Gold (XAUUSD) soared above 3,000 USD, hitting a new all-time high

XAUUSD prices are showing rapid growth, rising above the 3,000 USD level. Today, the market is focused on the US industrial production statistics. Discover more in our XAUUSD analysis for today, 18 March 2025.

XAUUSD forecast: key trading points

- Market focus: US retail sales data for February showed an increase of 0.2% month-on-month and 3.1% year-on-year

- Current trend: a strong uptrend

- XAUUSD forecast for 18 March 2025: 3,000 and 3,050

Fundamental analysis

Gold continues its rapid growth in the uptrend, currently trading above 3,000 USD. The precious metal is in increased demand from investors and central banks as US President Donald Trump’s tariff wars continue.

During the American trading session today, market participants will focus on the US industrial production data for February, with the indicator expected to increase by 0.2% month-on-month.

Tomorrow, the US Federal Reserve will announce its decision on the benchmark interest rate, which is expected to remain unchanged at 4.50%. The primary focus will be on Federal Reserve Chairman Jerome Powell’s press conference, where he may shed light on the regulator’s further plans.

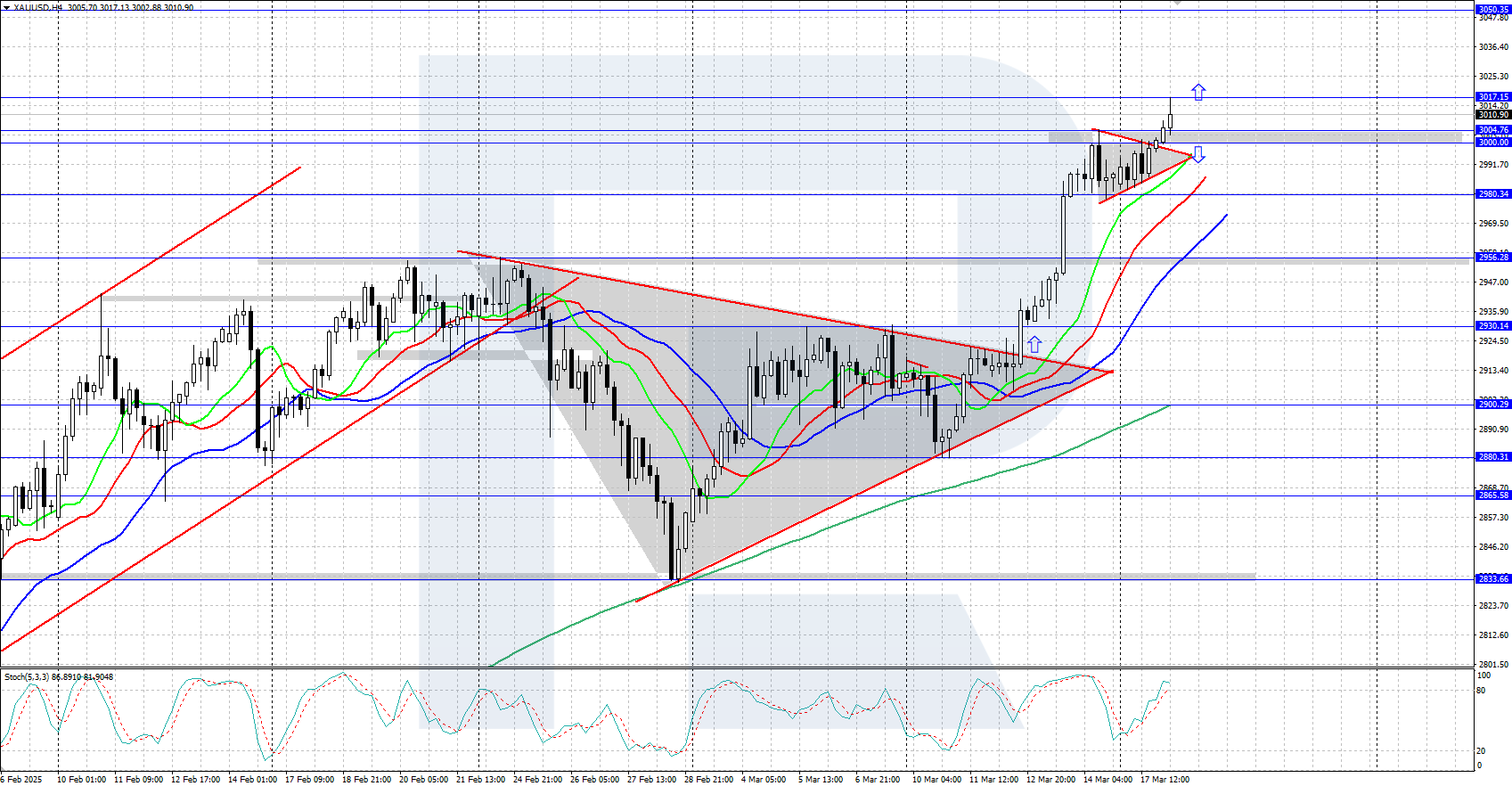

XAUUSD technical analysis

XAUUSD quotes continue to show a steady uptrend, reaching a new all-time high of 3,017 USD today. The key support level is currently at the psychologically important level of 3,000 USD.

The short-term XAUUSD price forecast suggests the pair could continue its upward trajectory to the area near 3,050 USD if the bulls retain the initiative. However, a downward correction is possible if the bears gain control and push prices below the 3,000 USD level.

Summary

Gold (XAUUSD) is strengthening, hitting another all-time high of 3,017 USD. The US industrial production data could add to asset volatility today.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.