XAUUSD prices on the way to new highs

While awaiting US economic data, XAUUSD quotes continue to rise and are testing the 5,035 USD level. Find more details in our analysis for 10 February 2026.

XAUUSD forecast: key takeaways

- US retail sales: previously at 0.6%, projected at 0.4%

- Current trend: moving upwards

- XAUUSD forecast for 10 February 2026: 5,050

Fundamental analysis

Today’s XAUUSD price forecast shows that gold is forming another upward wave, with quotes currently trading around 5,035 USD per ounce.

US retail sales is an indicator that reflects the total value of goods sold in retail trade over a month. This indicator shows how consumer demand has changed compared to the previous month. It includes sales in stores, food service outlets, online retail, and other commercial entities, excluding spending on services. The previous reading stood at 0.6%, and the forecast for 10 February 2026 suggests a decline to 0.4%. Overall, a decrease in retail sales indicates weakening consumer activity and a potential economic slowdown.

Rising geopolitical uncertainty, including in Europe and the Middle East, is also increasing interest in gold as a safe-haven asset.

The market is awaiting new economic data from the US, which could add to pressure on the USD, pushing gold prices higher.

Technical outlook

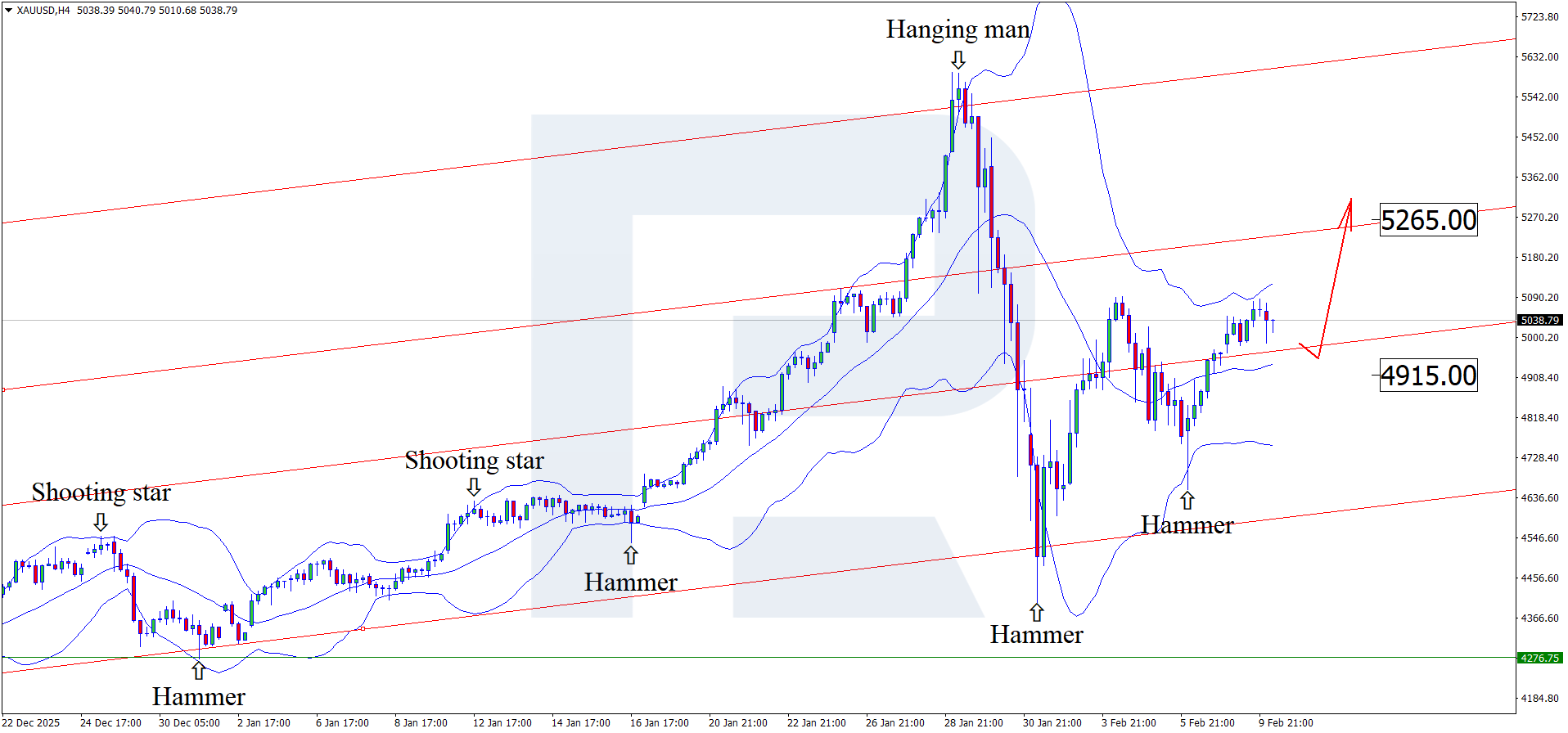

On the H4 chart, XAUUSD prices have formed a Hammer reversal pattern near the lower Bollinger Band and may continue their upward movement following the pattern’s signal. Since XAUUSD quotes remain within the ascending channel, the upside target may be 5,265 USD.

At the same time, today’s XAUUSD technical analysis also suggests an alternative scenario, in which prices correct towards the 4,915 USD level before further growth.

The potential for continued upward momentum remains in place, and in the near term, XAUUSD prices may move towards the next psychological level of 6,000 USD.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: moderately bullish

- Key resistance levels: 5,265 and 5,480

- Key support levels: 4,775 and 4,500

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation of XAUUSD quotes above the 5,050–5,075 zone will confirm the continuation of the recovery movement after the correction and open the potential for growth towards the next resistance area around 5,480. The move will be corrective and upward within the redistribution phase following an overheated uptrend. The risk-to-reward ratio is estimated at above 1:4.

Take Profit: 5,480 USD

Stop Loss: 4,980 USD

Alternative scenario (Sell Stop)

A breakout and consolidation below the 4,725 support level will indicate renewed downward pressure and cancellation of the current recovery structure. In this case, the probability of a deeper correction towards 4,500 will increase.

Take Profit: 4,500 USD

Stop Loss: 4,600 USD

Risk factors

Risk factors for XAUUSD growth include a possible strengthening of hawkish Fed rhetoric amid upcoming US labour market and inflation data, as well as a stronger US dollar. An additional limitation for the bullish scenario is gold’s failure to consolidate above the 5,050–5,075 zone, which would keep the market in a correction phase with elevated volatility.

Summary

After the decline, gold prices are regaining ground, with XAUUSD technical analysis suggesting a rise towards the 5,265 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.