Gold (XAUUSD) on the verge of a new record, unemployment data and the Fed decision weigh on the USD

US negative economic data and the Federal Reserve’s interest rate decision are weakening the USD. XAUUSD quotes tested another record high at 5,597 USD. Find more details in our analysis for 29 January 2026

XAUUSD forecast: key takeaways

- US initial jobless claims: previously at 200 thousand, projected at 206 thousand

- FOMC statement

- XAUUSD forecast for 29 January 2026: 5,700

Fundamental analysis

The XAUUSD price forecast for today shows that gold maintains its upward momentum and has once again set a new price record by testing the 5,597 USD level. XAUUSD quotes are currently trading around 5,548 USD per ounce.

US initial jobless claims reflect the number of people filing for unemployment benefits for the first time during the previous week. This indicator assesses labour market conditions, and an increase signals a rise in unemployment.

Today’s XAUUSD analysis takes into account that the previous reading stood at 200 thousand; the current forecast is negative for the US dollar, as claims are expected to rise to 206 thousand. While the change is relatively modest, the release of the actual data will provide greater clarity on the real state of the US labour market. Data in line with expectations or weaker-than-expected figures may exert additional pressure on the USD.

Yesterday, 28 January 2026, the FOMC released a statement confirming its commitment to a tight monetary policy stance. The decision to keep the interest rate at 3.75% reflected ongoing efforts to curb inflation, despite emerging signs of slowing economic growth in the US.

The statement also emphasised that the Federal Reserve will closely monitor economic data in the coming months, including employment, inflation, and consumer spending indicators, to determine further policy steps. The Committee reiterated its readiness to act flexibly depending on changes in economic conditions.

Particular attention was paid to potential monetary policy adjustments in 2026, including the possibility of a rate hike should inflationary pressures continue to intensify.

Technical outlook

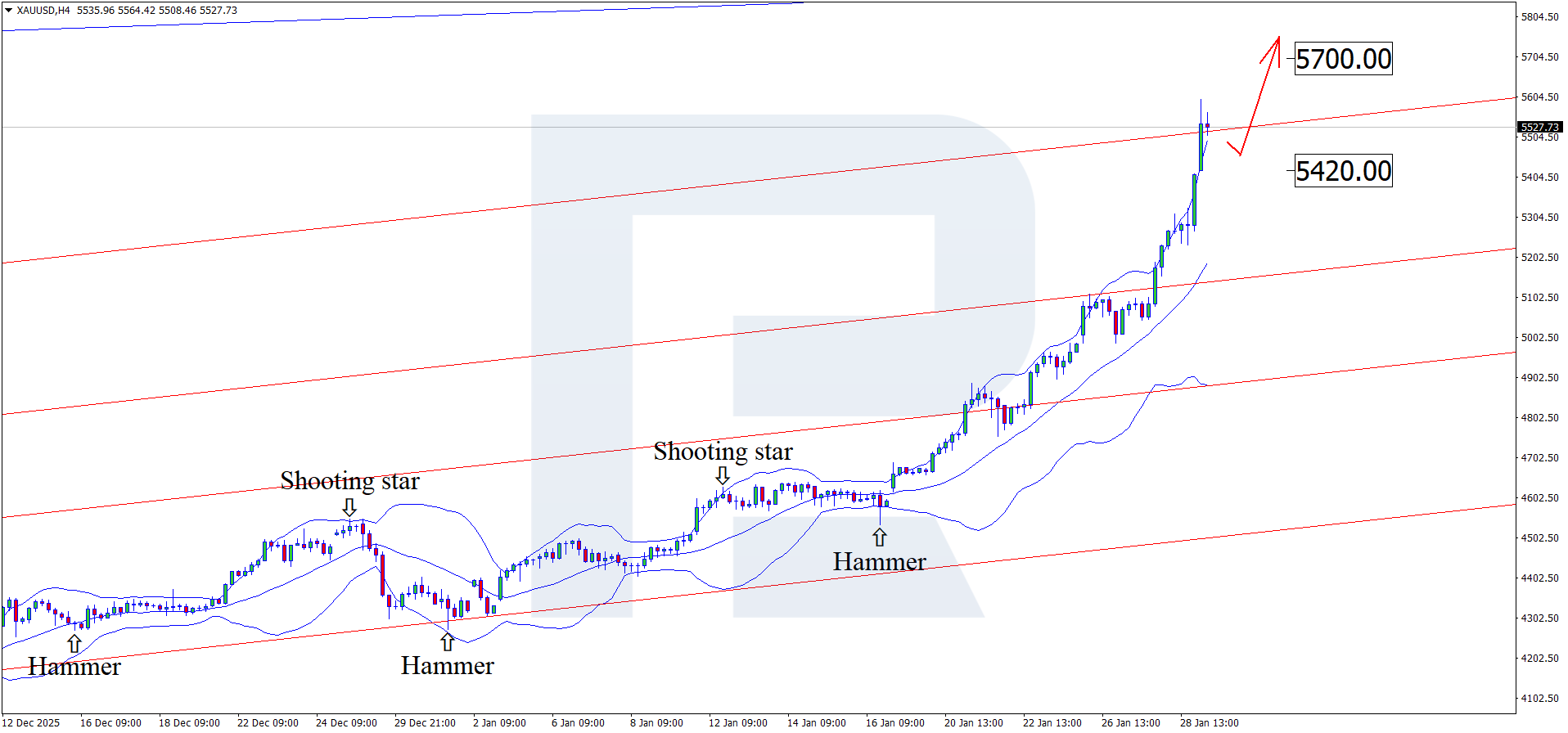

On the H4 chart, XAUUSD formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, quotes continue to develop an upward wave following the pattern’s signal. Since XAUUSD prices have moved beyond the ascending channel, the next psychological upside target could be 5,700 USD.

At the same time, today’s XAUUSD technical analysis also suggests an alternative scenario, which includes a price correction towards the 5,420 USD level before growth.

The possibility of further upside remains, and in the near term, XAUUSD may move towards the next major psychological level at 6,000 USD.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 5,600 and 5,700

- Key support levels: 5,270 and 5,000

XAUUSD trading scenarios for today

Main scenario (Buy Limit)

After a correction towards the support area near 5,420, conditions may emerge for the uptrend to continue. Buying on a pullback appears to be the optimal approach.

The risk-to-reward ratio exceeds 1:5.

- Buy Limit: 5,420 USD

- Take Profit: 5,700 USD

- Stop Loss: 5,370 USD

Alternative scenario (Sell Stop)

A decline in XAUUSD prices and consolidation below the 5,100–5,080 area would signal a deeper correction after the rally. In this case, the market may enter a profit-taking phase with a move towards the lower boundary of the ascending channel.

- Sell Stop: 5,075 USD

- Take Profit: 5,000 USD

- Stop Loss: 5,155 USD

Risk factors

The main risks to the bullish scenario are a sharp strengthening of the US dollar, unexpected hawkish signals from the Fed, and large-scale profit-taking after reaching all-time highs. A return below 5,000–4,980 would be the first sign of weakening of the current uptrend on the H4 chart.

Summary

The Federal Reserve’s decision to keep the interest rate unchanged at 3.75% triggered another wave of USD weakness. XAUUSD technical analysis suggests further upside potential towards the 5,700 USD level following a corrective pullback.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.