Gold (XAUUSD) at a new peak: higher levels ahead

Gold (XAUUSD) prices have tested 4,600 USD, with the market relying on a pool of political risks. Find more details in our analysis for 12 January 2026.

XAUUSD forecast: key takeaways

- Gold (XAUUSD) prices surged to a new high

- A broad spectrum of geopolitical risks supports demand for safe-haven assets

- US statistics are also bolstering gold

- XAUUSD forecast for 12 January 2026: 4,620

Fundamental analysis

Gold (XAUUSD) prices rose by more than 1% on Monday and exceeded 4,601 USD per ounce, reaching a new all-time high once again. The rally was driven by rising geopolitical risks and expectations of further interest rate cuts in the US.

On Sunday, Iran’s parliamentary speaker warned the US and Israel about the consequences of possible intervention following threats of military strikes by President Donald Trump. The statements came amid mass protests in Iran, which reportedly resulted in hundreds of deaths.

Additional tension comes from the US actions towards Venezuela. After the removal of President Nicolas Maduro, Washington continues its blockade of the country. Last week, the US seized two more tankers linked to Venezuelan oil exports.

Gold is also supported by US macroeconomic data. Friday’s statistics showed lower-than-expected employment growth, strengthening bets on continued easing by the US Federal Reserve. The market is currently pricing in two additional interest rate cuts this year.

The outlook for gold (XAUUSD) is positive.

XAUUSD technical analysis

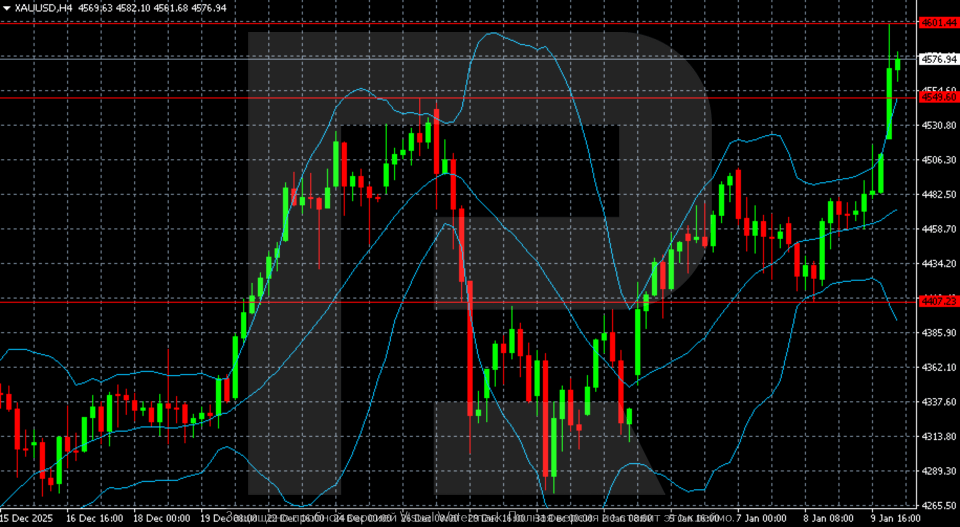

On the H4 chart, gold (XAUUSD) maintains a pronounced uptrend. Prices accelerated and moved above the upper Bollinger Band, indicating strong momentum and rising volatility. Quotes approached the 4,580–4,600 zone, hitting new local highs and confirming buyer dominance.

The move developed after a deep correction at the end of December, followed by a V-shaped recovery and the formation of a series of higher lows. The advance is impulsive. Recent candlesticks show large bodies with minimal pullbacks, which is typical of the final acceleration phase within a trend.

At the same time, price action above the upper Bollinger Band increases the risk of a short-term correction. In the near term, a pause or pullback towards the 4,550–4,500 area is possible to relieve overbought conditions. As long as prices hold above this zone, the bullish structure remains intact. A consolidation above 4,600 would strengthen the bullish scenario and create conditions for a move towards 4,620.

Summary

Gold (XAUUSD) continues its sharp rally amid geopolitical risks and supportive US data. However, the higher prices climb, the greater the probability of a technical correction. The gold (XAUUSD) forecast for today, 12 January 2026, does not rule out a move towards 4,620, provided quotes hold above 4,600.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.