Silver (XAGUSD) prices hold above 32.00 USD

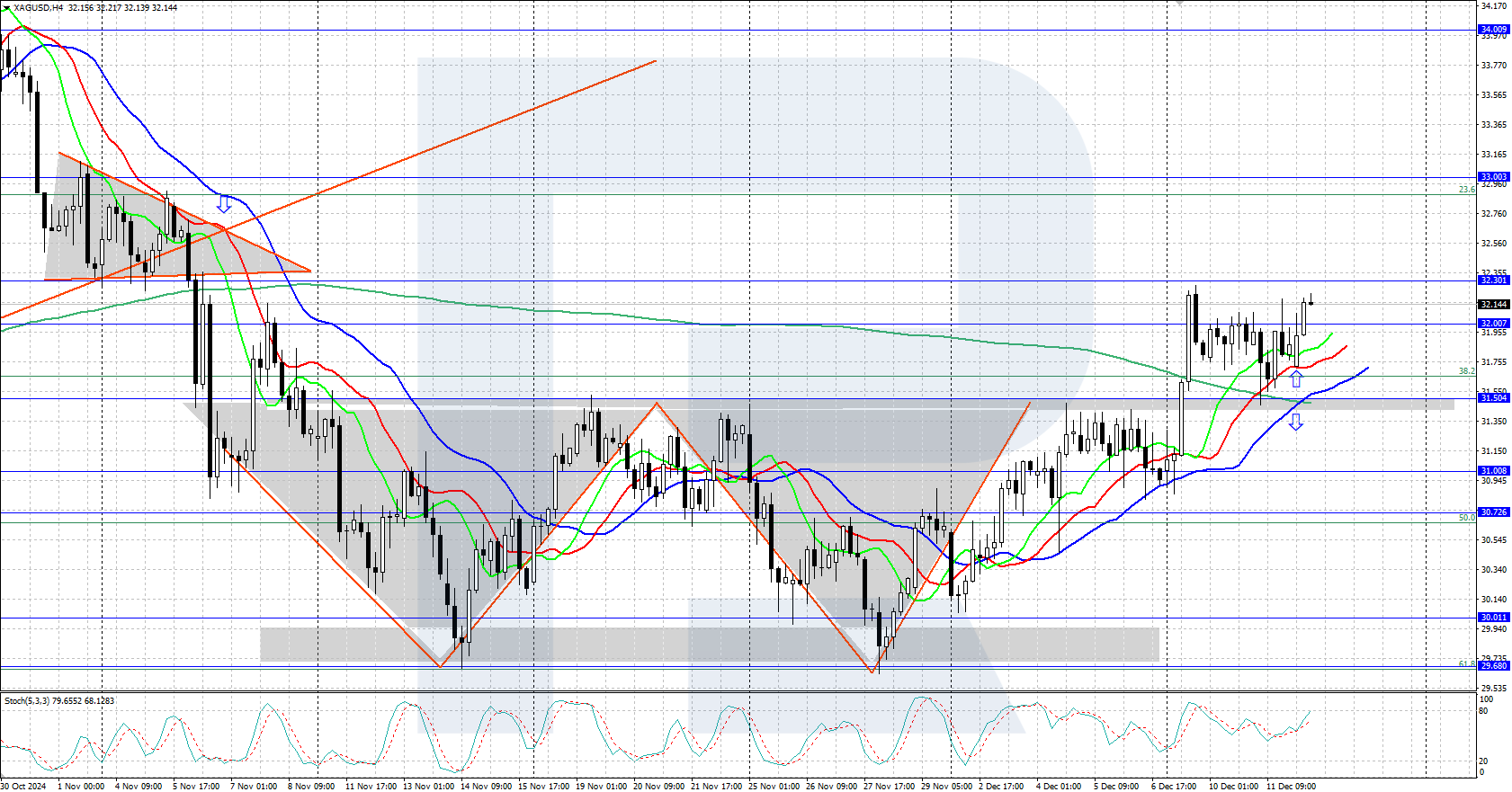

The XAGUSD pair has formed a reversal towards the long-term uptrend on the daily chart, rising above 32.00 USD. Further growth may occur soon. Find out more in our Silver price analysis for today, 12 December 2024.

XAGUSD forecast: key trading points

- Market focus: US inflation data is due today, with the Producer Price Index (PPI) scheduled for release

- Current trend: the asset is experiencing an upward movement

- XAGUSD forecast for 12 December 2024: 33.00 and 31.50

Silver fundamental analysis

Silver has exited a sideways range and is now showing an upward movement on the daily chart; the long-term trend in the asset suggests further growth. Prices are currently supported by an escalation of the conflict in the Middle East, strengthening Gold and Silver as safe-haven assets.

During the US trading session, market participants will focus on US inflation data for November, with the PPI scheduled for release. It is expected to rise by 0.2% month-on-month and 2.6% year-on-year. Weaker-than-forecast data will exert pressure on the USD and help strengthen Silver. Conversely, stronger figures may bolster the US dollar and push the XAGUSD pair lower.

XAGUSD technical analysis

Silver prices have been moving upward this week, holding above 32.00 USD. The daily chart shows a double-bottom bullish reversal pattern, with the price moving towards the pattern’s target near 33.00 USD.

The short-term Silver price forecast suggests that prices may rise to 33.00 USD if bulls hold the quotes above 31.50 USD. Conversely, if bears push prices below 31.50 USD, they could fall towards the support area near 30.00 USD.

Summary

XAGUSD prices remain above 32.00 USD, with the chart showing a double-bottom reversal pattern. Today, the market will focus on US inflation statistics, including the PPI data release.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.