Gold (XAUUSD) soars above 3,200 USD — will the rally continue?

XAUUSD quotes confidently surged above 3,200 USD following Thursday’s US inflation data. Discover more in our analysis for 11 April 2025.

XAUUSD forecast: key trading points

- US Consumer Price Index (CPI) for March: projected at 2.5%, currently at 2.4%

- US Producer Price Index (PPI) for March is in focus today

- Current trend: strong uptrend

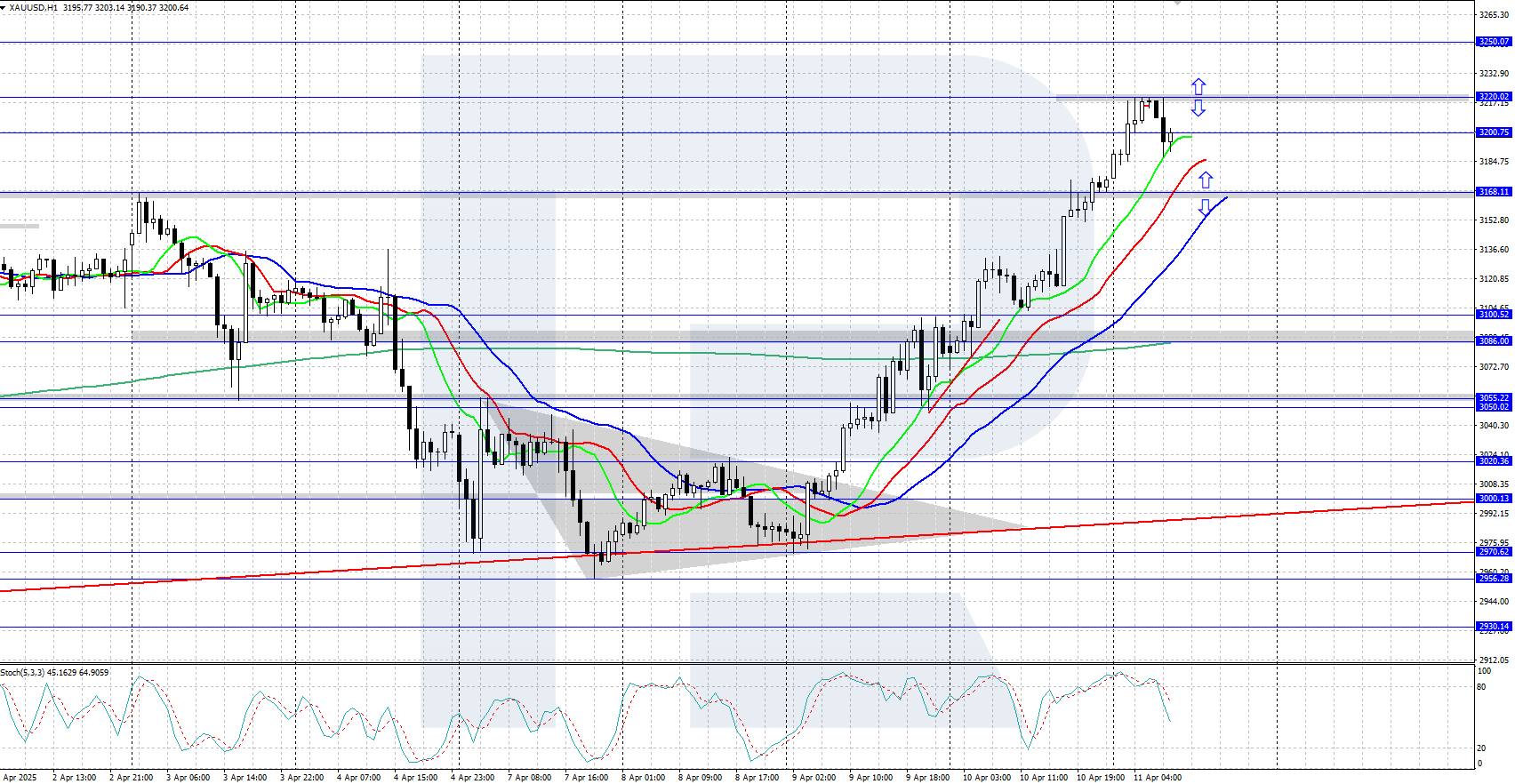

- XAUUSD forecast for 11 April 2025: 3,220 and 3,168

Fundamental analysis

Gold climbed above 3,200 USD per ounce on Friday, setting a new all-time high amid soaring demand for safe-haven assets as US-China trade tensions escalate.

On Thursday, US officials confirmed that tariffs on Chinese imports were raised to 145%, with a new 125% levy added on top of an existing 20% duty.

Additional downward pressure on the US dollar came from weaker-than-expected inflation data. The CPI rose by just 2.4% year-on-year and slipped by 0.1% month-on-month. The US PPI data for March is set for release today.

XAUUSD technical analysis

Gold remains in a strong uptrend, currently trading around 3,200 USD. The Alligator indicator confirms the bullish momentum, with the key support level at 3,168 USD.

The short-term XAUUSD forecast suggests further growth to the 3,300 USD area if the bulls keep prices above the 3,168 USD support level. However, if the bears push prices below this mark, a correction towards 3,100 USD may follow.

Summary

Gold prices set a new all-time high of 3,220 USD amid mounting US-China trade tensions. Today, the market will closely watch the US PPI data for March.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.