Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Disclaimer: the information in this article is based on the analysis of reputable financial resources and analytical data from RoboForex specialists. It reflects the conclusions of thorough research, but it should be taken into account that economic changes may significantly affect market conditions, which may lead to changes in Gold forecasts. We recommend conducting your own research and consulting with professionals before making important financial decisions.

Gold remains one of the most reliable tools for hedging risks during global crises. Its popularity confirms the enduring appeal of this asset, which is projected to persist in the long term.

After an impressive rally until October 2025, the gold market entered a consolidation phase and is now trading around the 4,000 USD per ounce level. The metal set a new price record, reaching 4,381 USD per ounce on 20 October 2025. Despite the current stabilisation, analysts remain confident in gold’s potential in 2026, forecasting further growth.

The escalation of the conflict in Ukraine, rising tensions in the Middle East and political instability in Europe continue to increase economic uncertainty. These risks support growing demand for gold among investors and central banks. In particular, the People’s Bank of China continues its purchases, remaining one of the largest buyers of the precious metal.

Table of contents:

- Key takeaways: Gold (XAUUSD) price prediction

- How to make a Gold price forecast?

- Why has the price of Gold increased?

- XAUUSD live price chart

- Gold (XAUUSD) weekly technical analysis

- Long-term Gold (XAUUSD) technical analysis

- Expert Gold price forecast 2026 and beyond

- Expert Gold price predictions for 2030

- Pros and cons of investing in Gold

- Conclusion

- FAQ

Key takeaways: Gold price prediction

Analysts forecast that gold prices will continue to rise, with new record highs possible in 2026. XAUUSD prices are expected to decline to 3,800 USD by the end of 2025 and then rise to 4,500 USD over the following two years, driven by strong demand from major central banks and changes in the monetary policy of the Federal Reserve.

Gold remains an attractive asset amid weakening confidence in the US dollar across Asia and persistent geopolitical tensions. Morgan Stanley expected gold prices to stabilise at 2,700 USD in Q1 2025, while UBS forecast an increase to 2,900 USD by year-end. Goldman Sachs analysts believed gold could reach 3,700 USD in 2025. But in reality, gold prices tested 4,381 USD.

Analysts pay particular attention to gold-reserve purchases by central banks in developing countries, which aim to reduce dependence on the dollar and lower sanction-related risks. They note that the growing US national debt will place pressure on confidence in the US currency in the long term, which will also push gold prices higher.

How to make a Gold price forecast?

Gold price forecasts are based on the analysis of the main factors determining its supply and demand. It also takes into account the price patterns on the price chart, the assessment of technical indicators, as well as the dynamics in emerging markets. Experts and investors distinguish three main approaches to make an accurate XAUUSD forecast:

- US monetary policy

- Central bank purchases

- Geopolitical risks

These key drivers are strongly influenced by the level of confidence in the US dollar and its current strength or weakness. Other important factors include shifts in investor sentiment, political instability during election periods, the threat of a recession, capital outflows from ETFs, sensitivity of physical demand, US unemployment levels, as well as risks in the banking sector and various industries in the US, the European Union, and China.

Fundamental factors

Fundamental analysis of gold (XAUUSD) relies on changes in the monetary policy of central banks, especially the US Federal Reserve, as well as other key factors that influence gold prices. These include the level of global consumption, investment demand, rising central-bank demand, changes in the Federal Reserve’s interest rate and China’s gold purchases. These factors strongly affect price behaviour and form the basis for further gold forecasts.

Federal Reserve interest rate cuts

Gold traditionally shows a strong correlation with central-bank interest-rate dynamics. Historically, gold tends to rise steadily when interest rates decline and inflation accelerates, acting as a risk-hedging instrument. The shift in the US monetary cycle became one of the factors driving gold prices higher in 2025. In September 2025, the regulator lowered the interest rate to 4.25%. In October 2025, another rate cut took place, bringing it down to 4.0%. The regulator also noted that a new stage of the easing cycle had begun, and decisions in 2026 would now be made more cautiously.

Global gold demand

According to the World Gold Council (WGC) report for Q3 2025, total gold demand increased by 3% compared with the same period a year earlier and reached 1,313 tonnes, a record figure for Q3. The total value of demand exceeded 384 billion USD for the first time, driven by strong investment activity at record gold prices.

Global investment demand grew by 538 tonnes due to rising interest in ETFs, mainly from Western investors. According to the WGC, in Q2 2025, total investment demand for gold (including bars and coins) increased by 41% compared with the same period in 2024.

Demand for gold in the technology sector fell by 2% year-on-year.

Central-bank gold purchases

According to the WGC Gold Demand Trends Report of September 2025, central banks purchased 39 tonnes of gold, up 79% from August, marking the highest monthly net purchases in 2025. Overall, central-bank demand remains strong. In the first three quarters of 2025, cumulative demand reached 3,717 tonnes. Central banks planned to purchase about 1,000 tonnes of gold in 2025, potentially marking the fourth consecutive year of rising central-bank gold purchases.

A survey conducted among central banks showed that 43% of respondents planned to increase their gold reserves in 2025, the highest share since such surveys began in 2018. The main reasons cited include the desire to reach an optimal level of reserves, support domestic gold production, and protect against financial crises and inflation risks.

Central banks in developed countries traditionally hold a larger share of gold in their reserves. For example, in the US, France, Germany and Italy, gold accounts for about 70% of reserves. In emerging markets, this share is much lower – in China, gold accounts for only 5.1% of reserves. However, central banks in emerging markets are actively increasing their gold reserves, aiming to reach levels typical of developed economies, which may support gold prices in the future.

China resumed gold purchases

The People’s Bank of China increased its gold reserves by an additional 23.95 tonnes over the first three quarters of 2025.

According to the latest data as of the end of September 2025, the volume of gold in the reserves of the People’s Bank of China stands at approximately 2,303.5 tonnes. The PBOC has resumed reserve accumulation, confirming China’s intention to diversify its reserves despite high gold prices.

Tech analysis

This approach involves analysing historical data on gold charts to identify price trends using various technical indicators, chart patterns, and other analytical tools. Technical analysis helps to identify key resistance and support levels, trend lines, as well as to predict possible price reversals over the long term.

Based on historical data, we see that XAUUSD typically demonstrates an uptrend in the long term. Therefore, trend indicators such as Moving Averages, Bollinger Bands, and the Ishimoku indicator are often used to analyse it. Oscillators such as the RSI and MACD help to identify where the downward correction may end and signal possible upward reversal points.

Market sentiment

The main fundamental factors supporting the growth of XAUUSD prices remain stable. Sustained demand from major central banks, which are actively increasing their gold reserves, continues to drive positive sentiment in the market. This trend is particularly noticeable in emerging economies, where central banks are seeking to diversify their assets and reduce dependence on the US dollar.

Rising geopolitical tensions, including those in the Middle East, add to global uncertainty and encourage investors to seek safe-haven assets such as gold. In 2026, the key drivers of gold demand will include increased central bank purchases, capital inflows into exchange-traded funds amid monetary policy easing, as well as geopolitical risks and the possible escalation of trade tensions. After a period of declining demand, these funds have recorded net inflows, indicating active capital reallocation by institutional investors and supporting the continued rise in precious metal prices.

Why has the price of Gold increased?

The rise in gold prices in 2025 was driven by multiple factors, including geopolitical instability. The conflicts in Ukraine and the Middle East, along with political crises in Germany and France, heightened investor concerns. In addition, the easing of US Federal Reserve monetary policy and trade tariffs amid slowing inflation reduced the attractiveness of debt assets, which in turn boosted demand for gold. Central banks in developing countries and China increased their purchases of the precious metal, seeking to reduce dependence on the US dollar and minimize sanctions-related risks. Retail investors in countries such as China, India, Turkey, and Russia also stepped up their gold purchases, using it as protection against the depreciation of their national currencies.

Gold demand was also influenced by macroeconomic factors. The growing US national debt, the record-length government shutdown in terms of days the US government remained non-operational, and declining trust in the US dollar increased interest in gold as a safe-haven asset. The policies of the Trump administration, including the introduction of import tariffs and the refusal to enforce the debt ceiling, heightened uncertainty and strengthened gold’s position. The renewed interest in gold ETFs and the metal’s weak correlation with other asset classes have made it a popular choice among retail investors. In 2026, these factors will continue to reinforce gold's status as an asset capable of preserving value amid rising market volatility and political instability.

XAUUSD live price chart

Gold (XAUUSD) weekly technical analysis

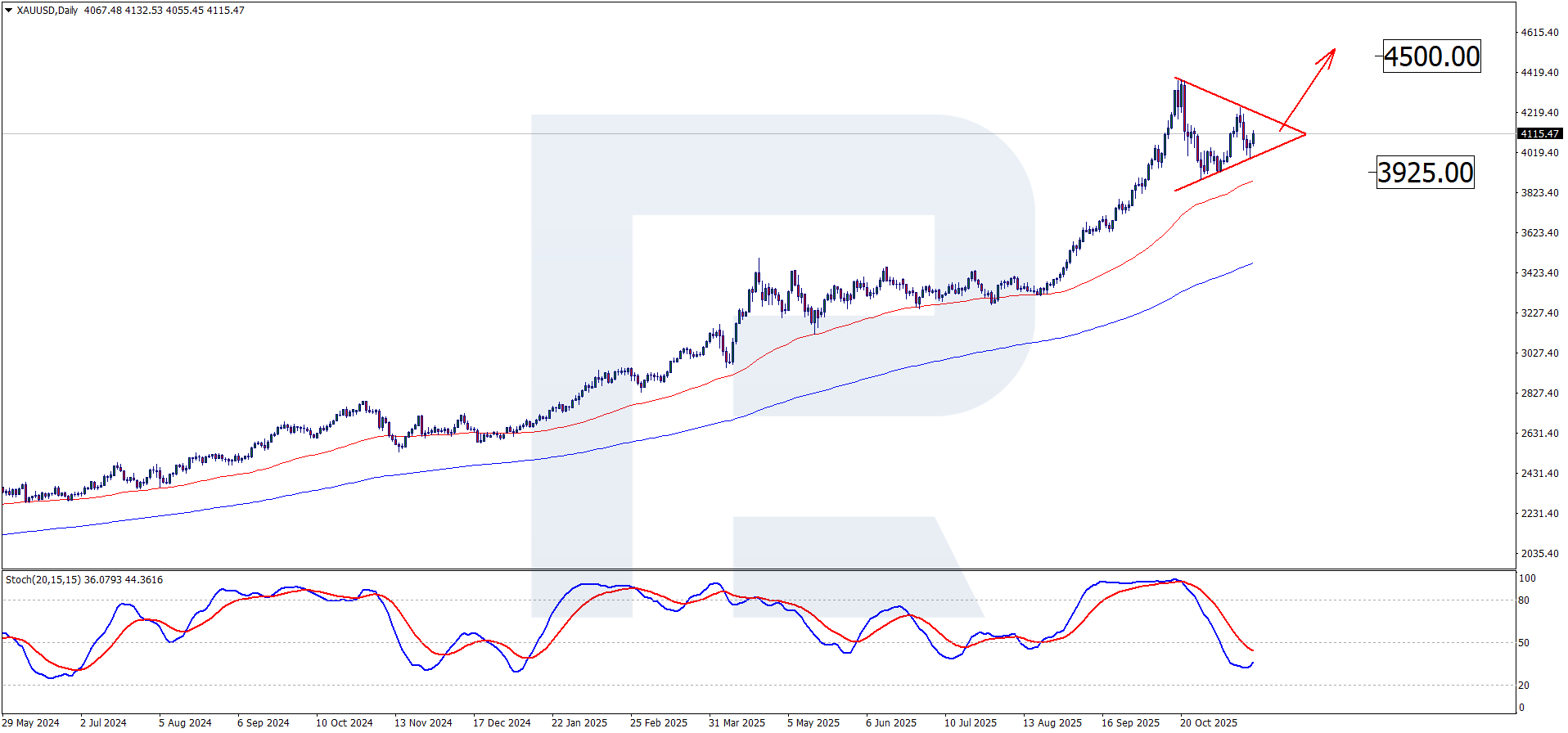

On the daily chart, gold is moving toward the upper boundary of the “Triangle” pattern. Key support was located at 3,925 USD, and the rebound from this level opened the way for further price growth within the development of the pattern. In this scenario, the target level is 4,500 USD. The Stochastic Oscillator indicates that the correction may soon be completed, as the %K and %D lines are converging. The resistance zone is located near 4,200 USD, and a breakout above it may signal the continuation of the upward movement.

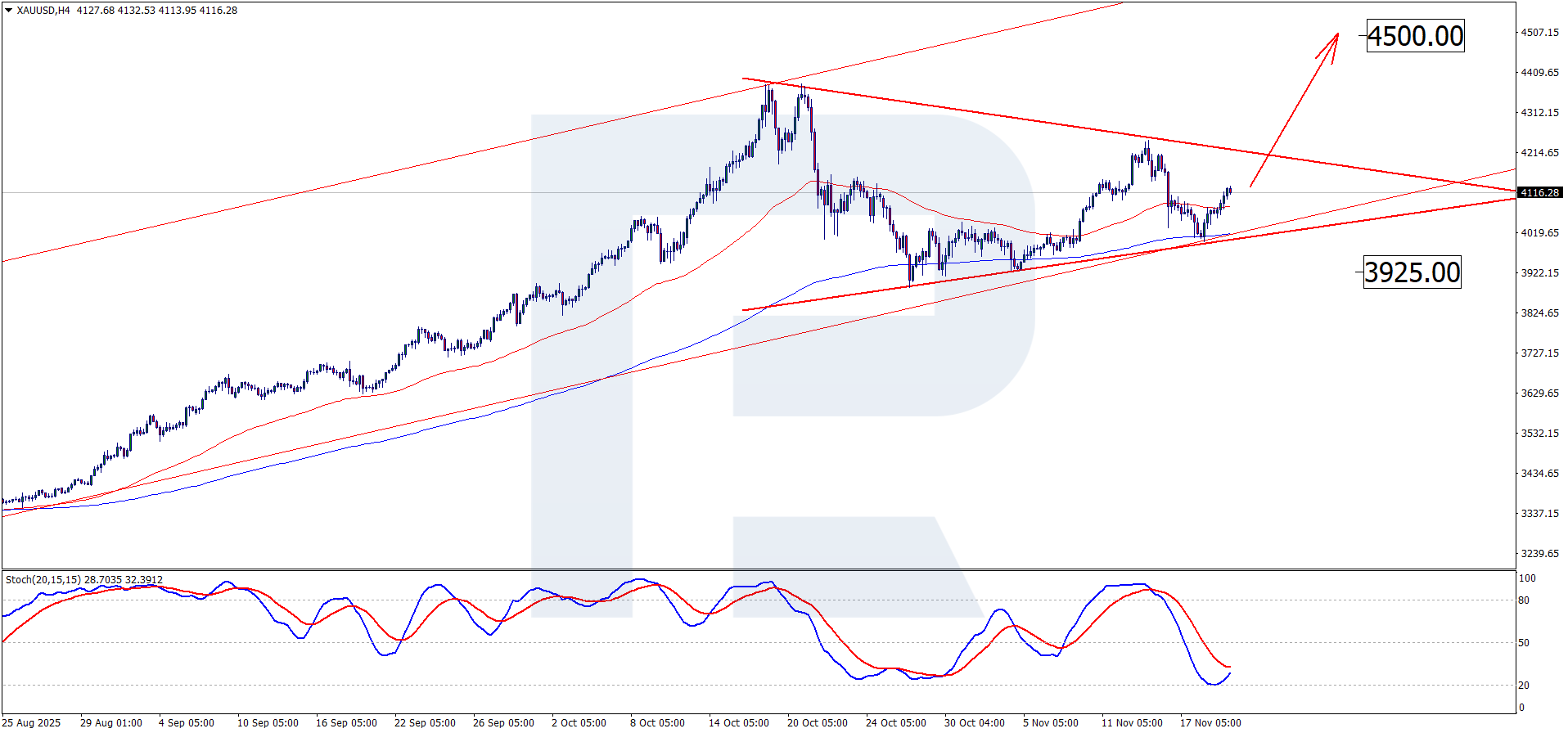

On the H4 XAUUSD chart, prices continue to move within a medium-term uptrend. The EMA-65 and EMA-200 lines are moving toward each other and may cross in the near future. In this case, it is highly likely that buyers will continue to accumulate positions and increase pressure on the USD. After the crossover, EMA-65 and EMA-200 may diverge again, confirming the continuation of the bullish trend. According to the main XAUUSD forecast for 2026, the bullish wave may continue toward 4,500 USD, after which a corrective wave is likely to form. A rebound from the support line on the Stochastic Oscillator increases the probability of further growth. Price consolidation above the 4,200 USD level will serve as a signal for continued upward movement.

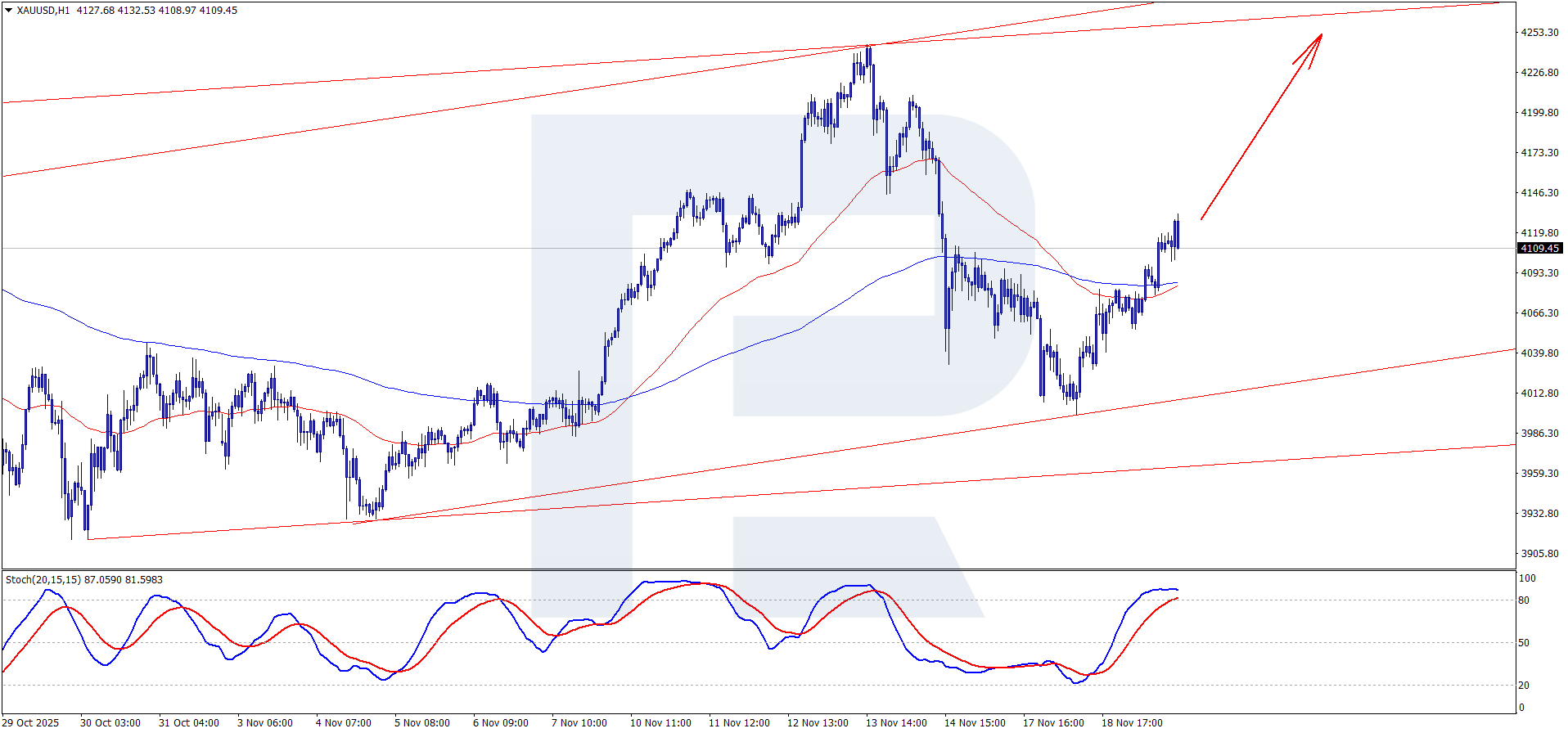

On the hourly XAUUSD chart, the price has crossed the EMA-65 line, continuing to move within the upward channel. In the short term, the bullish impulse may continue toward the 4,500 USD mark. Additional support for the bullish scenario is provided by the crossover of the %K and %D lines on the Stochastic Oscillator.

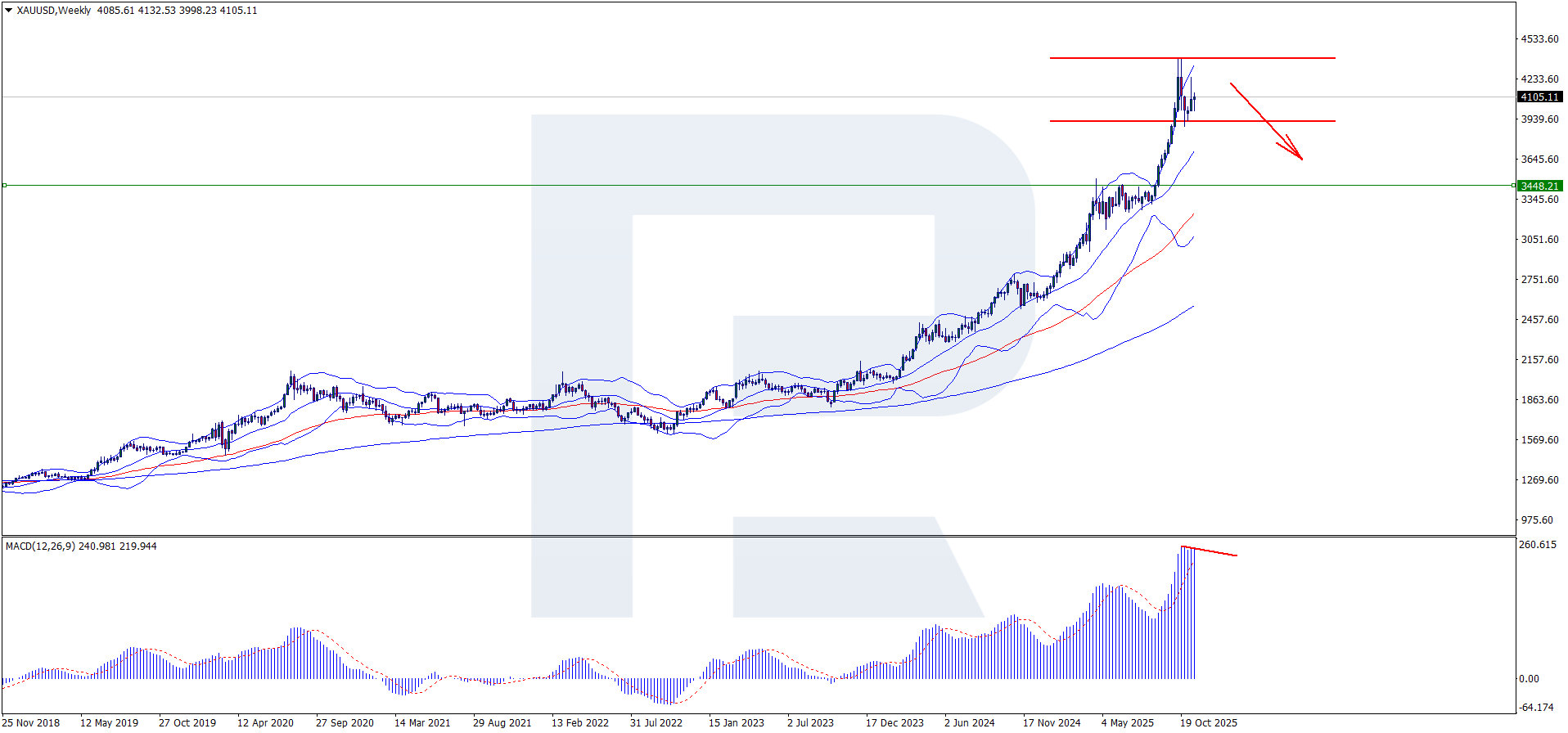

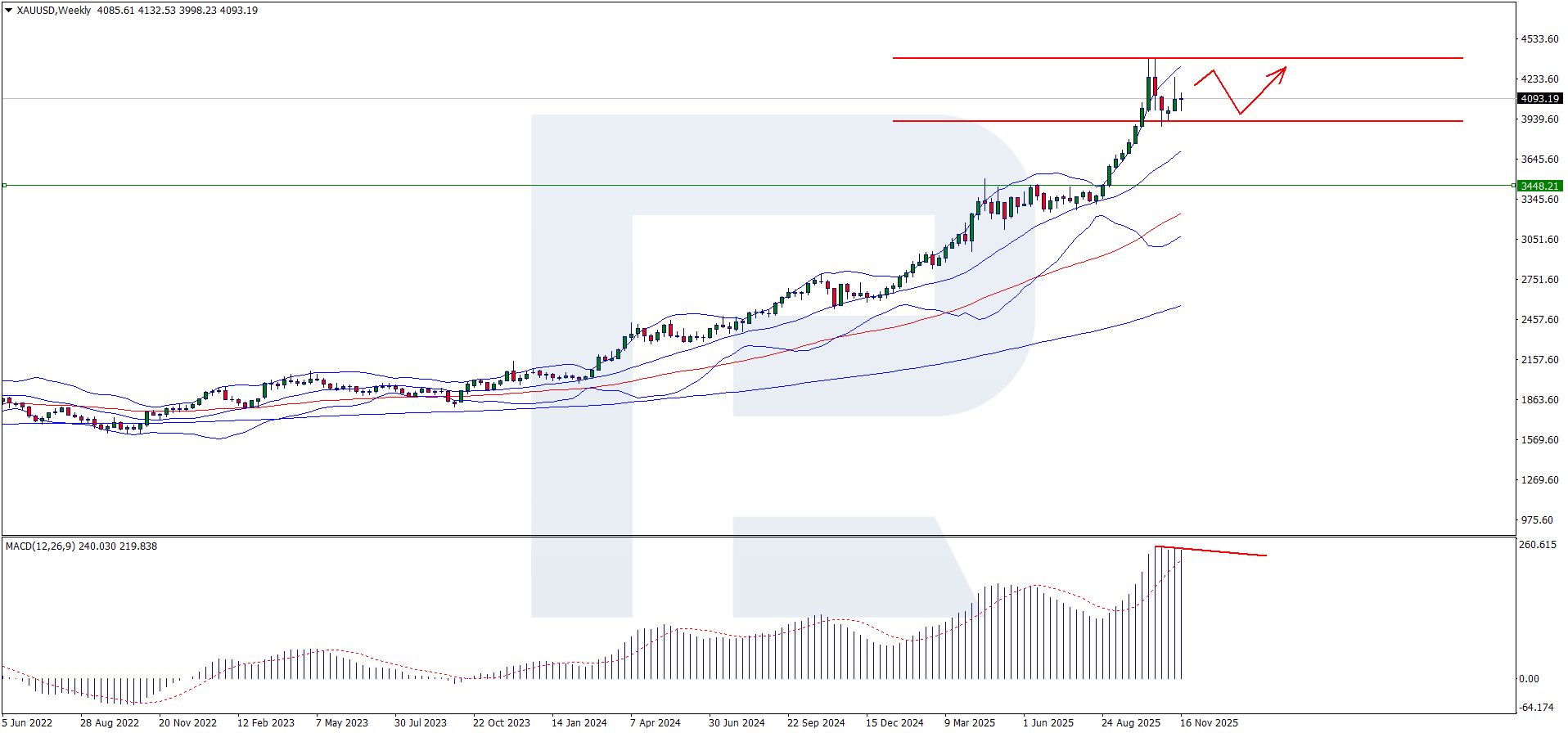

Long-term Gold (XAUUSD) technical analysis

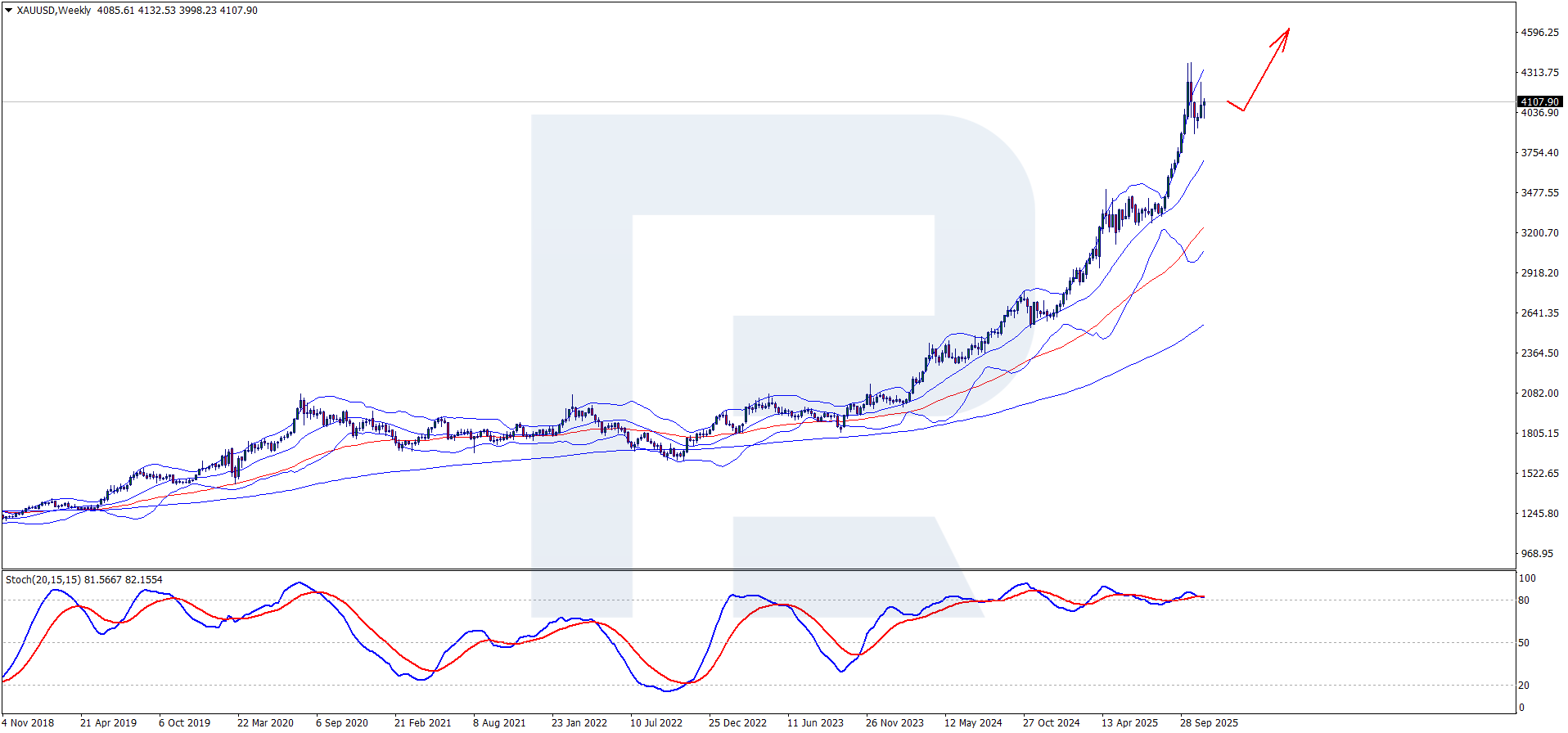

When preparing a long-term gold price forecast, it is important to consider several possible scenarios. This forecast highlights key support and resistance levels and analyses the price behaviour within the Bollinger Bands. It examines how frequently and significantly prices manage to break through either side of this trend indicator, helping to better understand current market trends and investor sentiment. It is worth noting that when key levels are broken, gold may either accelerate its upward movement or enter a correction, depending on changes in the external economic environment.

Bullish scenario

On the weekly timeframe, XAUUSD has been consistently holding above the middle line of the Bollinger Bands indicator since 2024, which indicates a prevailing bullish trend. At the moment, prices also remain above this line, regularly breaking through the upper band, which signals increasing buying pressure. Within the positive scenario and the XAUUSD price forecast, further growth of the precious metal can be expected, with a breakout of the psychological level of 4,500 USD. Consolidation above this mark will likely lead to another test of the upper Bollinger Bands boundary. Previously, an acceleration of growth occurred when the upper boundary of the indicator was breached; therefore, if the price consolidates above 4,500 USD, a continuation of the bullish trend can be expected, with the next target at 5,000 USD.

Bearish scenario

A potential downward scenario is associated with the beginning of a bearish wave on the MACD indicator. If gold prices decline toward 3,925 USD, this will create conditions for a correction and trigger a drop in XAUUSD quotes. The nearest downside target will be the key support level at 3,450 USD. A breakout of this level will open the way for a deeper decline toward 3,200 USD as part of a corrective wave. This pattern forms when the price breaks the support level, confirming a trend reversal.

Sideways scenario

XAUUSD quotes have already rebounded from the 4,381 USD resistance level, then dropped to the support level of 3,925 USD and bounced off it. At present, prices are rising again and approaching resistance. If the buying pressure proves insufficient, another pullback towards the 3,925 USD support level is possible. If a new decline occurs but sellers fail to overcome the support, prices may resume growth while remaining within the sideways range. This scenario would indicate market uncertainty and expectations for new factors that could determine the future direction of movement and push prices out of the range.

Expert Gold price forecast 2026 and beyond

J.P. Morgan

J.P. Morgan has strengthened its bullish forecast for gold in 2026, emphasizing its continued appeal as a hedging instrument amid geopolitical tensions, a potential recession, and active central bank purchases. According to the bank’s latest outlook, the average gold price by mid-2026 may reach the 5,200–5,300 USD per ounce range. This growth, in J.P. Morgan’s view, is supported by strong investment demand, central bank gold purchases, and a broad desire to protect assets from systemic and inflationary risks.

UBS

UBS has raised its baseline gold forecast to 4,200-4,700 USD per ounce, driven by inflation risks, geopolitical tensions, and shifting expectations regarding Federal Reserve rate decisions. Strong central bank demand, growing interest in ETFs, and increasing participation from both retail and institutional investors continue to support prices, while supply remains constrained. UBS also maintains a long position in gold within its global and Asian asset allocations.

Deutsche Bank

Deutsche Bank has raised its gold price forecast for 2026 — the new expected average price is 4,450 USD per ounce, up from the previous 4,000 USD. The projected gold price range for 2026 is from 3,950 to 4,950 USD per ounce. The main factor behind the revision is the steady inflow of investments into gold and the persistent demand from central banks, which are buying up most of the supply on the market.

Goldman Sachs

Goldman Sachs raised its mid-2026 gold forecast to 5,000 USD. The shift in Federal Reserve monetary policy has led the bank to revise its timing expectations. Nevertheless, analysts remain confident in a stable bullish trend, driven by increasing global demand, including from investment funds and central banks.

Bank of America

Bank of America expects gold to reach 5,000 USD per ounce in 2026, with further upside possible under more aggressive scenarios. Key drivers include the US sovereign debt crisis, a weakening dollar, and rising gold purchases from BRICS nations. BofA also notes that even if the dollar remains strong, gold continues to serve as a strategic asset amid the global trend toward de-dollarization.

Citi Research

Citi Research expects gold to consolidate around 3,250 USD in 2026, while in an optimistic scenario prices may exceed 3,500 USD, supported by strengthening investment demand and heightened geopolitical tensions.

Expert Gold price predictions for 2030

Many experts agree on the long-term bullish trend of the XAUUSD price as various fundamental factors point to it. Below are some of the expert opinions:

Charlie Morris, Head Of Multi Asset, Atlantic House Investments in the article in Alchemist magazine predicts a possible XAUUSD price of 7,000 USD per ounce by 2030. His prediction is based on several key factors. First, real inflation is expected to increase, which Morris believes could reach 4 per cent per decade. Second, real interest rates are expected to change. In addition, a fair value premium is factored in, which could increase substantially. These assumptions are based on analyses of current and past trends in the economy and the Gold market.

Another analyst Peter Leeds predicts that the XAUUSD price could reach 10,000 USD per ounce by 2030, driven by a number of economic and geopolitical factors. The main drivers of growth are the weakening of the US dollar due to the huge national debt, the growing budget deficit and its decreasing role in international trade, especially with the reduced use of the petrodollar. The BRICS countries, which are actively building up Gold reserves, are also having an impact: their new Gold-backed currency is expected to become a serious competitor to the dollar. An additional growth factor will be global economic instability and the growing demand for Gold as an ‘insurance’ asset.

The author emphasises that XAUUSD prices will grow annually, but the timing of reaching the 10,000 USD mark depends on the speed of development of the processes mentioned above. The key triggers may be the intensification of geopolitical conflicts, devaluation of the dollar or mass transition of investors to Gold. To maximise the benefits, it is recommended to invest both in physical Gold and in shares of Gold mining companies with low debts and high reserves. Gold remains a solid defence against economic turmoil and loss of purchasing power of currencies.

Pros and cons of investing in gold

Gold has long been one of the most popular instruments for capital protection and risk mitigation. Even though it has many advantages, such as protection against inflation and portfolio diversification, it is important to consider the disadvantages of investing in this asset. For an investor, knowing the pros and cons of investing in gold helps in making informed investment decisions.

Pros

- Inflation protection: gold traditionally serves as a reliable hedge against inflation. As prices rise and the purchasing power of currency falls, gold maintains or even increases its value, helping investors protect their savings.

- Portfolio diversification: gold can add diversification to an investment portfolio because its value typically has low correlation with stocks and bonds. Therefore, the price of this precious metal often moves in the opposite direction, reducing overall portfolio risk.

- Liquidity: gold is a highly liquid asset that can be easily bought and sold on global markets. This makes it attractive for investors who may need to quickly convert their assets into cash.

- Safe-haven in crises: during periods of economic or geopolitical instability, XAUUSD is often seen as a "safe haven" asset. Investors tend to invest in the metal amidst uncertainty, which often supports and can even increase the value of gold when other assets may be declining.

- Tangible asset: unlike stocks or bonds, gold is a physical, tangible asset that can be held and stored. This gives investors a sense of confidence and security compared to digital assets.

- Long-term value preservation: over time, gold has maintained its value, making it a reliable means of preserving wealth through generations. It is less susceptible to risks associated with fiat currencies and other financial assets.

- Global demand: gold is in demand worldwide, both as a commodity for industrial use and as a store of value. This global demand supports stability and provides potential for price growth.

Cons

- Lack of passive income: unlike stocks or bonds, gold does not generate passive income, such as dividends or interest. Investors can only rely on the appreciation of gold, which can be unpredictable.

- Volatility: despite its reputation as a stable asset, gold can exhibit significant short-term price fluctuations. These fluctuations can lead to losses for investors focused on short-term gains.

- Storage costs: physical gold requires secure storage, especially when held in large quantities. This adds additional costs that can reduce the overall profitability of gold investments.

- Lack of yield: gold does not generate income, unlike bonds or stocks. This can be a drawback for investors seeking regular passive income from their investments.

- Dependence on global factors: the value of gold depends on numerous factors such as supply and demand, economic indicators, and geopolitical situations. This means that gold prices can be subject to external shocks over which investors have no control.

- Market manipulation risks: XAUUSD prices can be affected by market manipulations, especially by large financial institutions or states, which can lead to unpredictable price changes.

- Opportunity costs: investing in gold means essentially locking capital in a non-yielding asset. This can lead to missed opportunities for investing in other assets that may offer higher returns over time, such as stocks or bonds.

Conclusion

The sharp rise in gold prices in 2025 is driven by political and economic instability, including geopolitical conflicts and the US Federal Reserve’s monetary policy easing. Central banks, particularly in developing countries, increased their gold purchases, while retail investors actively used gold to hedge against inflation and currency depreciation. Additionally, the growing US national debt and Trump’s tariff proposals supported demand for gold as a safe-haven asset against uncertainty and volatility.

Based on technical analysis, gold maintains its upward momentum on the chart. Buyers have managed to keep prices above the EMA-65 line for an extended period. The 2026 gold forecast points to a potential rise to the 4,500 USD and 5,000 USD levels, provided there is a strong consolidation above the nearest resistance at 4,381 USD. The Stochastic Oscillator confirms bullish momentum, signalling a potential continuation of the upward move. However, a breakout below the lower boundary of the Triangle with price consolidation under 3,925 USD may trigger a bearish correction towards 3,450 USD or lower.

Gold forecasts for 2026 range from moderate to optimistic. Overall, analysts predict rising prices for the metal, with estimates ranging from 4,500 USD to 5,000 USD. Expectations of Fed rate cuts, along with demand from central banks and investors, including physical purchases and ETFs, are anticipated to support prices. However, potential strengthening of the US dollar and higher bond yields could pose risks to this growth. Nevertheless, gold retains strong upside potential, especially if political instability or economic risks intensify.

FAQ

Whether it's a good time to buy gold depends on current market conditions, economic indicators, and your financial goals. Given gold's role as a hedge against inflation and currency devaluation, it can be a wise investment during periods of economic uncertainty or when inflation is expected to rise. It's important to consider both the current XAUUSD price trends and broader economic forecasts before making a decision.

It is likely that investing in Gold can provide significant long-term benefits. Historically, Gold has maintained its value for centuries, providing a hedge against economic instability and inflation. It is an effective way to diversify an investment portfolio, as its price movements tend to differ from stocks and bonds. However, like any investment, it comes with risks and should be balanced with other types of investments to manage overall risk.

Today's Gold price forecasts can be found in the RoboForex Market Analysis section.

Experts forecast that gold prices in the third quarter of 2025 will fluctuate within the 3,900–4,500 USD range, with some scenarios allowing for a decline to 3,925 USD. The Federal Reserve’s monetary easing, geopolitical risks, and concerns over US fiscal sustainability continue to support the upward trend. However, analysts warn that by the end of 2025 investment demand may begin to weaken, especially if the US dollar strengthens and the US economy shows signs of recovery. Year-end projections vary, but growth toward 5,000 USD remains possible in 2026. Despite potential risks, gold is still viewed as a strategic safe-haven asset amid global instability, making its purchase justified from a long-term investment perspective.

While returns on any investment are not guaranteed, Gold could be profitable over the next five years, especially if economic or geopolitical conditions create uncertainty or instability. Gold’s historical performance during such times suggests that it could appreciate in value under similar future conditions. Investors should pay attention to global economic indicators and central bank policies, as they will play an important role in shaping Gold market dynamics. Diversification and careful monitoring will be key to managing investment risk and capitalizing on potential market opportunities for Gold.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.