Gold (XAUUSD) holds steadily above 2,600 USD

XAUUSD prices received support from buyers at the 2,600 USD level and reversed upwards last week. Growth will likely continue this week. More details in our XAUUSD analysis for today, 2 December 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting US labour market statistics, with ADP indicators, nonfarm payrolls, and the unemployment rate scheduled for release this week

- Current trend: a downward correction is underway

- XAUUSD forecast for 2 December 2024: 2,650 and 2,600

Fundamental analysis

XAUUSD quotes declined to 2,600 USD last week as part of a downward correction but rebounded strongly towards the long-term uptrend. Gold has solid fundamental drivers for further growth due to elevated demand from investors and central banks, driven by the Federal Reserve’s ongoing interest rate-cutting cycle and the escalation of regional military conflicts.

This week, the market will focus on US labour market statistics, with ADP indicators, nonfarm payrolls, and the unemployment rate scheduled for release. Better-than-expected data could bolster the US dollar and extend the correction in the XAUUSD pair, while weaker-than-expected figures could allow Gold to approach its annual highs.

XAUUSD technical analysis

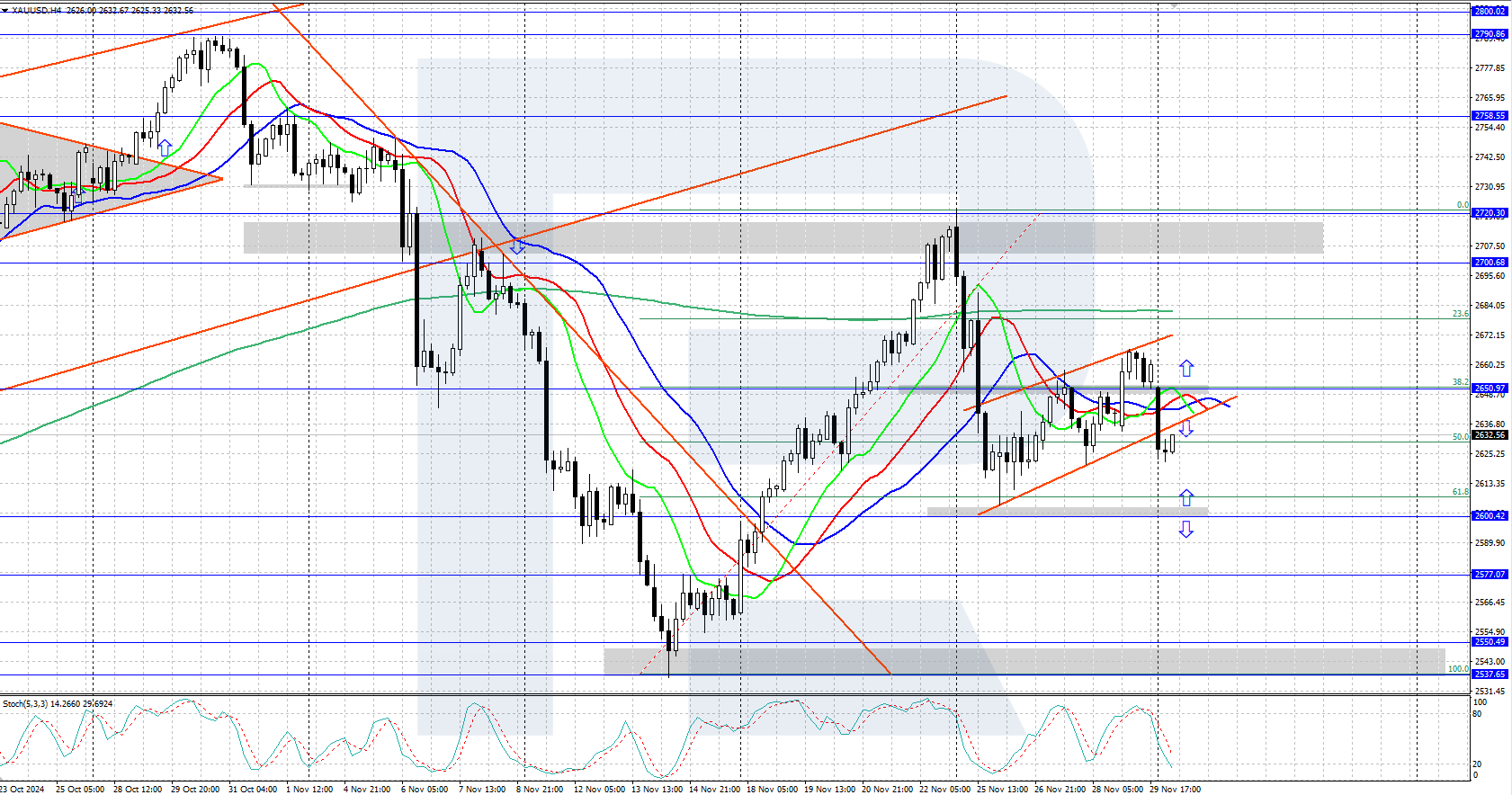

On the H4 chart, the XAUUSD pair corrected to solid support around 2,600 USD last week and then reversed upwards, with prices now trading around 2,625 USD. If the correction is complete, the asset could resume its upward trajectory, targeting an all-time high of 2,790 USD within the long-term uptrend.

The short-term XAUUSD price forecast suggests that after bouncing back from 2,600 USD and consolidating above 2,650 USD, the pair could continue its upward trajectory, with the nearest target at the 2,700-2,720 USD resistance area. However, the downward wave could continue if bears regain control and establish themselves below 2,600 USD.

Summary

XAUUSD quotes remain above 2,600 USD, and US labour market statistics are anticipated to drive further Gold price movements this week.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.