Gold (XAUUSD) is on the rise amid uncertainty and central banks’ purchases

XAUUSD quotes are rising after breaking above a resistance level, with the current price at 2,747 USD. More details in our analysis for 22 January 2025.

XAUUSD forecast: key trading points

- Buyers have surpassed the key resistance level of 2,725 USD

- The main drivers of Gold’s price increase are the unpredictability of Donald Trump’s trade policy and the weakening of the US dollar

- Central banks are actively purchasing Gold, supporting its prices

- XAUUSD forecast for 22 January 2025: 2,765 and 2,795

Fundamental analysis

XAUUSD prices have reached an 11-week high, approaching last year’s record levels, driven by steady demand for safe-haven assets. Buyers surpassed the key resistance level at 2,725 USD, and sustained buying pressure is creating favourable conditions for the uptrend to continue, with the potential to test the next resistance level at 2,790 USD.

The main factors contributing to Gold’s price increase are the unpredictability of US President Donald Trump’s trade policy and the weakening US dollar, which make Gold more appealing to investors holding other currencies.

Traders note that persistent macroeconomic and trade uncertainties, alongside concerns about the deteriorating fiscal situation in the US, continue to bolster demand for safe-haven assets like Gold. Active purchases of Gold by global central banks provide significant support for prices.

XAUUSD technical analysis

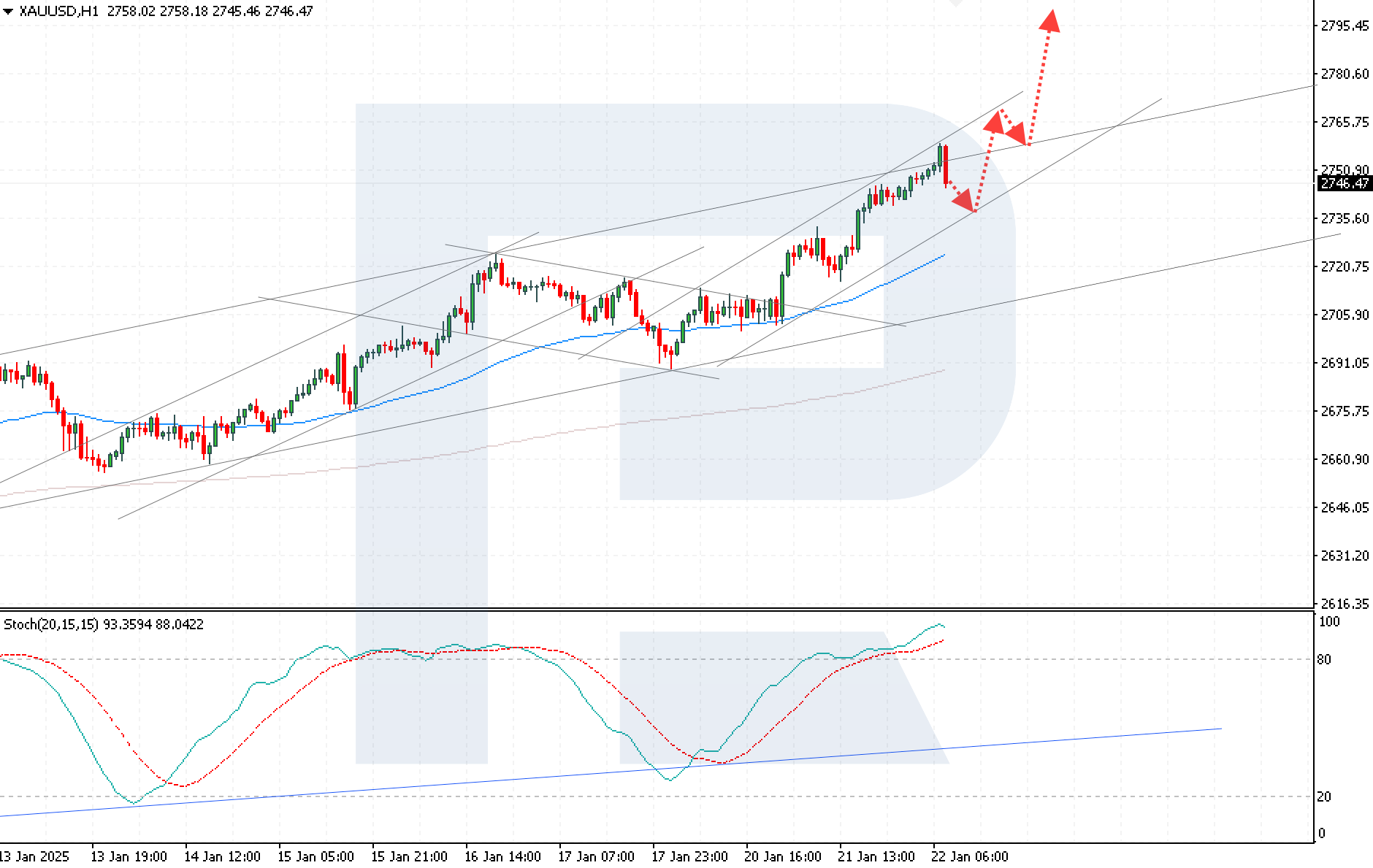

On the XAUUSD hourly chart, the uptrend remains intact despite the current correction. The price has rebounded from the EMA-65 line, reaffirming the prevailing bullish sentiment. However, the Stochastic Oscillator values indicate an overbought condition, suggesting a potential short-term bearish correction before the price resumes its upward trajectory.

The XAUUSD forecast for 22 January 2025 suggests a price decline to 2,735 USD. Subsequently, the price may rebound from the lower boundary of the ascending channel before rising to 2,765 USD. Breaking above this resistance level could pave the way to the next target of 2,795 USD. Conversely, a breakout below the channel’s lower boundary and consolidation below 2,730 USD would invalidate the bullish scenario, signalling a further decline to 2,705 USD.

Summary

Gold’s price growth is driven by sustained demand for safe-haven assets due to global trade uncertainty and the weakening of the US dollar. Prices are further supported by active Gold purchases by numerous central banks, reinforcing conditions for a stronger uptrend.

Today’s XAUUSD analysis suggests a potential downward correction with a possible decline to 2,735 USD before the trend resumes its upward momentum to 2,765 and 2,795 USD. A decisive breakout below the 2,730 USD support level could negate this scenario, increasing the likelihood of a further bearish correction towards 2,705 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.