Gold (XAUUSD) awaits US employment data

XAUUSD prices are consolidating within a narrow range, close to 2,650 USD, as market participants await today’s ADP US employment statistics. Find out more in our XAUUSD analysis for today, 4 December 2024.

XAUUSD forecast: key trading points

- Market focus: market participants are awaiting today’s ADP US labour market data

- Current trend: consolidating within the range

- XAUUSD forecast for 4 December 2024: 2,700 and 2,600

Fundamental analysis

XAUUSD prices continue to hold above 2,600 USD. The asset appears ready to complete its correction and move up to annual highs. Political instability in South Korea and the escalation of local military conflicts in the Middle East and Ukraine support the demand for Gold.

Automatic Data Processing Inc. (ADP) will release US employment statistics during today’s American session. If the data comes in above the forecast (+150,000 jobs), it could support the US dollar and push the XAUUSD pair into a local correction again. Conversely, weaker-than-expected data could drive further growth in the pair.

XAUUSD technical analysis

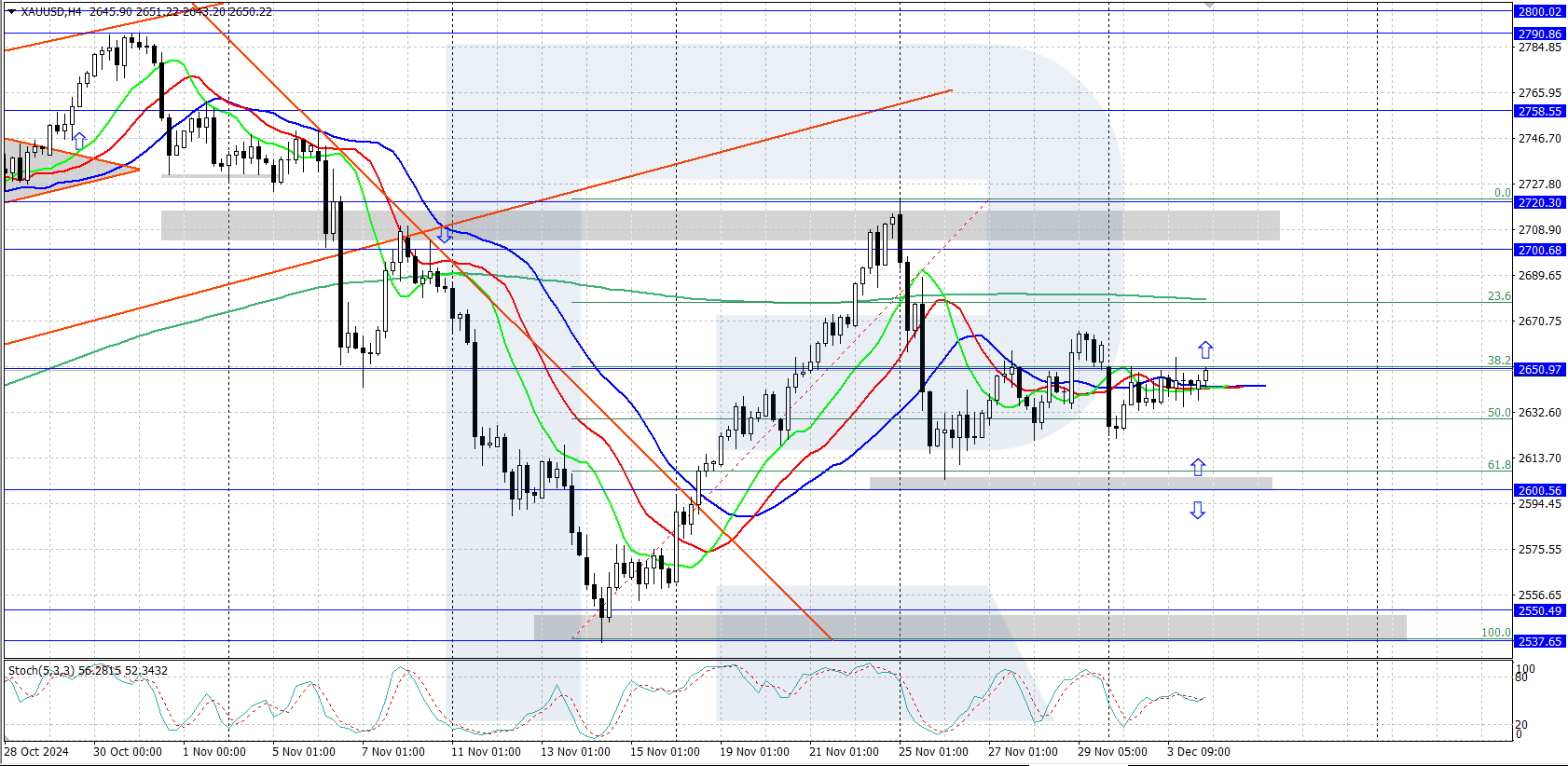

On the H4 chart, the XAUUSD pair has secured above 2,600 USD, with prices now hovering around 2,650 USD. If the correction is complete, the asset could continue its ascent to the all-time high of 2,790 USD within the long-term uptrend. US labour market statistics could drive the upcoming movement in Gold prices.

The short-term XAUUSD price forecast suggests that after bouncing back from 2,600 USD and consolidating above 2,650 USD, the pair could continue its upward trajectory, with the nearest target being the 2,700-2,720 USD resistance area. However, a downward correction could strengthen if bears seize the initiative and establish themselves below 2,600 USD.

Summary

Gold (XAUUSD) has gained a foothold above 2,600 USD. Today, the market will focus on the ADP US employment data, which could drive further Gold price movements.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.