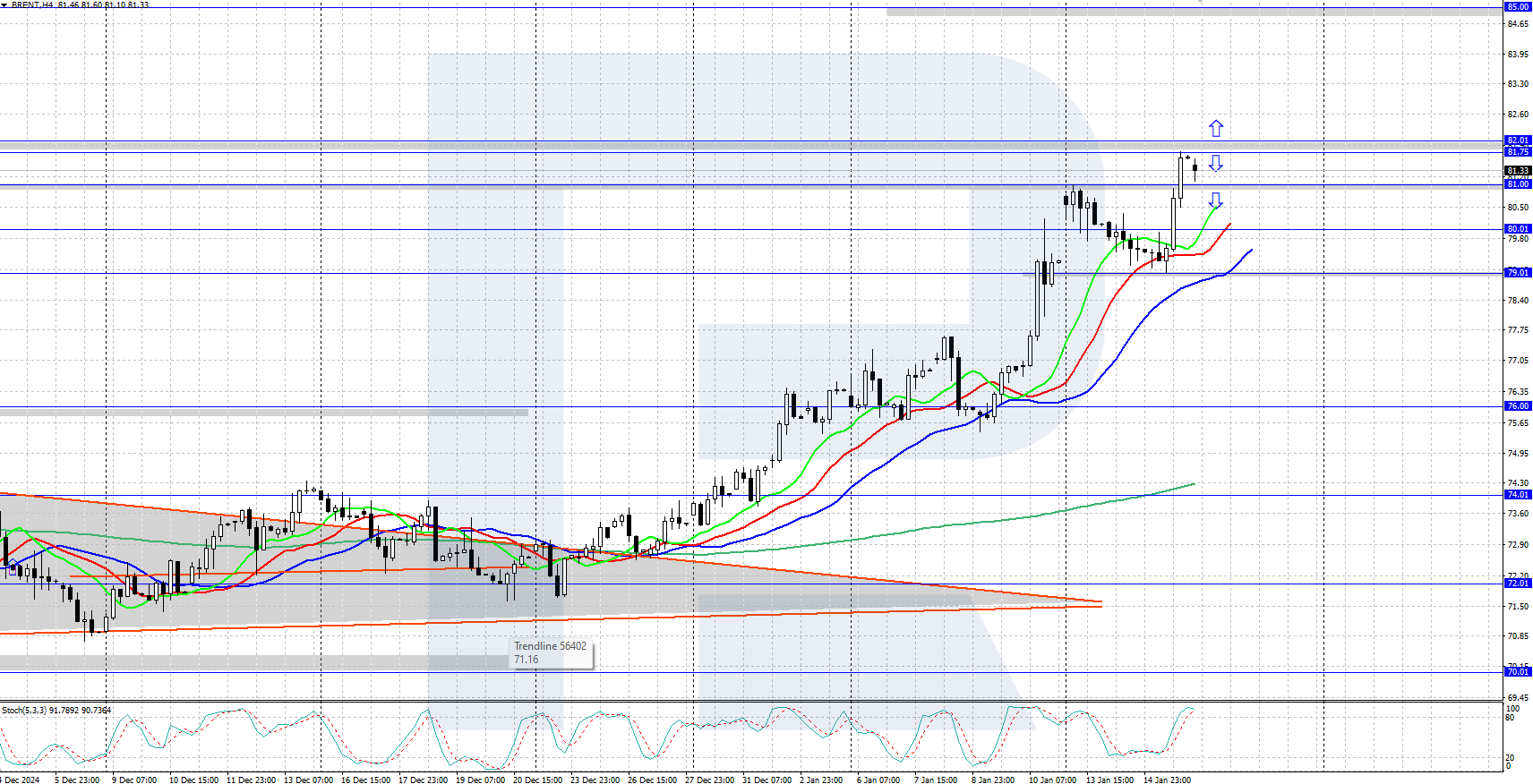

Brent consolidated above 81.00 USD

Brent continues to rise steadily, with quotes surpassing the 81.00 USD level yesterday. More details in our analysis for 16 January 2025.

Brent forecast: key trading points

- Brent quotes climbed above 81.00 USD

- US oil inventories decreased by 1.96 million barrels, as reported by the Energy Information Administration (EIA)

- Brent forecast for 16 January 2025: 82.00 and 79.00

Fundamental analysis

Brent prices gained nearly 2.5% on Wednesday, advancing to 81.75 USD per barrel, the highest level since August 2024. This growth was driven by EIA data that showed a drop of 1.96 million barrels in US crude oil inventories.

Additional factors for the rise in oil prices are slowing US inflation rates, sanctions against Russian oil tankers, and expectations for higher oil demand in 2025. OPEC+ maintained its global oil demand growth forecast at around 1.43 million barrels daily by 2026.

Brent technical analysis

After surging on Wednesday, Brent quotes are consolidating slightly above 81.00 USD today. The asset is trading in a strong uptrend on the daily chart, with the Alligator indicator below the price chart and directed upwards, confirming the asset’s current strengthening trend.

The short-term Brent price forecast suggests that prices could rise to 85.00 USD if the bulls push the quotes above the 81.75-82.00 USD resistance area. However, a downward correction to the 79.00 USD support level is possible if the bears close the day lower than 81.00 USD.

Summary

Brent prices rose above 81.00 USD amid slowing inflation and reduced US crude oil reserves. The asset is in a strong uptrend and likely to continue its ascent after a minor correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.