Brent declined to 72.00 USD amid the Middle East negotiations

Brent prices plummeted on Monday following easing tensions in the Middle East, with support emerging at 72.00 USD during today’s Asian session. More details in our Brent analysis for today, 26 November 2024.

Brent forecast: key trading points

Fundamental analysis

Brent quotes fell by about 3% on Monday after news broke that Lebanon and Israel had agreed on the terms of a ceasefire between Israel and Hezbollah. This development helped reduce market participants’ expectations of possible disruptions to energy supplies from the Middle East.

The American Petroleum Institute (API) will release its US oil inventory statistics today, followed by data from the Energy Information Administration (EIA) tomorrow. A decrease in oil reserves may support Brent prices, while an increase could pressure the asset lower.

The OPEC+ meeting scheduled for 1 December will be crucial for the oil market, providing up-to-date forecasts for global oil demand, supply changes, and potential cartel actions to regulate oil prices.

Brent technical analysis

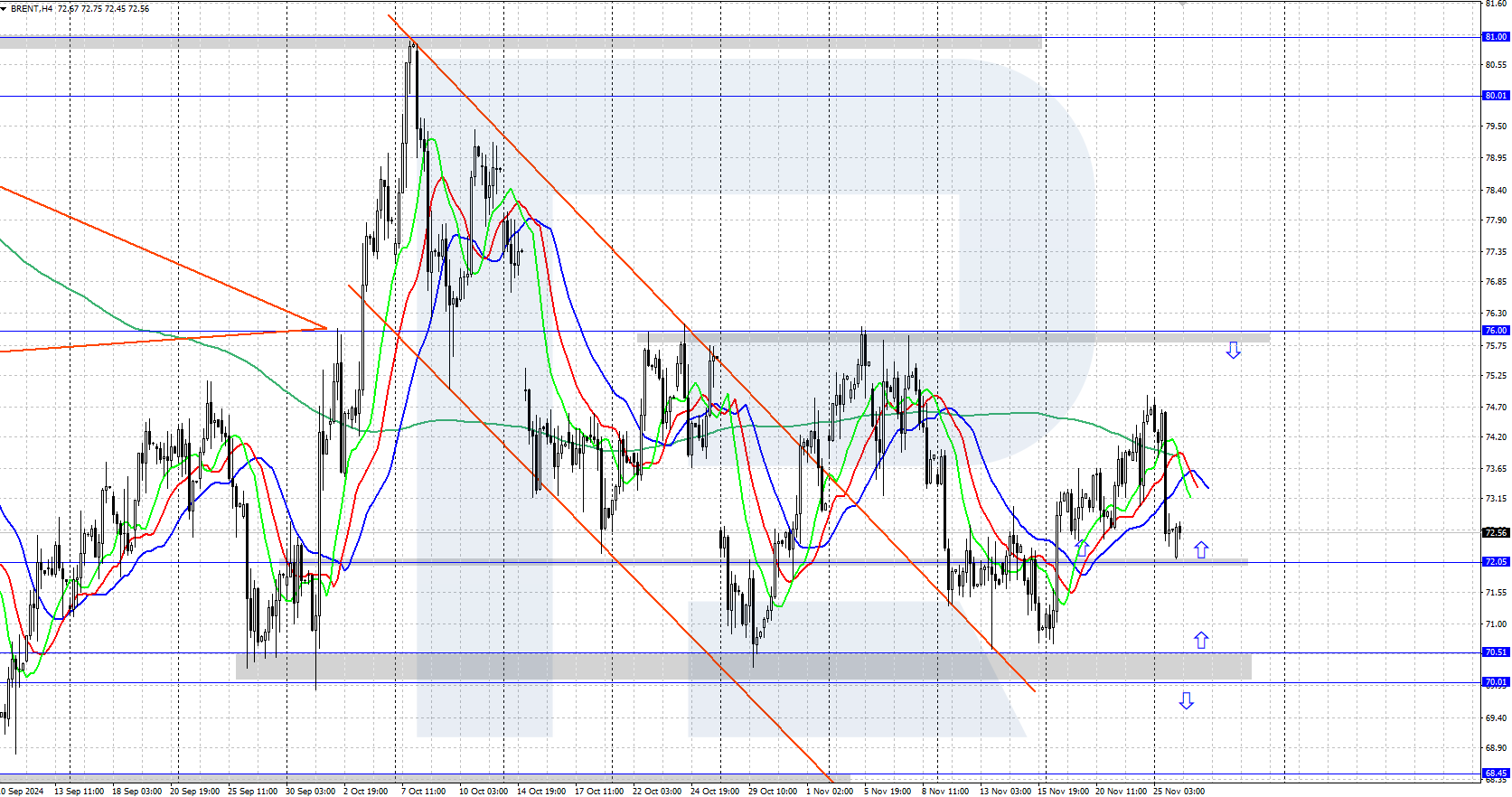

Brent prices fell sharply yesterday but found support at the 72.00 USD level today. The asset is trading within a wide sideways range on the daily chart, with the upper boundary at 76.00 USD and the lower at 70.00 USD. A breakout from this range will determine the next directional move.

The short-term Brent price forecast suggests a potential reversal towards the 76.00 USD resistance level if bulls hold above 72.00 USD. Conversely, if bears push prices below the 72.00 USD level, they could plunge to the 70.00-70.50 USD support area.

Summary

Brent declined to 72.00 USD amid Middle East peace talks. The upcoming OPEC+ meeting on 1 December will determine the future dynamics of the oil market.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.