Brent is on the rise, returning to the area around 75.00 USD

Brent prices received support from OPEC+ and reversed upwards. The quotes are now hovering around 75.00 USD, with growth likely to resume. Find out more in our Brent analysis for today, 5 November 2024.

Brent forecast: key trading points

Fundamental analysis

Brent quotes have risen by nearly 3% since the beginning of the week after OPEC+ announced that it would follow its current output reduction policy until the end of the year and would not increase supplies by 180 million barrels per day, as previously planned. The oil cartel is intentionally regulating the amount of commodity output to support oil prices.

Another factor affecting oil price growth is another round of escalation in the conflict in the Middle East. The media reported that Iran plans a large-scale attack on Israel’s military facilities. The escalation may lead to a decline in oil supplies from this region and drive Brent prices up.

Brent technical analysis

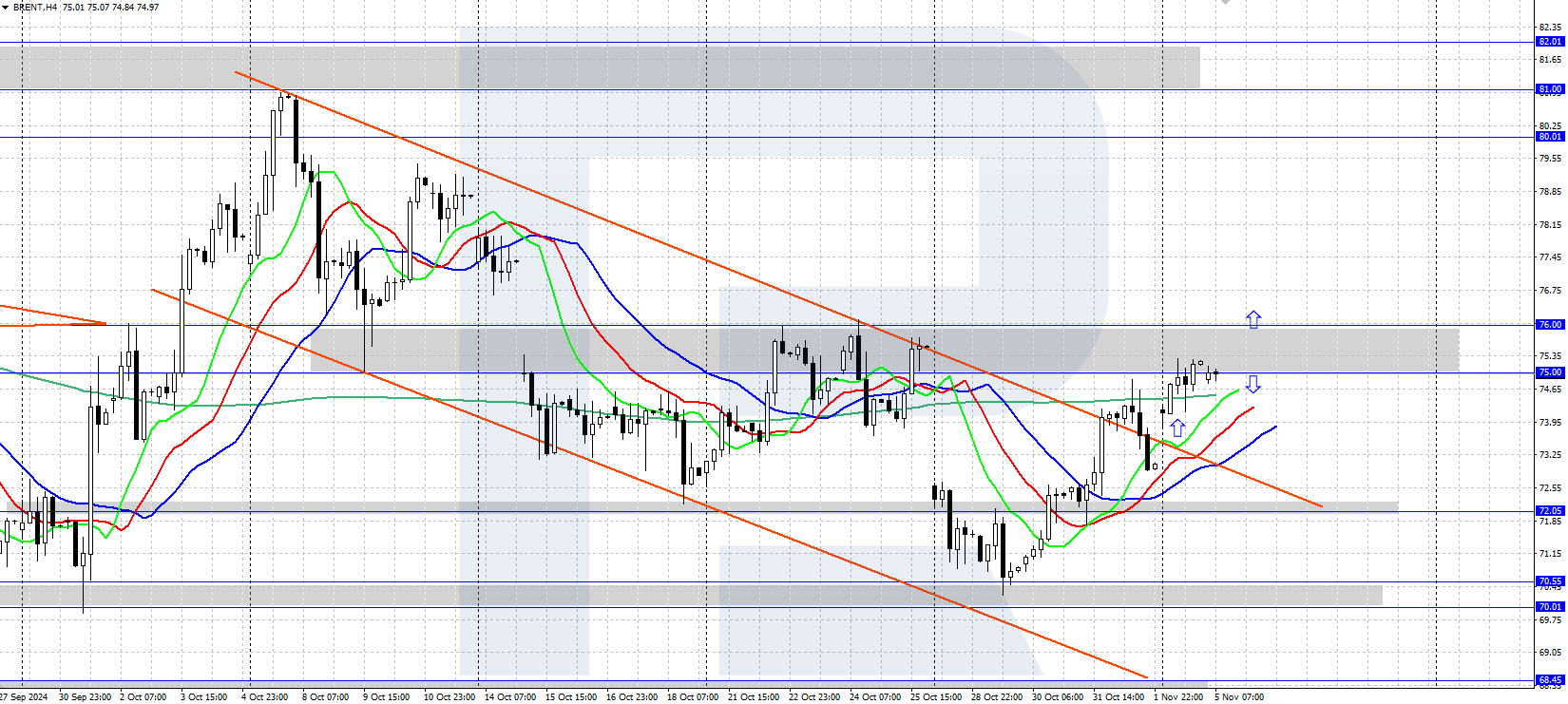

Brent quotes show an upward movement. The asset price fell to the 70.00 USD level for a while, where it found support from buyers and reversed upwards, breaking the boundary of a descending price channel. The 75.00-76.00 USD price range is now a crucial resistance area for oil.

The short-term Brent price forecast suggests that if bulls surpass the 75.00-76.00 USD resistance area, the price could rise further to the 80.00 USD resistance level. If bears resist the attack, a downward correction could develop, aiming for the 72.00 USD support level.

Summary

Oil prices received support from the OPEC+ decision not to increase oil output until the end of the year and reversed upwards, returning to the area around 75.00 USD. Due to the US presidential election, the markets are expected to see increased volatility today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.