Gold (XAUUSD) consolidates above 3,400 USD; will the rally continue?

XAUUSD quotes remain firmly above 3,400 USD as escalating Middle East tensions drive investors towards safe-haven assets. Discover more in our analysis for 16 June 2025.

XAUUSD forecast: key trading points

- Market focus: gold prices rise amid intensifying Middle East conflict

- Current trend: strong upward momentum remains

- XAUUSD forecast for 16 June 2025: 3,400 and 3,500

Fundamental analysis

Israel and Iran launched new strikes over the weekend, heightening fears of a broader regional conflict. Investors are preparing for key central bank meetings this week, with a particular focus on the US Federal Reserve.

Markets expect the Fed to keep interest rates unchanged at the upcoming meeting. However, all attention is on any forward guidance regarding the timing and scale of potential rate cuts. At present, market participants anticipate the Federal Reserve may continue to ease its monetary policy as early as September.

XAUUSD technical analysis

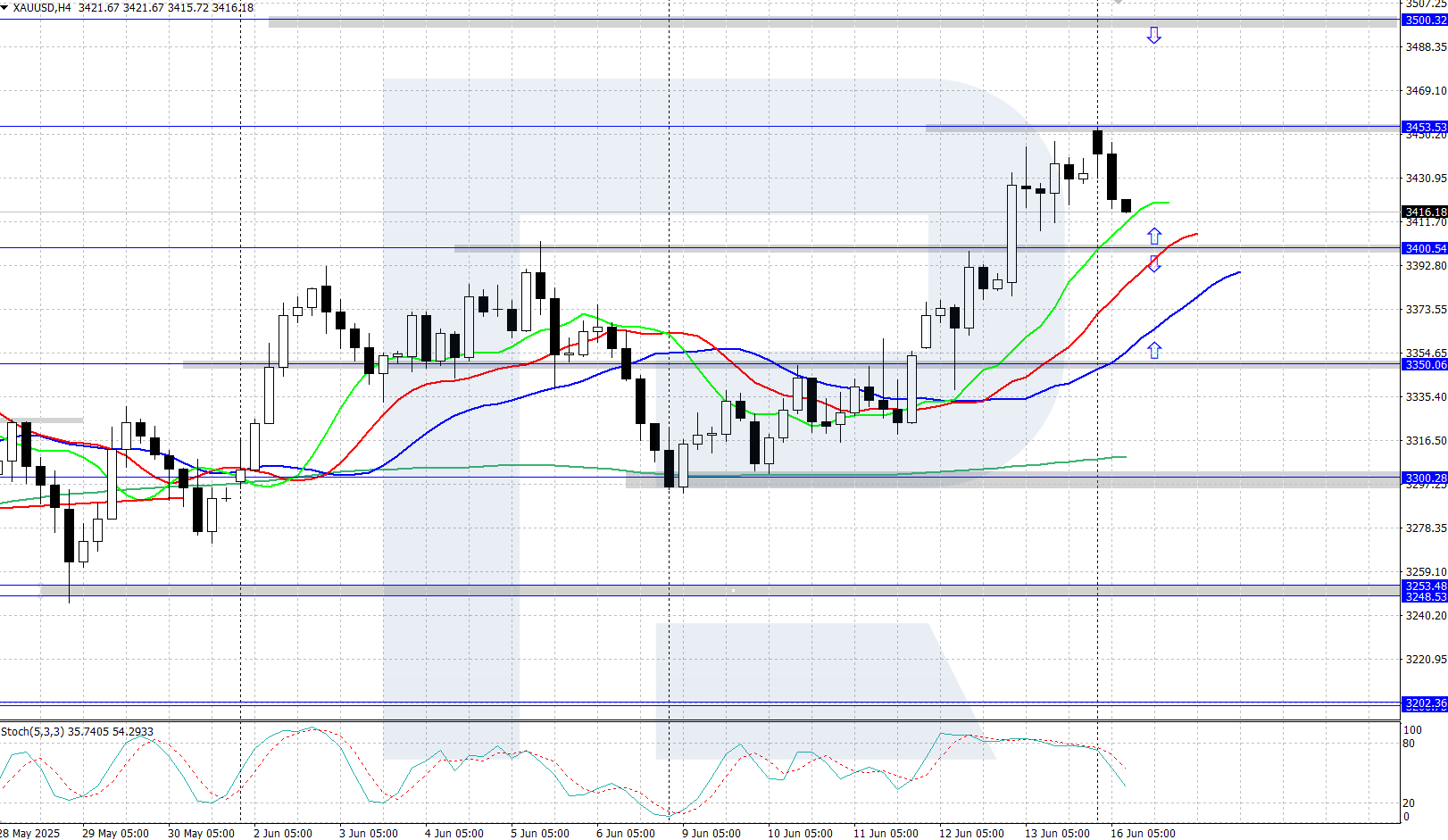

Gold maintains its strong upward trajectory, having rebounded from the 3,300 USD support level. The Alligator indicator is rising, confirming the current bullish momentum. In the near term, this upward movement may continue.

The short-term XAUUSD price forecast suggests growth towards the all-time high at 3,500 USD if bulls retain the initiative. However, if bears regain control and push prices below 3,400 USD, a correction towards 3,350 USD becomes possible.

Summary

Gold prices remain firmly above 3,400 USD as tensions between Iran and Israel escalate. This week, the market's focus shifts to the Federal Reserve’s interest rate decision.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.