Trump and Chinese data hold Brent above water — but pressure remains

Brent crude is strengthening but remains capped below key resistance at 65.60 USD. Full outlook in our analysis for 15 April 2025.

Brent forecast: key trading points

- Donald Trump exempted certain tech products from tariffs and hinted at reduced auto import duties

- China’s crude oil imports rose nearly 5% year-on-year in March

- Brent forecast for 15 April 2025: 61.40

Fundamental analysis

Brent oil prices are rising for the third consecutive session, supported by fresh trade concessions announced by US President Donald Trump. He exempted certain tech products from tariffs and indicated a possible reduction in car import duties — a sign markets interpreted as a softening stance, boosting appetite for risk assets including oil.

Additional support came from China’s crude import data. According to the General Administration of Customs, China imported 51.41 million tonnes of crude in March — the highest since August 2023 — marking a near 5% year-on-year increase. The rise followed a slowdown in January and February and was largely driven by higher volumes from Iran.

Brent technical analysis

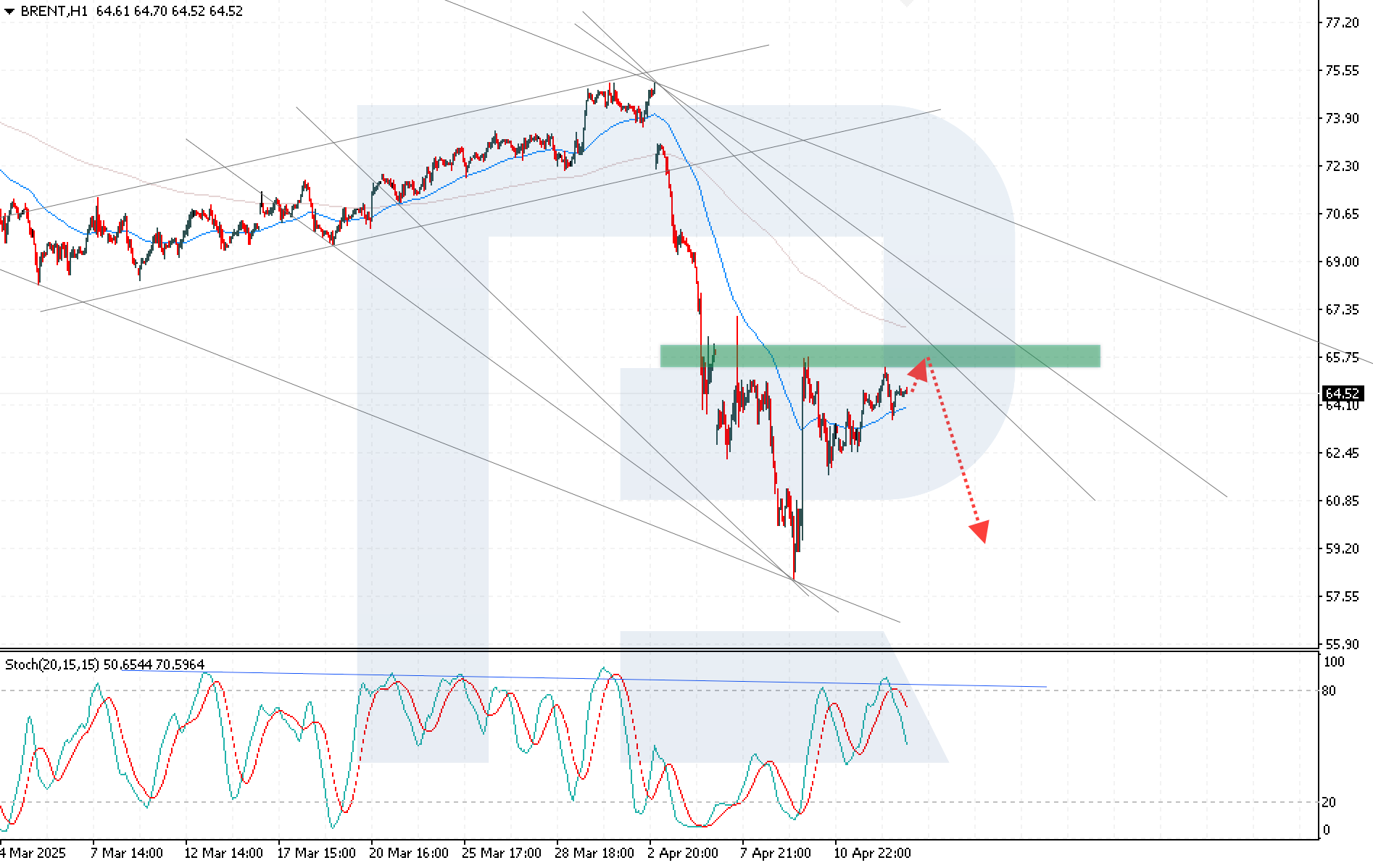

Brent continues to consolidate below strong resistance at 65.60 USD. Today’s forecast anticipates a test of this resistance, followed by a possible pullback toward 61.40 USD.

Technical indicators support a bearish scenario: Moving Averages signal a dominant downtrend, while the Stochastic Oscillator has reversed from overbought territory, showing a %K/%D crossover — a classic sign of potential decline. A confirmed break below 63.55 USD would validate the downside outlook.

Summary

Brent prices remain under pressure from the 65.60 USD resistance level, despite temporary support from US trade concessions and stronger crude demand from China. The Brent outlook for today points to persistent downside potential, with the next target at 61.40 USD if resistance holds.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.