Gold (XAUUSD) is up, rising above 2,650 USD

This week, XAUUSD prices received support from buyers at the 2,600 USD level and reversed upwards, with growth likely to continue. More details in our XAUUSD analysis for today, 29 November 2024.

XAUUSD forecast: key trading points

- Market focus: the US markets are closed as the country celebrates Thanksgiving Day

- Current trend: Upward movement

- XAUUSD forecast for 29 November 2024: 2,650 and 2,700

Fundamental analysis

XAUUSD quotes completed a downward correction and confidently reversed upwards, resuming the long-term uptrend. Gold remains in strong demand from central banks and investors, supported by the Federal Reserve’s monetary policy easing and the escalation of local military conflicts. The decline in the US dollar against major currencies also contributed to Gold’s growth this week.

With US markets closed today for the Thanksgiving holiday, no macroeconomic data is expected to be released. Without major news, Gold may continue to strengthen moderately within the current technical framework.

XAUUSD technical analysis

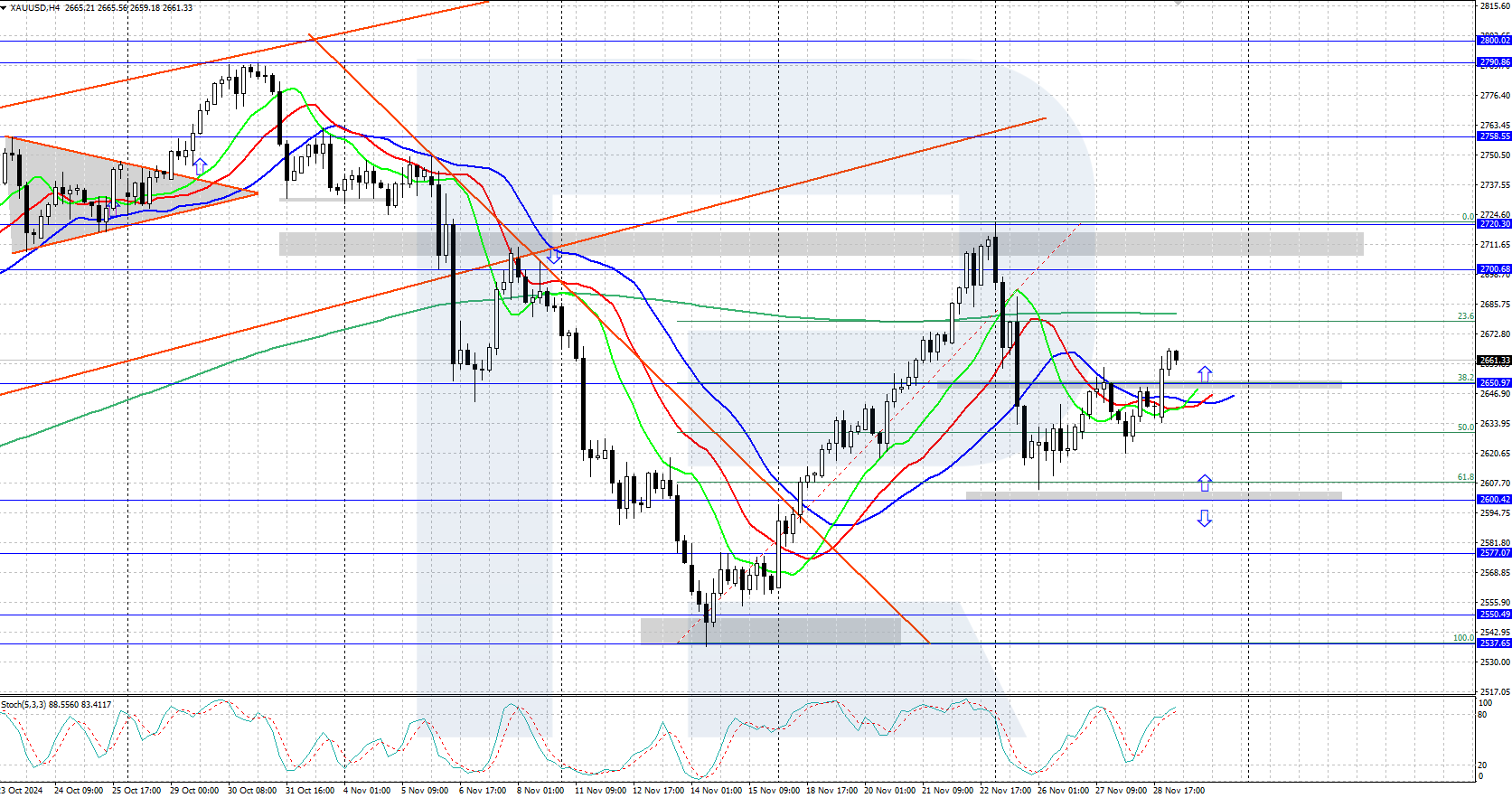

On the H4 chart, the XAUUSD pair corrected towards solid support around 2,600 USD and reversed upwards, with prices currently trading above 2,650 USD. The asset now has potential for further growth, targeting an all-time high of 2,790 USD within the long-term uptrend.

The short-term XAUUSD price forecast suggests that after the upward reversal from 2,600 USD and consolidation above 2,650 USD, the pair could maintain its upward momentum, with the nearest target in the 2,700-2,720 USD resistance area. However, if bears take control and firmly establish themselves below 2,600 USD, this could signal the end of the upward scenario.

Summary

XAUUSD quotes have completed a downward correction and gained a foothold above 2,650 USD. The US financial markets are closed today, with no significant news release expected.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.