Brent tumbles, falling below 72.00 USD

Brent prices declined moderately during the Asian session. Market participants are awaiting the release of the OPEC monthly report today. Find out more in our Brent analysis for today, 12 November 2024.

Brent forecast: key trading points

- Current trend: trading within a broad sideways range

- Market focus: market participants are awaiting today’s statistics from the OPEC monthly report

- US data: the API crude oil inventory data will be published today

- Brent forecast for 12 November 2024: 75.00 and 70.00

Fundamental analysis

Brent quotes are declining ahead of the OPEC monthly report. It appears market participants expect the statistics to show worsening conditions in the oil market. Last month’s OPEC report lowered forecasts for global oil demand growth until the end of 2024.

US crude oil stock statistics from the American Petroleum Institute (API) will be released today, and the Energy Information Administration (EIA) data is due tomorrow. A decrease in inventories may support Brent prices, while an increase will likely push the asset price down.

Brent technical analysis

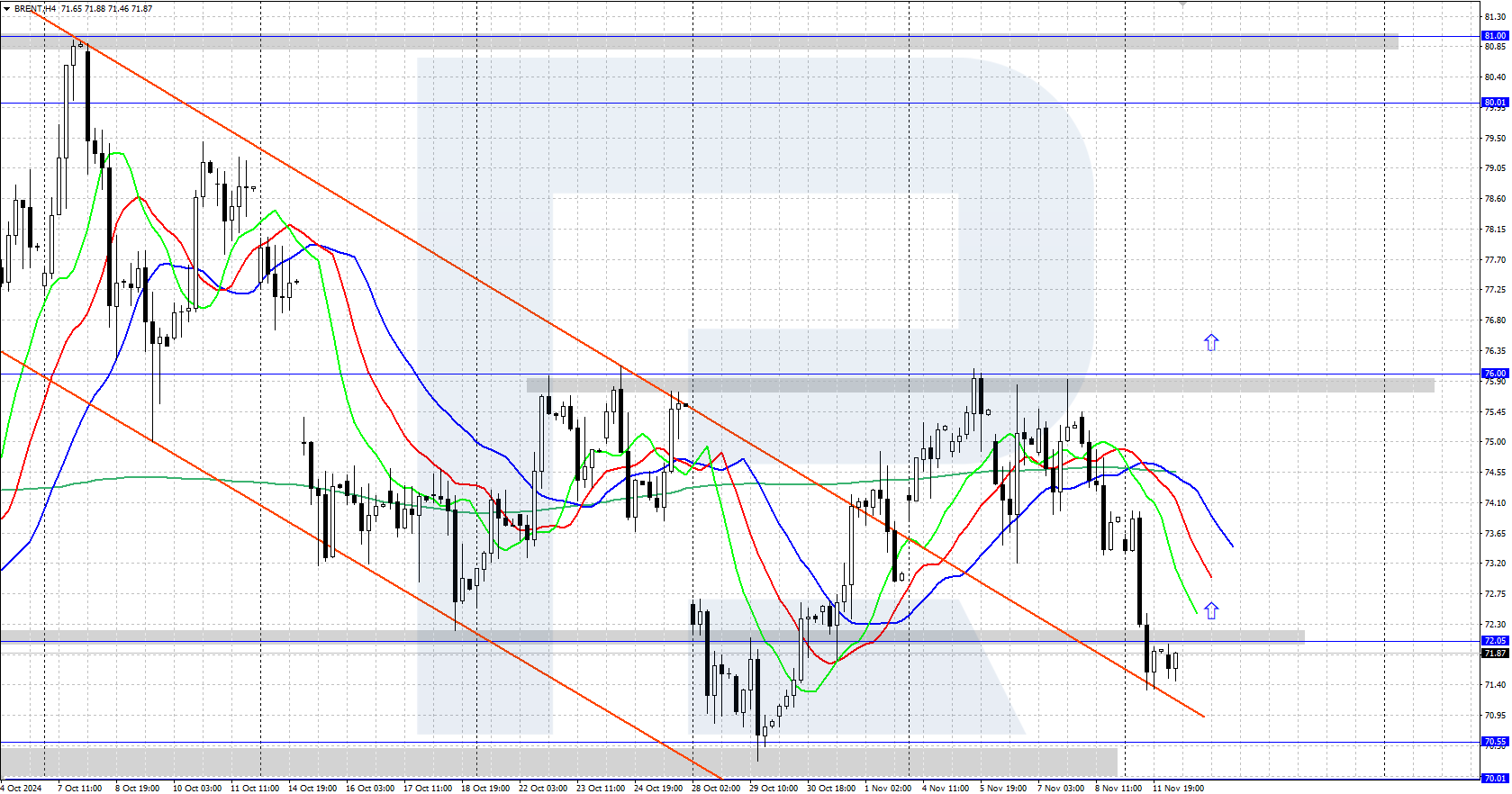

Brent quotes are showing a downward movement, with the asset price dropping to around 72.00 USD. The asset is trading within a wide sideways range on the daily chart, with the upper boundary at 76.00 USD and the lower at 70.00 USD. The 70.00-70.55 USD price range is the nearest strong support.

The short-term Brent price forecast suggests that prices could rise to the 76.00 USD resistance level if bulls reverse the quotes upwards from the 70.00-72.00 USD range. Conversely, if bears continue attacking and push prices below 70.00 USD, prices could decline further to the 68.00-68.50 USD support area.

Summary

Brent quotes tumbled below 72.00 USD ahead of the OPEC monthly report. The US oil stock statistics from the American Petroleum Institute (API) are also scheduled for release today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.