Gold plunges after record high – what is behind the XAUUSD collapse?

Gold is undergoing a corrective phase, currently trading around 4,125 USD per ounce. Find more details in our analysis for 22 October 2025.

XAUUSD forecast: key trading points

- Active closing of long positions

- Temporary strengthening of the US dollar

- Current trend: forming a corrective wave

- XAUUSD forecast for 22 October 2025: 4,300 and 4,050

Fundamental analysis

Today’s XAUUSD price forecast shows that after setting a new all-time high at 4,381 USD, gold quotes pulled back, currently trading near 4,125 USD per ounce.

The forecast for 22 October 2025 highlights several main reasons behind the decline:

- Active liquidation of long positions following the strong upward rally

- US dollar rebound, which reduced demand for gold as a safe-haven asset

- Lower expectations for further growth in geopolitical tensions around the world

This pullback in XAUUSD quotes was largely anticipated, with Asian investors viewing it as an opportunity to re-evaluate their positions.

Chinese funds and private traders have reportedly taken advantage of the dip to accumulate gold, treating the current weakness as a buying opportunity amid ongoing trade frictions between the US and China.

While the sharp decline caused some market anxiety, it represents a natural correction after an extended rally. In the medium term, gold retains strong upside potential, particularly if the Federal Reserve proceeds with expected interest rate cuts.

XAUUSD technical analysis

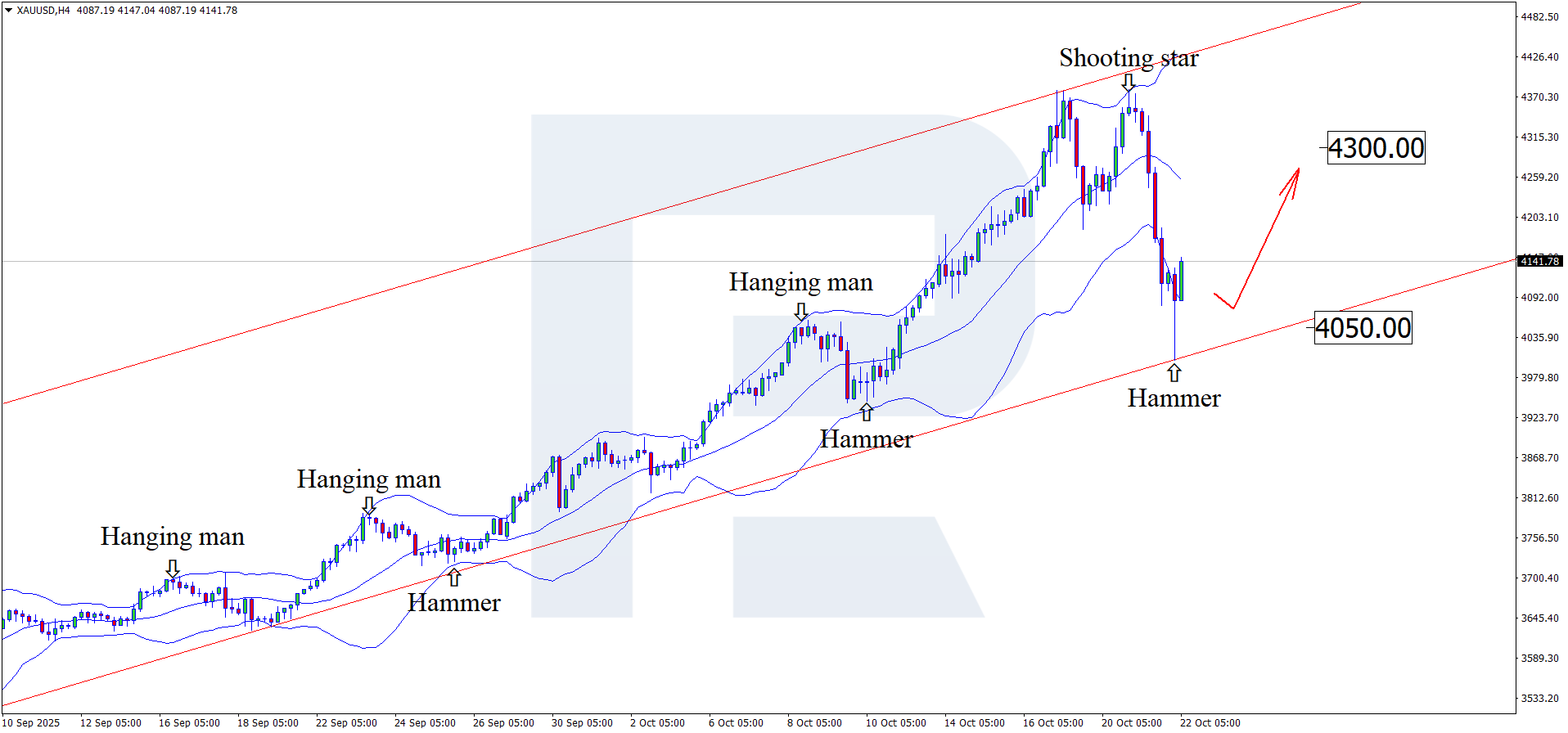

On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the lower Bollinger Band. Gold is currently forming an upward wave following the signal from the pattern. Since XAUUSD quotes remain within an ascending channel, an upside target could be at 4,300 USD.

However, an alternative scenario suggests that prices could continue their decline towards 4,050 USD before growth.

The potential for further upside persists, with the next psychological target for XAUUSD prices seen at 4,500 USD.

Summary

Profit-taking and temporary US dollar strength triggered a pullback in gold prices. However, technical analysis of XAUUSD points to a likely continuation of the broader uptrend once the current correction phase is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.