Gold (XAUUSD) accelerates — yearly targets may be hit ahead of schedule

Gold tested 3,380 USD, bringing annual targets closer. Full analysis for 21 April 2025 below.

XAUUSD forecast: key trading points

- Gold (XAUUSD) set another all-time high and continues climbing

- USD weakness boosts gold’s appeal for non-dollar investors

- XAUUSD forecast for 21 April 2025: 3,386 USD

Fundamental analysis

Gold (XAUUSD) surged to a new record high at 3,380 USD as demand for safe-haven assets intensifies amid worsening global trade tensions. The sharp decline in the US dollar also continues to support gold’s upside.

Last week, President Donald Trump initiated a new investigation into potential tariffs on all critical mineral imports into the US. This move signals an escalation in trade disputes — particularly with China — and has further rattled markets.

The dollar’s slide to a three-year low has made gold more attractive to holders of other currencies, fuelling strong international demand.

Additionally, the recent interest rate cut by the European Central Bank has boosted demand for non-yielding assets like gold in a low-return environment.

Overall, the outlook for gold remains bullish.

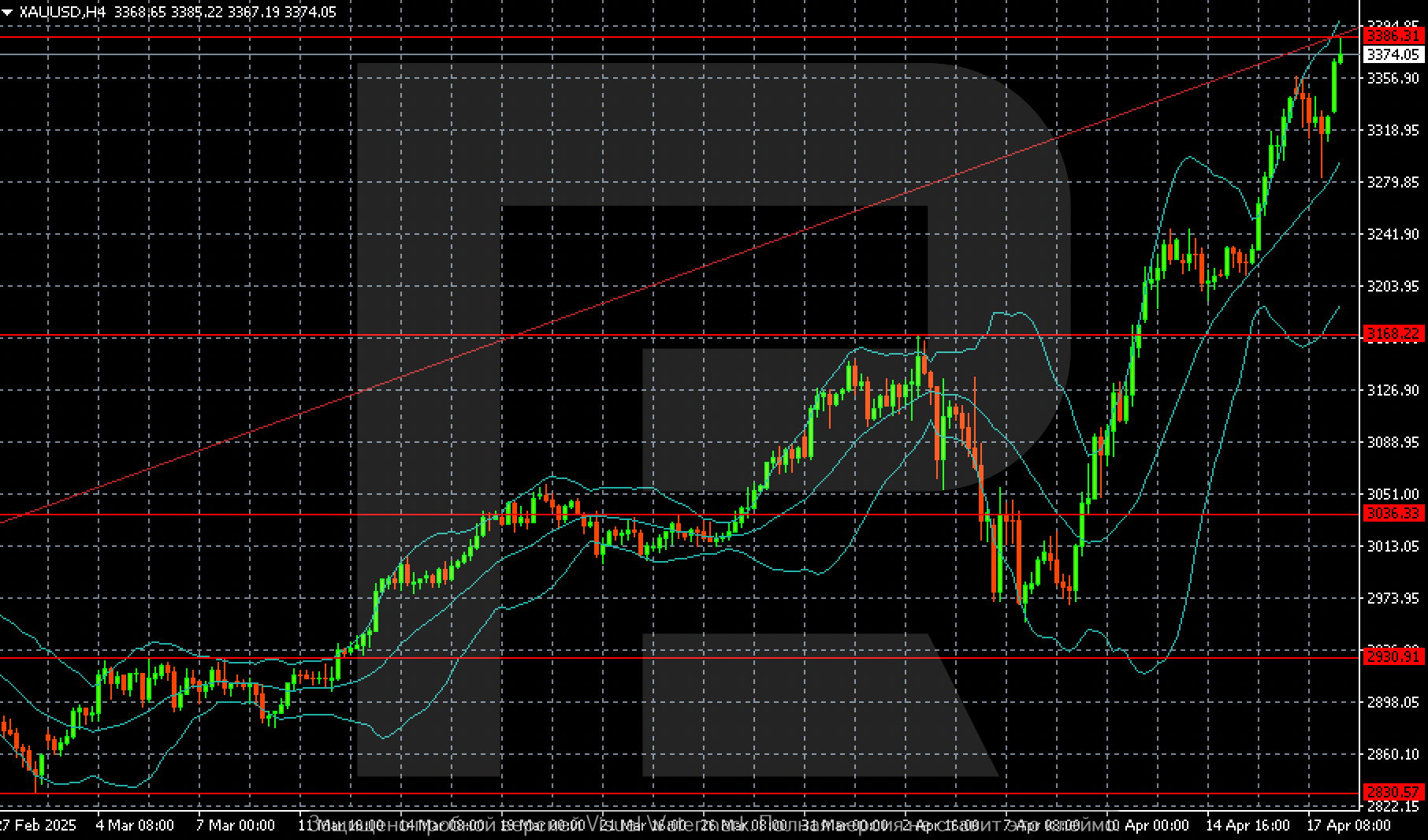

XAUUSD technical analysis

On the H4 chart, XAUUSD remains in a strong uptrend, with the current impulse wave aiming for 3,386 USD. A successful retest of this level may open the path toward 3,400 USD and beyond.

Summary

Gold has tested 3,380 USD and continues to push higher, nearing the long-term target of 3,500 USD — potentially ahead of schedule. Today’s forecast for 21 April 2025 anticipates a retest of 3,386 USD and further bullish momentum toward 3,400 USD. The backdrop of global trade tensions and a weak dollar continues to favour gold’s ascent.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.