Gold (XAUUSD) looks for a rebound trigger amid safe-haven demand

XAUUSD quotes are attempting to recoup some losses, hovering around 3,004 USD. Compared to industrial metals, Gold appears more attractive. Discover more in our analysis for 8 April 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices have halted their decline after three sessions of heavy selling and are stabilising

- Investors seek safe-haven assets as the global trade war escalates

- XAUUSD forecast for 8 April 2025: 3,008 and 3,046

Fundamental analysis

Gold (XAUUSD) prices have climbed to 3,004 USD, recovering from a four-week low. Demand for safe-haven assets is rising amid heightened fears of a possible global recession driven by intensifying trade tensions.

On Monday, US President Donald Trump threatened to impose an additional 50% tariff on China starting Wednesday unless Beijing rolls back its 34% retaliatory duties. At the same time, the European Union proposed 25% counter-tariffs on some US goods.

Markets are now awaiting Wednesday’s release of the Federal Reserve’s latest meeting minutes.

Despite the three-session decline, Gold prices have gained over 13% this year.

The Gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

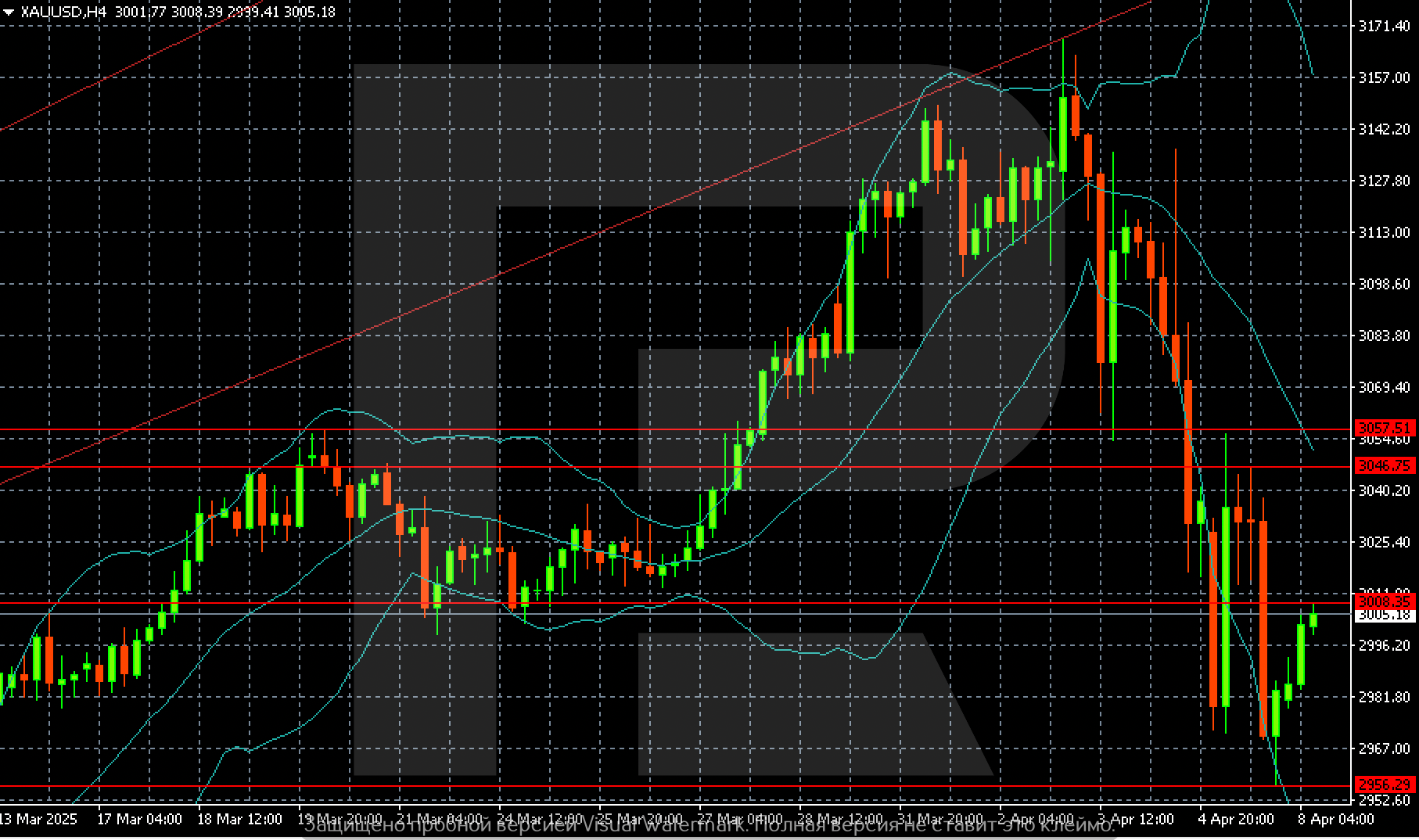

On the H4 chart, Gold (XAUUSD) shows signs of recovery. If prices consolidate above 3,008 USD, a move towards 3,046 USD looks likely. Until then, the 2,956 USD support level remains in focus.

Summary

Gold (XAUUSD) prices have paused after a three-day sell-off and are stabilising. The Gold (XAUUSD) forecast for today, 8 April 2025, suggests a potential recovery towards 3,046 USD after prices consolidate above 3,008 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.