XAUUSD forecast: Gold continues to strengthen against the US dollar

A potential rise in inflation and a decrease in the US PMI could support Gold growth to 2,790 USD. More details in our XAUUSD analysis for today, 24 January 2025.

XAUUSD forecast: key trading points

- The University of Michigan US inflation expectations: previously at 2.8%, projected at 3.3%

- US services PMI: previously at 56.8, projected at 56.4

- Current trend: moving upwards

- XAUUSD forecast for 24 January 2025: 2,790 and 2,750

Fundamental analysis

The XAUUSD forecast for 24 January 2025 shows that the pair continues to form a growth wave.

The University of Michigan's US inflation expectations will be released at the beginning of the US trading session. The previous reading was 2.8%, and the forecast for 24 January 2025 suggests that inflation may rise to 3.3%, affecting XAUUSD prices.

The US services Purchasing Managers’ Index (PMI) is projected to decrease to 56.4 given that it has been gradually increasing over the past three months. A weaker-than-forecast actual reading may lead to the weakening of the US dollar. A stronger-than-expected PMI could support the US dollar to some extent.

The XAUUSD price forecast appears rather optimistic, with prices having the potential to reach new highs.

XAUUSD technical analysis

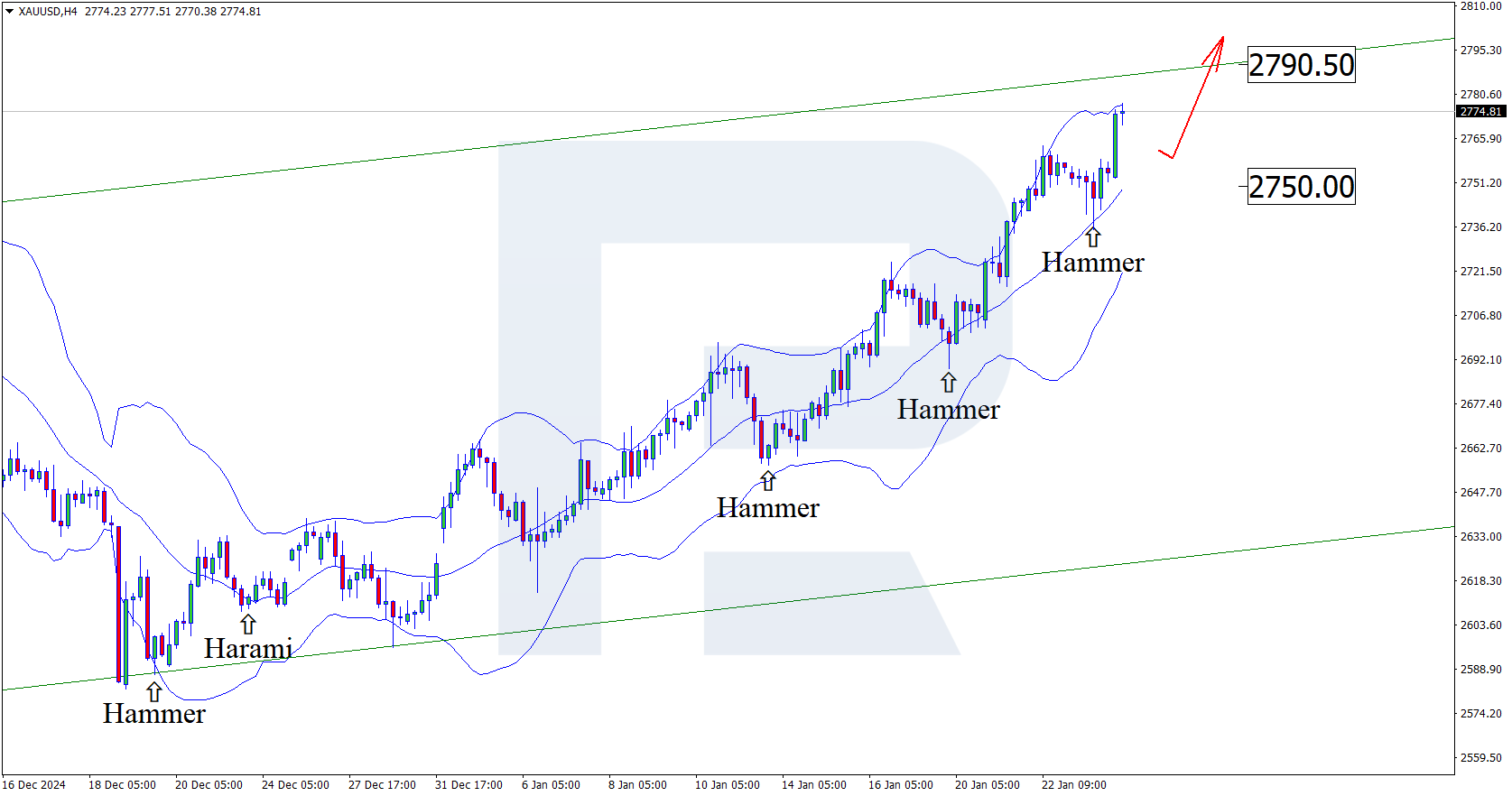

After pulling back, the XAUUSD price has formed a Hammer reversal pattern near the middle Bollinger band on the H4 chart. At this stage, it continues its upward momentum following the pattern signal. The uptrend will likely develop further as prices remain within an ascending channel after a pullback.

The growth target could be the next resistance level at 2,790 USD. A breakout above this level will open the potential for a more substantial upward movement.

However, an alternative scenario is possible, where the price corrects towards 2,750 USD before maintaining its upward trajectory. Once it is complete, Gold could reach a new all-time high in the near term and head to 2,800 USD.

Summary

The negative forecast for US fundamental data drives further an uptrend in XAUUSD, with the growth target at the 2,790 USD resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.