Brent in positive territory: geopolitical risks are rising globally

Brent crude oil prices rose to 68.90 USD, with the market focus on Iran and India. Find out more in our analysis for 10 February 2026.

Brent forecast: key takeaways

- Brent oil is actively reacting to new geopolitical tensions

- The market is watching Iran and India’s crude oil purchases

- Brent forecast for 10 February 2026: 70.00

Fundamental analysis

Brent prices climbed to 68.90 USD per barrel on Tuesday, maintaining the gains of previous sessions amid heightened tensions between the US and Iran, despite signs of progress in negotiations.

On Monday, the US issued a warning to all US-flagged vessels recommending that they avoid Iranian waters and the Strait of Hormuz. This followed intentions by both sides to continue dialogue after talks in Oman last Friday were described as constructive.

At the same time, uncertainty surrounding the outcome of the negotiations remains. Iran insists on maintaining its uranium enrichment program, which remains a key point of disagreement for Washington.

The market is also paying close attention to India’s purchases of Russian oil. A recent US trade deal with New Delhi was linked to the possibility of freezing imports of Russian crude. India remains one of the largest buyers of Russian oil, and any sustained reduction in supplies could become a significant factor supporting global oil prices.

The outlook for Brent is cautious.

Technical outlook

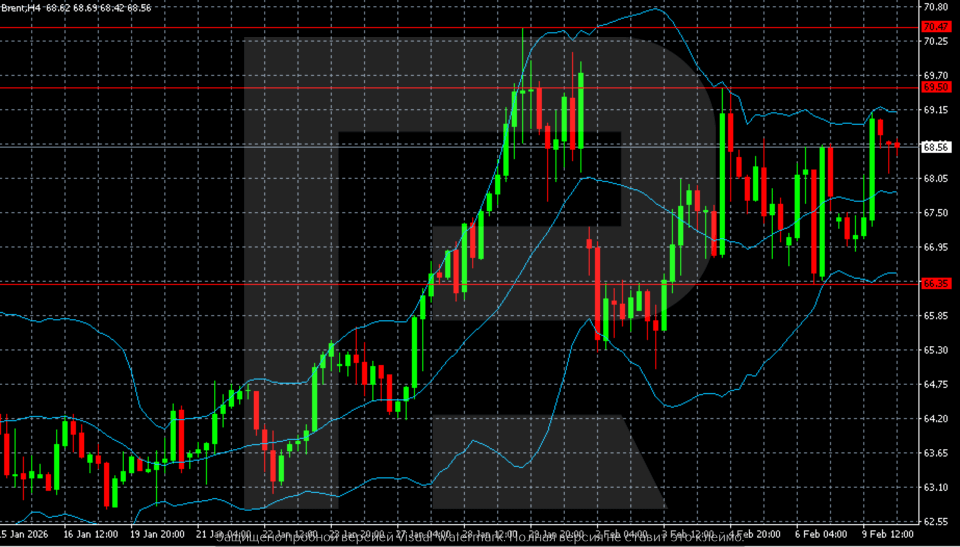

On the H4 chart, after a sharp momentum rally in late January, Brent prices reached the 70.00–70.50 area, where a local high formed and a correction began. The decline was accompanied by a move below the middle Bollinger Band and an increase in intraday volatility.

In early February, Brent found support near 66.30 and shifted into sideways movement. Prices are currently consolidating in the 66.30–69.50 range, near the middle Bollinger Band. The structure suggests a stabilisation phase following the impulse, with balance between recovery attempts and the risk of a deeper correction.

Brent overview

- Asset: Brent

- Timeframe: H4 (Intraday)

- Trend: moderately bullish

- Key resistance levels: 69.50 and 70.00

- Key support levels: 66.30 and 65.50

Brent trading scenarios for today

Main scenario (Buy Stop)

Brent remains in a stabilisation phase following the momentum-driven rally in late January. Prices are consolidating in the 66.30–69.50 range amid persistent geopolitical risks and heightened attention to the situation around Iran and oil supply flows.

A breakout and consolidation above 69.50 would signal a continued recovery towards the round level of 70.00 USD. While the current H4 structure suggests balance of forces, buyers have the upper hand as long as prices hold above 66.30.

The risk-to-reward ratio is around 1:3.

- Buy Stop: 69.50 USD

- Take Profit: 70.00 USD

- Stop Loss: 68.70 USD

Alternative scenario (Sell Stop)

If geopolitical tensions ease or investors take profit after the rally, a pullback from the upper boundary of the range is possible. A loss of the 66.30 support level would increase correction risks and open the way towards 65.50.

This scenario is corrective and does not cancel the prevailing upward bias.

- Sell Stop: 66.20 USD

- Take Profit: 65.50 USD

- Stop Loss: 67.10 USD

Risk factors

Geopolitics remains the key source of uncertainty. Any escalation around Iran or risks to shipping through the Strait of Hormuz could sharply boost oil demand and lead to an accelerated breakout above the 70.00 zone. At the same time, de-escalation or confirmation of stable supply could trigger a deeper correction.

Summary

Brent crude continues to edge higher, supported by geopolitical risks. The Brent forecast for today, 10 February 2026, suggests a rise towards the 70.00 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.