Gold (XAUUSD) holds steady amid slowing US inflation

XAUUSD quotes are slightly declining after rebounding from the 2,700 USD resistance level. Discover more in our analysis for 16 January 2025.

XAUUSD forecast: key trading points

- The US core inflation rate decreased to 3.2% in December, down from 3.3% in November year-on-year

- The overall Consumer Price Index remained stable, reinforcing confidence in easing inflationary pressures

- Slowing inflation has fuelled expectations of Federal Reserve monetary policy easing, reducing the opportunity cost of holding non-performing assets and boosting interest in Gold

- XAUUSD forecast for 16 January 2025: 2,710 and 2,745

Fundamental analysis

XAUUSD prices are correcting following two days of growth, with buyers striving to establish a foothold above the 2,700 USD level. Despite the current correction, prices remain elevated due to easing US core inflation, which heightens expectations of a softer Federal Reserve policy this year.

Core inflation growth slowed to 3.2% year-on-year in December, down from 3.3% in November, aligning with analysts’ forecasts. Core inflation also eased month-on-month, decreasing to 0.2% from the previous 0.3%. The overall CPI did not show significant deviations, bolstering market participants’ confidence in the gradual easing of inflationary pressures.

This data has sparked interest in Gold, as easing inflation may prompt the Federal Reserve to revise its current monetary policy tightening course. A softer stance from the regulator could reduce the cost of holding non-performing assets such as Gold, which supports its appeal.

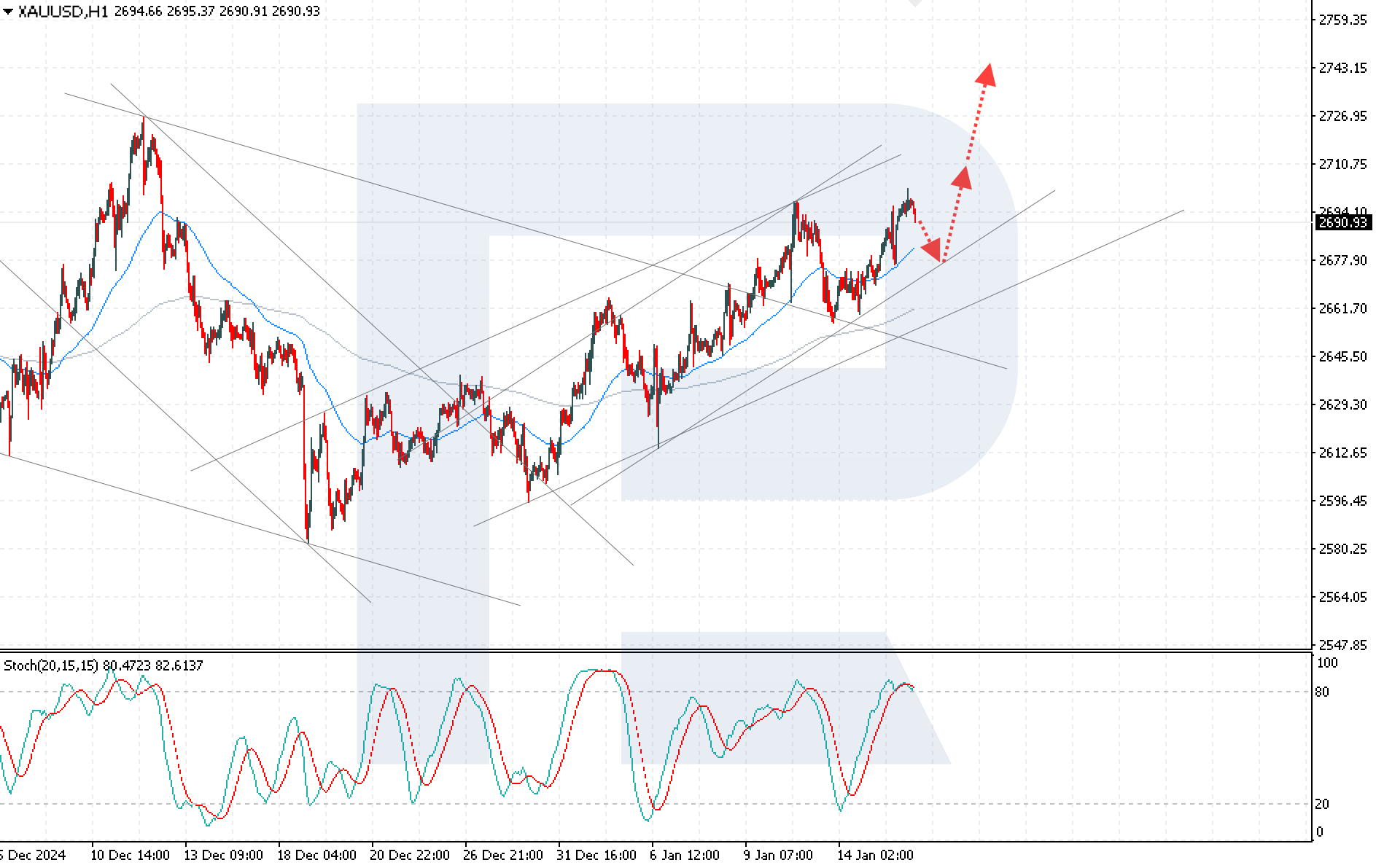

XAUUSD technical analysis

On the H4 chart, the XAUUSD pair continues to trade within an ascending channel. Buyers have yet to secure a position above the 2,700 USD resistance level, increasing the likelihood of a downward correction towards 2,675 USD.

The crossing of signal lines on the Stochastic Oscillator provides further confirmation of a decline. According to the XAUUSD forecast for 16 January 2025, a rebound from the 2,675 USD support level may signal resumed growth towards 2,710 USD. A breakout above this resistance level would pave the way to the next key target of 2,745 USD for buyers.

An alternative scenario suggests a breakout below the lower boundary of the ascending channel, with the price consolidating below the 2,670 USD level. This will increase the risks of a deeper bearish correction towards the target level of 2,645 USD.

Summary

Gold remains an attractive asset amid easing US inflation and expectations for Federal Reserve monetary policy easing, which reduces the opportunity cost of holding non-performing assets. Buyers’ attempts to consolidate above 2,700 USD confirm strong demand for Gold as an instrument for preserving value. The XAUUSD price forecast suggests a high likelihood of a downward correction towards 2,675 USD, followed by an onward recovery. A breakout above the 2,710 USD resistance level would pave the way to 2,745 USD, while consolidation below 2,670 USD would heighten the risk of a bearish correction towards 2,645 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.