Brent turns lower again: risks are piling up

Brent crude slipped to 61.97 USD per barrel. The market is struggling to withstand the pressure. More details in our analysis for 11 December 2025.

Brent forecast: key trading points

- Brent is pricing in the full spectrum of geopolitical risk

- The broader picture for the oil sector remains bearish

- Brent forecast for 11 December 2025: 61.20

Fundamental analysis

On Thursday, Brent crude is holding near 61.97 USD per barrel. Earlier, reports emerged that the United States intercepted a sanctioned tanker off the coast of Venezuela. The incident led to reduced shipments from the South American producer and heightened fears of further escalation.

Additional geopolitical tension came after a strike on a “shadow fleet” tanker linked to Russia’s oil-trading infrastructure, despite Washington’s calls for a ceasefire. This marks the fifth attack on Russia-associated vessels since late November.

The rise in geopolitical risks is unfolding against the backdrop of an overall bearish market environment. Expectations remain that rising production from OPEC+ and its allies will outpace weak demand and create a supply surplus.

On Thursday, the market awaits the release of new monthly reports from OPEC and the IEA, which may help clarify the supply–demand balance.

Meanwhile, U.S. government data showed crude inventories falling by 1.8 million barrels for the week. Cushing stocks rose for the first time in four weeks, yet they remain at the lowest seasonal level since 2007.

Brent technical analysis

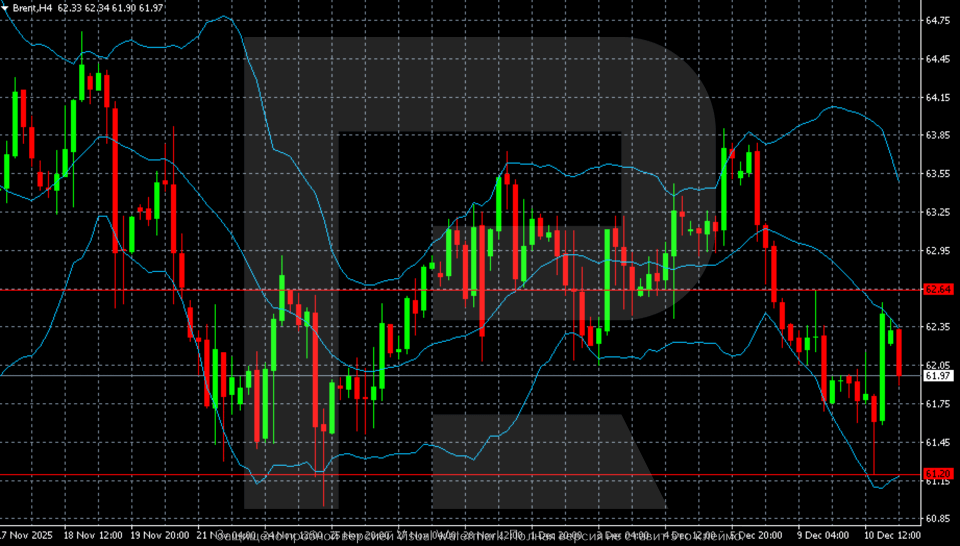

On the H4 chart, Brent maintains a bearish bias after a wave of selling pushed the price toward the support zone at 61.20. This is a key level where previous reversals formed. The current recovery attempt remains weak. Price action is staying below the middle Bollinger Band, indicating seller dominance.

The upper Bollinger Band slopes downward, signaling rising volatility within the downtrend. The lower band is expanding, pointing to continued downside pressure.

The nearest resistance is at 62.64 — a horizontal zone repeatedly tested in early December. Only a firm breakout above this level would signal weakening bearish pressure and open the path toward 63.20–63.60.

If sellers push the price below 61.20, Brent may extend its decline toward 60.80–60.50, where the next demand area is located.

Summary

As long as Brent trades below the middle Bollinger Band and fails to show a sustainable recovery above the 62.60 area, the overall structure remains bearish. The Brent forecast for today, 11 December 2025, suggests a drift toward 61.20.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.