Gold (XAUUSD) at a new high: no one wants risk

Gold (XAUUSD) prices rose to 3,168 USD. The market is risk-averse following the latest US tariff announcement. Discover more in our analysis for 3 April 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices have reached another all-time high

- Global investors are concerned about the possible impact of US tariffs on inflation, GDP, and trade relations

- XAUUSD forecast for 3 April 2025: 3,170 and 3,175

Fundamental analysis

Gold (XAUUSD) prices surged to 3,168 USD, setting another record high. The market is steering clear of risk after the US administration announced new trade tariffs.

Yesterday, US President Donald Trump introduced a 10% baseline tariff on all imports, with higher rates for countries with a trade surplus, including 34% on China, 20% on the EU, and 24% on Japan. A 25% tariff on foreign vehicles also took effect. Trump stated that these measures aim to stimulate domestic production and reduce the trade deficit.

From a fundamental perspective, Gold is supported by expectations of interest rate cuts around the world, increased central bank buying, and robust demand for gold-backed ETFs. Notably, a Chinese ETF added 233,000 ounces to its holdings.

The Gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

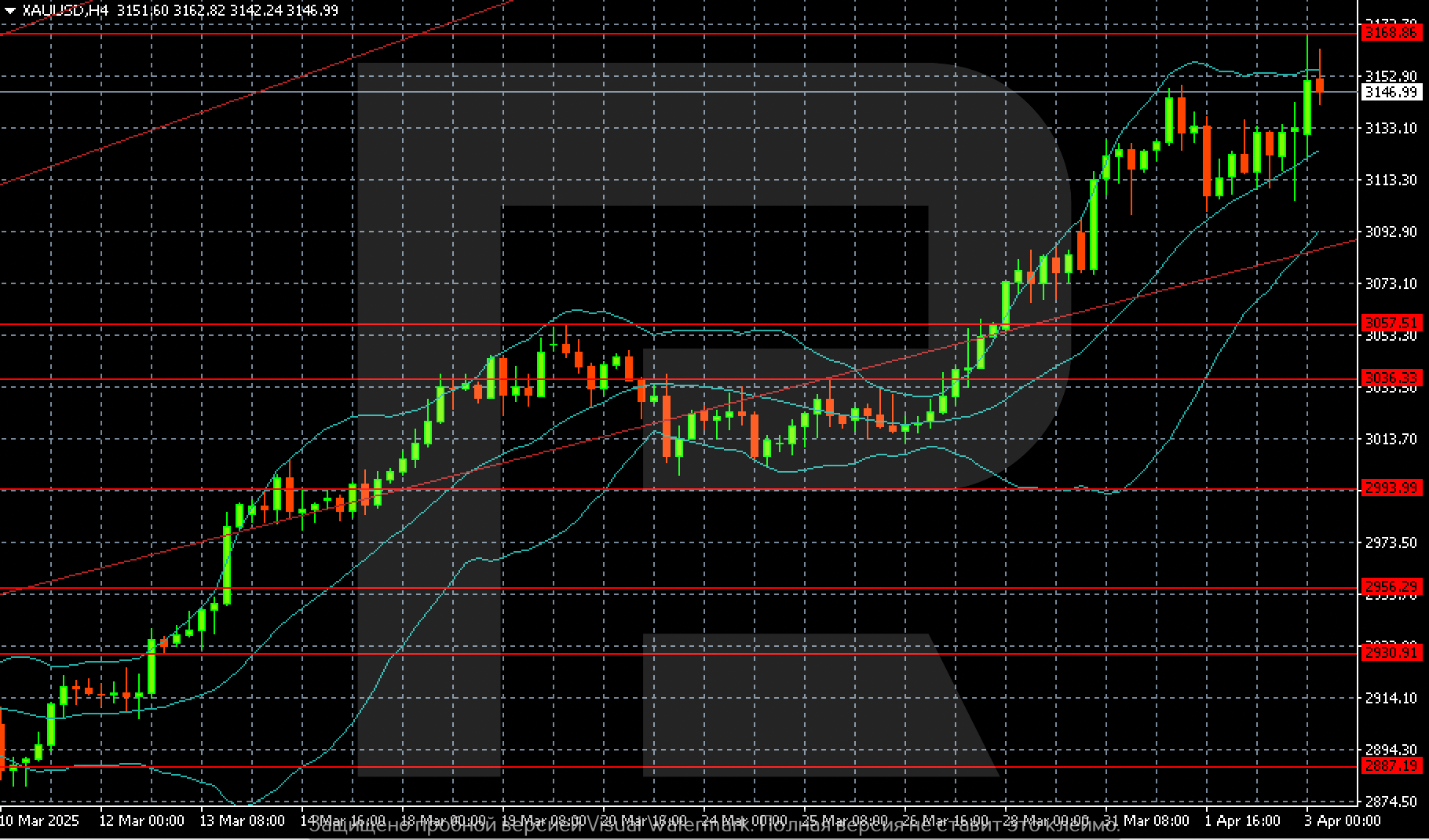

On the H4 chart, Gold (XAUUSD) has reached a new high of 3,168 USD. Conditions are in place for a local pullback to 3,146 USD, from where the market may resume upward movement towards 3,170 and then towards 3,175.

Summary

Gold (XAUUSD) prices have broken through another record and are poised for further growth. US tariffs and global risk aversion remain in focus. The Gold (XAUUSD) forecast for today, 3 April 2025, suggests that the pair could maintain its upward momentum, with a target at 3,175.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.