Brent oil rose above 73.00 USD, driven by the escalation in the Middle East

Brent prices are strengthening during the Asian session due to another escalation of the conflict in the Middle East. Find out more in our Brent analysis for today, 19 November 2024.

Brent forecast: key trading points

- Current trend: trading within a broad sideways range

- Market focus: Israel and Hamas exchanged missile strikes

- US data: the API US crude oil stock statistics are due today

- Brent forecast for 19 November 2024: 76.00 and 70.00

Fundamental analysis

Brent quotes rose by nearly 4% today amid another escalation of the conflict in the Middle East. Israel attacked targets in Lebanon, while Hamas struck at Israel. Oil prices responded to these developments with growth; investors are concerned about reduced regional supplies due to military actions.

US crude oil inventory statistics from the American Petroleum Institute (API) will be released today, with the Energy Information Administration (EIA) report due tomorrow. A decrease in crude oil inventories may support Brent quotes, while an increase would lower prices.

Brent technical analysis

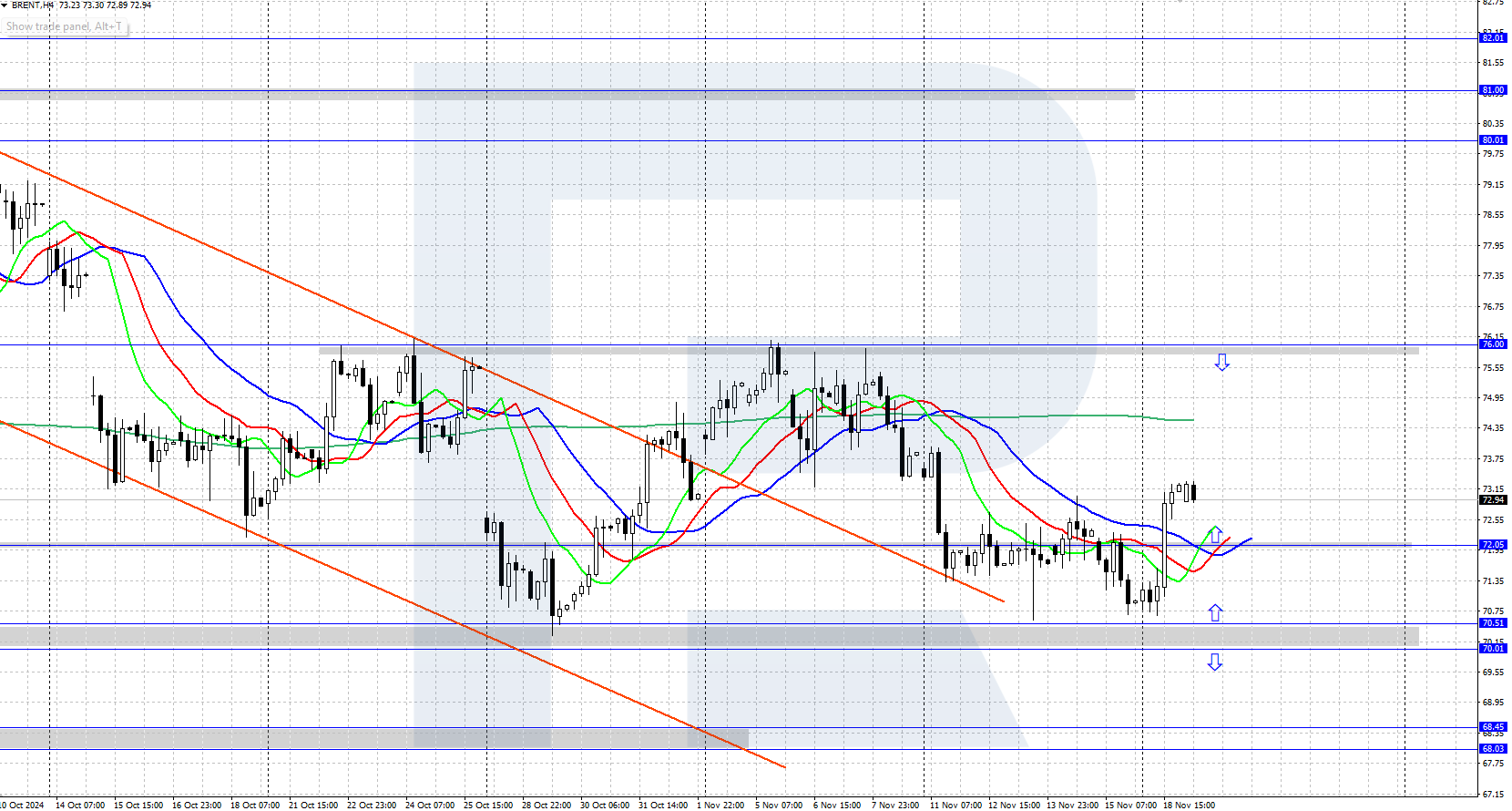

Brent prices show an upward movement, hovering around 73.00 USD. The asset is trading within a wide sideways range on the daily chart, with the upper boundary at 76.00 USD and the lower at 70.00 USD. A breakout from the range will determine further prospects for price movements.

The short-term Brent price forecast suggests that growth could continue towards the 76.00 USD resistance level if bulls secure prices above 72.00 USD. Conversely, if bears seize the initiative, prices could return to the 70.00-70.50 USD support area.

Summary

Brent oil halted its decline and reversed upwards, rising above 73.00 USD, with another escalation of the conflict in the Middle East supporting oil prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.