Silver (XAGUSD) prices secured above 31.00 USD

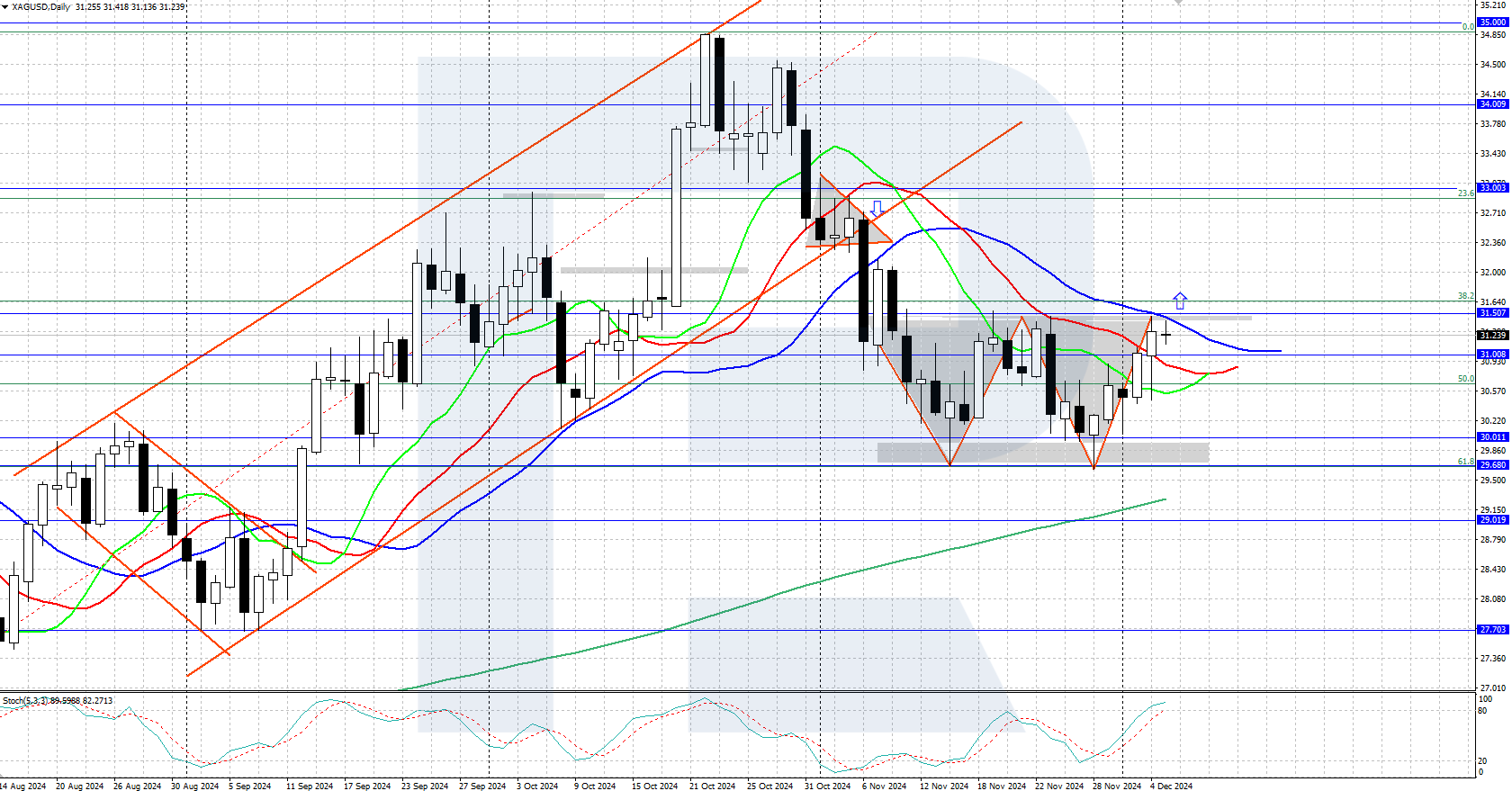

The XAGUSD pair is still trading within a downward correction. However, there are preconditions for its completion and an upward reversal. More details in our Silver price analysis for today, 5 December 2024.

XAGUSD forecast: key trading points

- Market focus: market participants will receive US labour market statistics tomorrow, with reports on nonfarm payrolls and the unemployment rate due for release

- Current trend: correcting downwards

- XAGUSD forecast for 5 December 2024: 31.00 and 31.50

Silver fundamental analysis

XAGUSD prices have been in a downward correction for over a month amid the strengthening of the US dollar and uncertainty about the pace of further interest cuts by the US Federal Reserve. Last week, the asset received strong support from buyers at 30.00 USD, forming a local upward reversal.

Yesterday’s US employment data from Automatic Data Processing Inc. (ADP) showed an increase of 146k in jobs, which was nearly in line with the forecast of +150k. Market participants await Friday’s release of nonfarm payrolls and the unemployment rate.

If the statistics come in above the forecast, it could support the US dollar and push the XAGUSD pair into another local correction. Conversely, weaker-than-expected data could lead to the completion of the correction, propelling prices towards annual highs.

XAGUSD technical analysis

Silver prices are experiencing a moderate upward movement, securing above 31.00 USD. The daily chart shows a double bottom bullish reversal pattern, which will be completed if the price breaks above the 31.50 USD resistance level. The pattern’s target area is around 33.00 USD.

The short-term Silver price forecast suggests that prices could rise to around 33.00 USD if bulls push the quotes above 31.50 USD. Conversely, if bears send prices below 30.00 USD, the downward correction could continue.

Summary

XAGUSD prices secured above 31.00 USD, forming a double bottom reversal pattern. Tomorrow, the market will focus on US employment data – nonfarm payrolls and the unemployment rate.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.