Gold (XAUUSD) in waiting mode: the decision is up to the Federal Reserve

Gold (XAUUSD) stalled near 4,210 USD. The Fed will define the near-term outlook. Find out more in our analysis for 10 December 2025.

XAUUSD forecast: key trading points

- Market focus: gold (XAUUSD) is trading in a range ahead of the Federal Reserve rate decision

- Current trend: solid central bank demand continues to provide stable support for gold prices

- XAUUSD forecast for 10 December 2025: 4,163 or 4,240

Fundamental analysis

Gold (XAUUSD) prices hovered around 4,210 USD per ounce on Wednesday, remaining in a narrow range ahead of the Fed’s rate decision. The market expects a rate cut but is awaiting clearer guidance on policy in 2026.

Most analysts expect a hawkish cut, meaning the Fed may reduce the rate now, but Jerome Powell is likely to emphasise caution in further easing amid persistent inflationary pressures.

Fresh data made the outlook even more mixed. US job openings once again exceeded expectations, and ADP data for late November showed a rebound in private hiring, complicating the Fed’s assessment of the economic trajectory.

Meanwhile, central banks continue to buy gold aggressively, with China increasing its reserves for the 13th consecutive month, bringing holdings to 74.12 million troy ounces.

Strong official-sector demand, combined with steady ETF inflows and physical buying, has been one of the key drivers behind gold’s roughly 60% rise since the beginning of the year.

The gold (XAUUSD) forecast is neutral.

XAUUSD technical analysis

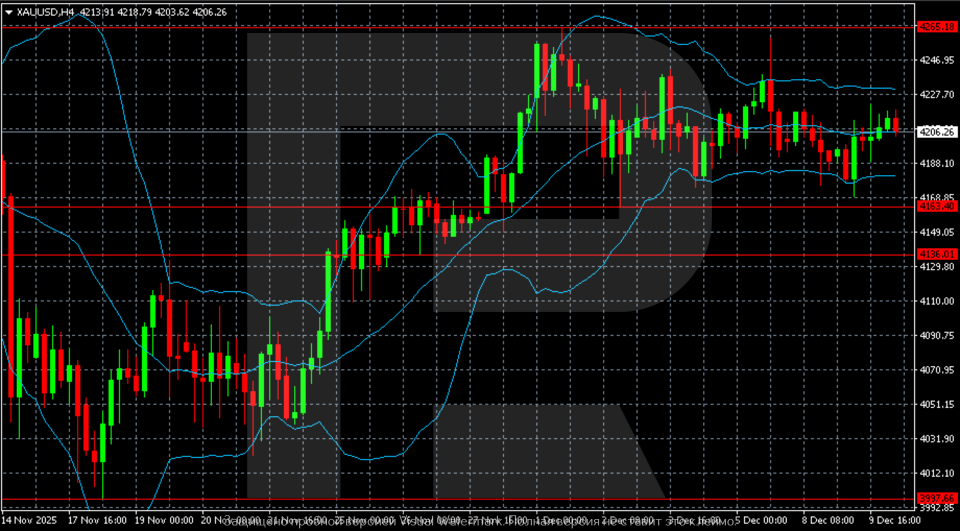

On the H4 chart, gold (XAUUSD) continues its sideways movement following the earlier bullish impulse that lifted prices towards the 4,265 resistance level. Quotes continue to fluctuate within the 4,163–4,240 range, without forming a clear trend as the market awaits the Federal Reserve decision.

Gold is trading near the middle Bollinger Band, indicating a neutral balance of forces. The upper band is gradually narrowing, reflecting lower volatility and the absence of any significant momentum.

The support level is located at 4,163; defending this level would keep open the possibility of retesting 4,240 and then moving towards 4,265. A breakout below 4,163 would open the door to a deeper correction towards 4,136 and further to 3,997 – the key lower demand zone.

The 4,240 resistance level remains the primary barrier for bulls. A breakout above this level would open the way to 4,265 and possibly new local highs.

Overall, as long as prices stay above 4,163, the structure remains moderately bullish. However, the market is awaiting a catalyst – the Fed’s announcement – to break out of the range.

Summary

XAUUSD quotes are hovering within a range ahead of the Fed decision. The gold (XAUUSD) forecast for today, 10 December 2025, suggests continued movement within the 4,163–4,240 corridor.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.