Gold (XAUUSD) briefly plummeted below 3,000 USD after Nonfarm Payrolls

XAUUSD quotes fell below the 3,000 USD level today following Friday’s robust US employment data. Find more details in our analysis for 7 April 2025.

XAUUSD forecast: key trading points

- US Nonfarm Payrolls: previously at 151 thousand, currently at 228 thousand

- US unemployment rate: previously at 4.1%, currently at 4.2%

- Current trend: correcting downwards

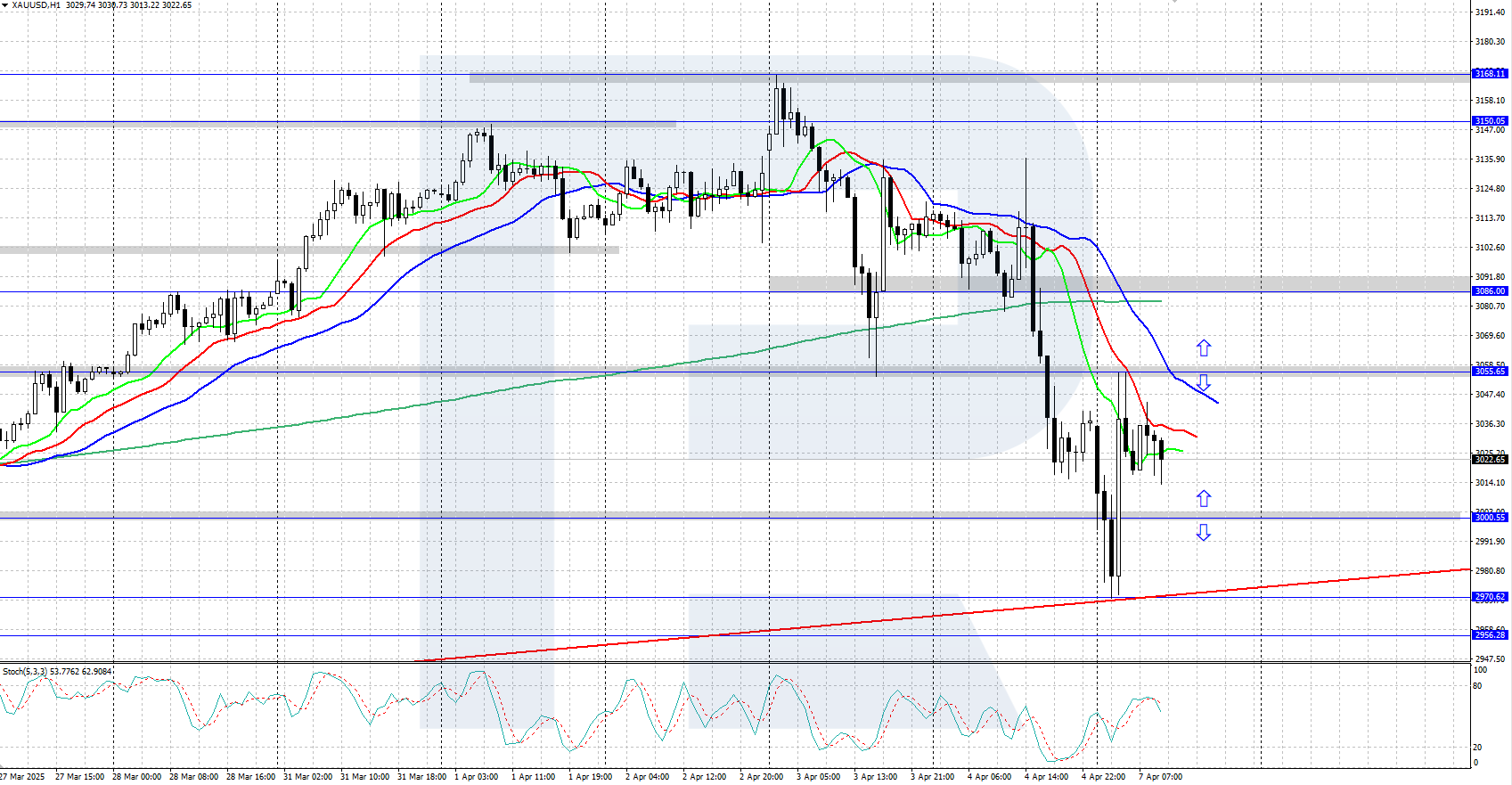

- XAUUSD forecast for 7 April 2025: 3,000 and 3,057

Fundamental analysis

Friday’s US Nonfarm Payrolls data exceeded expectations, with employment rising by 228,000, above the forecast of 151,000. Meanwhile, the unemployment rate edged up to 4.2% from 4.1% a month earlier.

Gold tumbled by more than 1%, briefly falling below 3,000 USD during Monday’s Asian session. Analysts attribute the decline to strong US employment data and investor behaviour — many are selling Gold to cover losses in other asset classes amid a sharp decline in equity markets.

XAUUSD technical analysis

Gold is currently undergoing a downward correction after hitting an all-time high of 3,168 USD last week. The Alligator indicator confirms the corrective movement, with the uptrend likely to resume once the correction is complete.

The short-term XAUUSD price forecast suggests a further decline towards the 2,956 USD support level if the bears gain a foothold below 3,000 USD. Conversely, if the bulls hold prices above the 3,000 USD level, the pair could rise to the 3,086 USD resistance level.

Summary

Gold prices have entered a downward correction, retreating towards the 3,000 USD area after robust US employment data and investors closing some positions to cover losses in stock markets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.