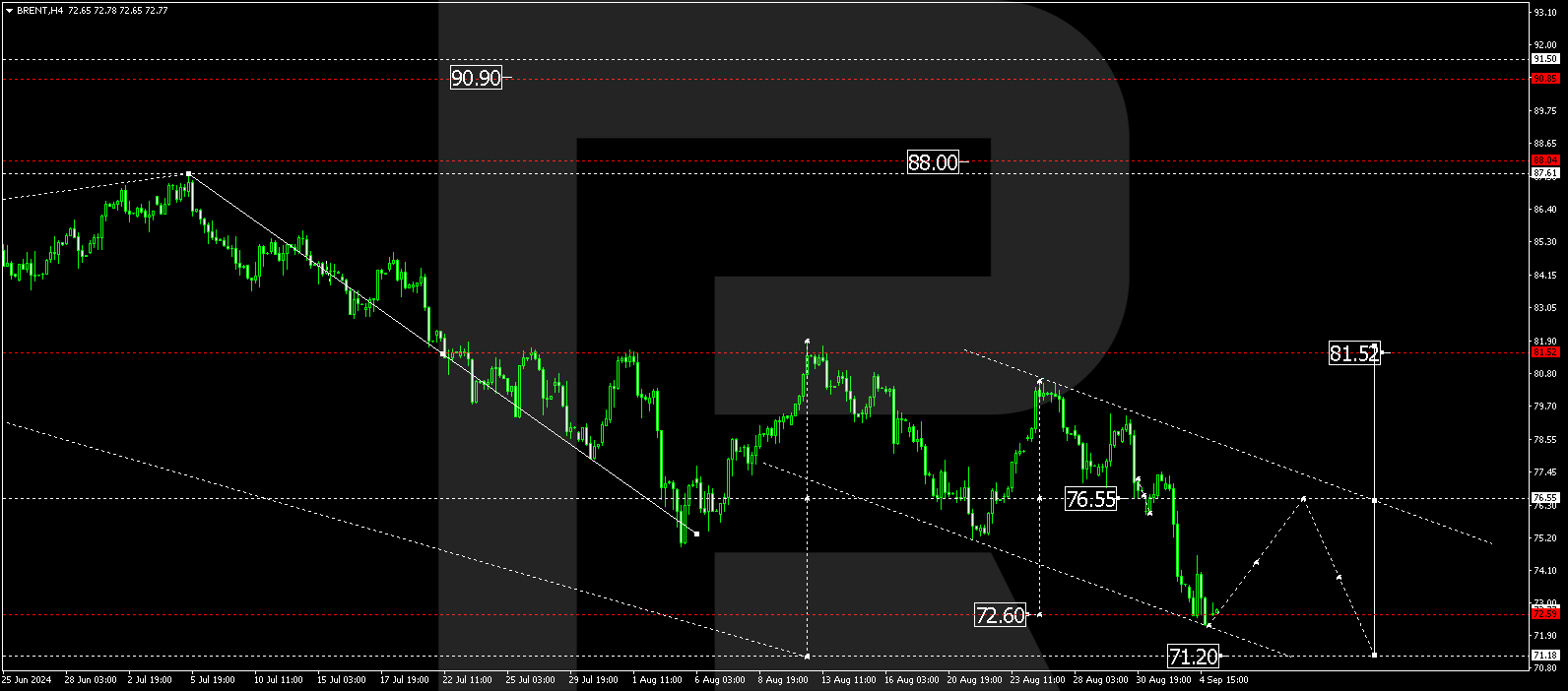

- Brent forecast for 5 September 2024: 76.55 and 71.20

Fundamental analysis

Brent quotes are declining after failing to hold within a sideways price range. Even yesterday’s data from the American Petroleum Institute (API), indicating a decrease of 7.8 million barrels in the US oil inventories, did not help. Oil prices are under pressure from a downward correction in the US stock indices.

US oil inventory statistics from the Energy Information Administration (EIA) are due today, with the figure expected to decrease by 0.9 million barrels. The US ADP employment data is also scheduled for release. Oil will likely focus on the reaction of the US stock market to employment data. A rise in the market will help strengthen Brent prices, while a decline will send them lower.

Brent technical analysis

On the H4 chart, Brent price has formed a consolidation range around 76.55 and has broken below it, reaching the wave’s local target of 72.60. A rise to 76.55 (testing from below) could follow today, 5 September 2024. According to the Brent price forecast, the price is expected to tumble to 74.50. A breakout below this level may signal further movements towards 71.20, marking the completion of the downward wave potential.

Summary

Technical indicators in today’s Brent forecast suggest a potential rise to 76.55, which is viewed as a correction of the previous downward wave. Once the correction is complete, a new decline will start, aiming for 71.20.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.