Gold (XAUUSD) closes third week higher: market sentiment clearly favours Gold

Gold (XAUUSD) prices have risen towards 3,350 USD as market doubts about trade stability persist. Discover more in our analysis for 25 April 2025.

XAUUSD forecast: key trading points

- Demand for safe-haven assets continues to support Gold

- Investors remain sceptical about progress in US-China trade relations

- XAUUSD forecast for 25 April 2025: 3,350 USD

Fundamental analysis

XAUUSD prices reached 3,350 USD on Friday before pulling back slightly.

Gold is on track to post its third consecutive weekly gain, driven by market scepticism about a potential trade deal between the US and China.

On Thursday, US President Donald Trump reiterated that negotiations with China are ongoing, despite Beijing’s statements denying any active discussions to resolve the dispute.

US Treasury Secretary Scott Bessent has acknowledged that lowering tariffs is a necessary step for talks to progress, but Trump has made it clear that the US will not reduce duties on Chinese imports unilaterally. Earlier this week, Gold hit a new all-time high of 3,500 USD amid concerns over the US economic outlook. Prices later eased as Trump softened his stance on the Federal Reserve’s independence.

Year-to-date, Gold has gained 30%.

The Gold (XAUUSD) forecast is positive.

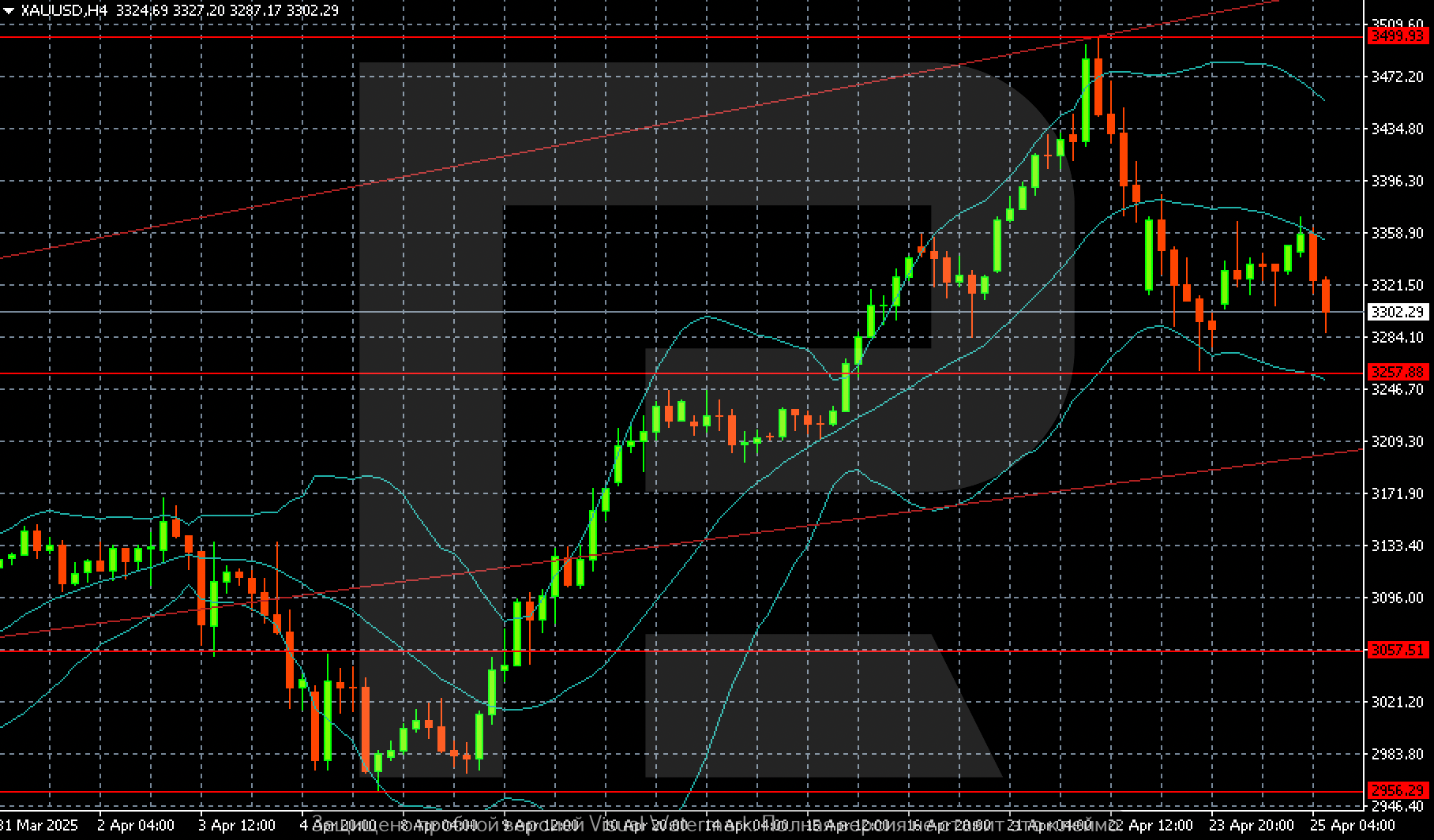

XAUUSD technical analysis

On the H4 chart, Gold (XAUUSD) shows potential for a local decline to 3,300 USD. However, conditions favour consolidation around 3,350 USD and higher.

The support level stands at 3,257 USD.

Summary

Gold (XAUUSD) resumes its upward momentum and is poised to close a third consecutive week in positive territory. The Gold (XAUUSD) forecast for today, 25 April 2025, anticipates a return to 3,350 USD after a correction towards 3,300 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.