XAUUSD updates its high amid expectations of Fed rate cuts

XAUUSD continues to show steady growth amid heightened geopolitical tensions. The current price is 4,489 USD. Details — in our analysis for 24 December 2025.

XAUUSD forecast: key takeaways

- Expectations of further easing of the Federal Reserve’s monetary policy and rising geopolitical tensions are boosting demand for gold as a safe-haven asset

- US GDP growth accelerated compared to Q2 (3.8%) and reached its highest pace in the past two years

- XAUUSD forecast for 24 December 2025: 4,610

Fundamental analysis

XAUUSD quotes are rising for the fourth consecutive trading session. During today’s trading, gold prices broke above the 4,500 USD level, setting a new all-time high. Investors are increasing demand for the precious metal amid expectations of further easing of the Federal Reserve’s monetary policy, as well as escalating geopolitical tensions, which are driving interest in safe-haven assets.

The US economy grew by 4.3% year-on-year in Q3 2025. GDP growth accelerated compared to Q2, when the figure stood at 3.8%, and became the strongest in the past two years. The data significantly exceeded market expectations. At the same time, inflationary pressure intensified in the US. The PCE Price Index rose to 2.8% in Q3, while the Core PCE Index, which the Federal Reserve views as a key gauge of inflation risks, accelerated to 2.9%.

XAUUSD technical analysis

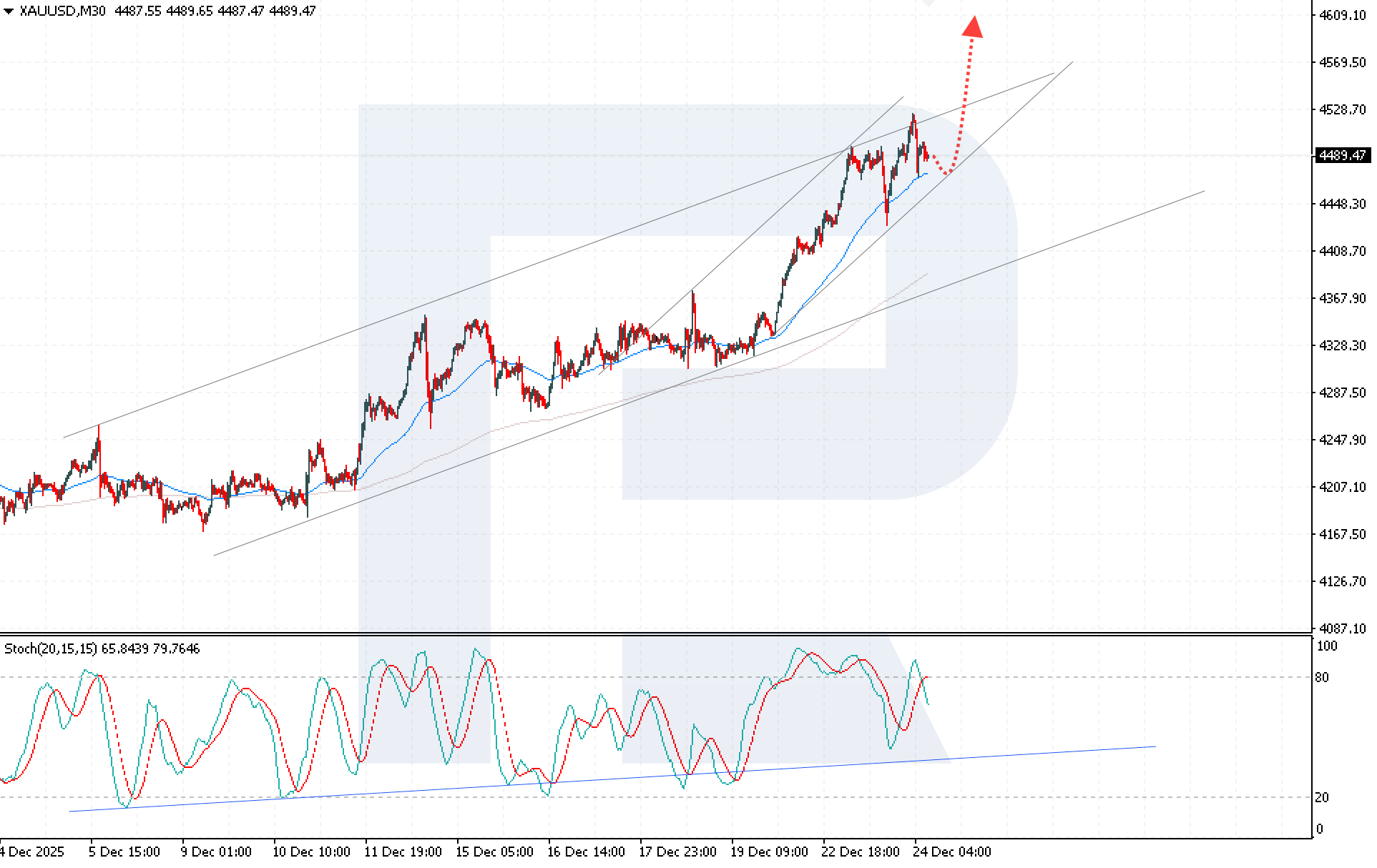

XAUUSD quotes continue to move within an ascending channel. Buyers are actively defending the lower boundary of the channel, creating conditions for renewed growth after a short-term correction.

The XAUUSD price forecast suggests a continuation of the upward move with a target at 4,610 USD. The Stochastic Oscillator supports the bullish scenario — its signal lines are turning away from the overbought zone and remain above the support line, indicating a recovery in buying activity.

A sustained break above 4,530 USD would strengthen buyers’ positions and confirm the potential for further growth within the current trend.

Summary

The record-breaking rally in gold reflects a combination of geopolitical risks and expectations of Fed policy easing, despite accelerating economic growth in the United States. The XAUUSD forecast points to the continuation of the upward trend, increasing the likelihood of further price growth toward 4,610 USD.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.