Gold (XAUUSD) in positive territory, but everything can change quickly

Gold (XAUUSD) prices have recovered to 5,050 USD, with market participants focused on US statistics. Find more details in our analysis for 9 February 2026.

XAUUSD forecast: key takeaways

- Gold (XAUUSD) prices are rising amid expectations of crucial US economic data

- Demand from global central banks remains high

- XAUUSD forecast for 9 February 2026: 5,050

Fundamental analysis

Gold (XAUUSD) climbed above 5,010 USD per ounce on Monday, reaching its highest level in more than a week amid expectations of key US macroeconomic data. The statistics may provide clearer signals on the future path of Fed interest rates.

Investors are focused on the January labour market report, due on Wednesday, which is expected to indicate stabilisation in employment. Inflation data scheduled for Friday is also in focus.

Additional support for prices came from political developments in Japan. The decisive victory of incumbent Prime Minister Sanae Takaichi strengthened expectations of looser fiscal policy and continued pressure on the yen.

Demand from central banks remains steady, with the People’s Bank of China increasing its gold reserves for the 15th consecutive month in January.

The geopolitical backdrop has also become calmer. Talks between the US and Iran held on Friday ended with an agreement to continue dialogue this week, easing fears of military escalation in the region.

The outlook for gold (XAUUSD) is moderate.

Technical outlook

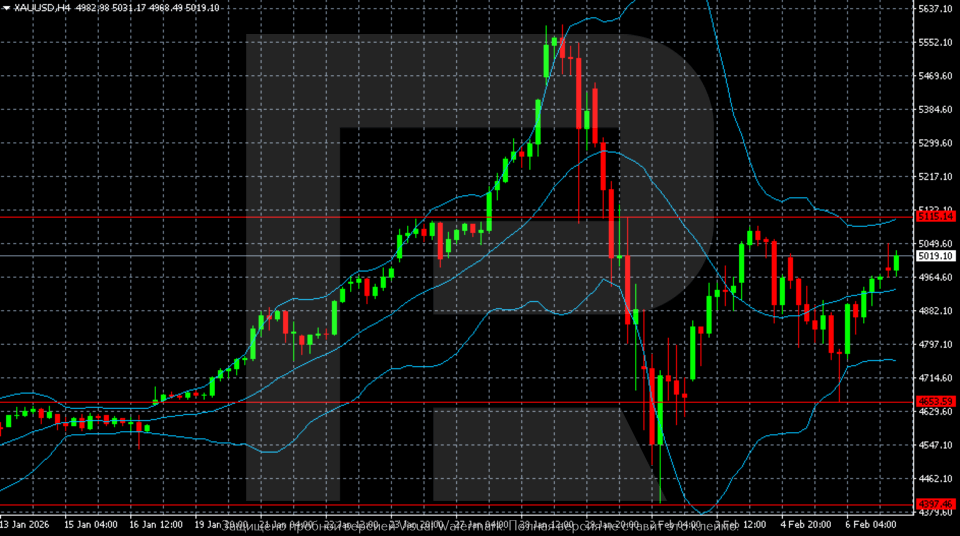

The XAUUSD H4 chart shows a shift in market regime after the extreme rally in late January. Prices moved sharply higher and formed a peak in the 5,550–5,600 area, followed by a strong impulsive pullback. The decline was accompanied by a move below the middle Bollinger Band and expanding volatility, signalling a breakdown of the previous momentum.

In early February, gold formed a local bottom in the 4,400–4,500 area and transitioned into a recovery phase. The rebound is corrective: prices have climbed back towards the 4,950–5,050 zone, which previously acted as support and where resistance is now forming. Quotes are trading near the middle Bollinger Band, with the bands gradually narrowing, indicating stabilisation after strong movements.

Overall, the structure resembles a redistribution phase following an overheated uptrend. The market has exited the impulsive growth phase and moved into a mode of high but controlled volatility, balancing between recovery and the risk of further correction.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: moderately bullish

- Key resistance levels: 5,050 and 5,480

- Key support levels: 4,725 and 4,500

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above the 5,050–5,075 zone will confirm continued recovery after the correction and open the way for growth towards the next resistance level near 5,480. The move would remain corrective-bullish within the redistribution phase following the overheated uptrend. The risk-to-reward ratio is estimated above 1:4.

Take Profit: 5,480 USD

Stop Loss: 4,980 USD

Alternative scenario (Sell Stop)

A breakout and consolidation below the 4,725 support level would signal renewed downside pressure and invalidate the current recovery structure. In this case, the likelihood of a deeper correction towards 4,500 would increase.

Take Profit: 4,500 USD

Stop Loss: 4,800 USD

Risk factors

Risks to XAUUSD growth include the potential strengthening of the Fed’s hawkish rhetoric amid upcoming US labour market and inflation data, as well as a stronger US dollar. An additional constraint for the bullish scenario is gold’s failure to consolidate above the 5,050–5,075 zone, which would keep the market in a correction phase with elevated volatility.

Summary

XAUUSD prices resumed their upward trajectory. The gold (XAUUSD) forecast for today, 9 February 2026, does not rule out a move towards 5,050, although there is also a risk of correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.