XAUUSD continues to rise: why the Fed will not be able to weaken gold in March

Employment growth and positive US economic data failed to provide sufficient support to the USD, while XAUUSD quotes continue to rise and are testing the 5,070 USD level. Discover more in our analysis for 12 February 2026.

XAUUSD forecast: key takeaways

- US initial jobless claims: previously at 231 thousand, projected at 222 thousand

- Change in US Nonfarm Payrolls: previously at 48 thousand, currently at 130 thousand

- XAUUSD forecast for 12 February 2026: 5,280

Fundamental analysis

Today’s XAUUSD forecast indicates that gold prices continue their upward trajectory, trading near 5,070 USD per ounce.

US initial jobless claims reflect the number of people who filed for unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment.

The XAUUSD forecast for 12 February 2026 takes into account that claims may decline to 222 thousand from the previous 231 thousand. A decrease in unemployment, combined with other economic indicators, could provide short-term support to the USD.

Yesterday’s Nonfarm Payrolls (NFP) data showed employment growth of 130 thousand versus a forecast of 70 thousand, which has nearly closed the door to a March rate cut by the Federal Reserve. Despite this, gold did not lose ground and instead posted a modest gain. This may indicate a shift in market perception: investors are beginning to doubt that the Fed's actions can significantly strengthen the USD and push XAUUSD prices lower.

Market participants are confident that the Fed will not cut interest rates in March, yet declining unemployment and strong US macroeconomic data are not helping the USD maintain its positions. Investors and central banks increasingly view gold as a safe-haven asset and continue to purchase the precious metal.

Technical outlook

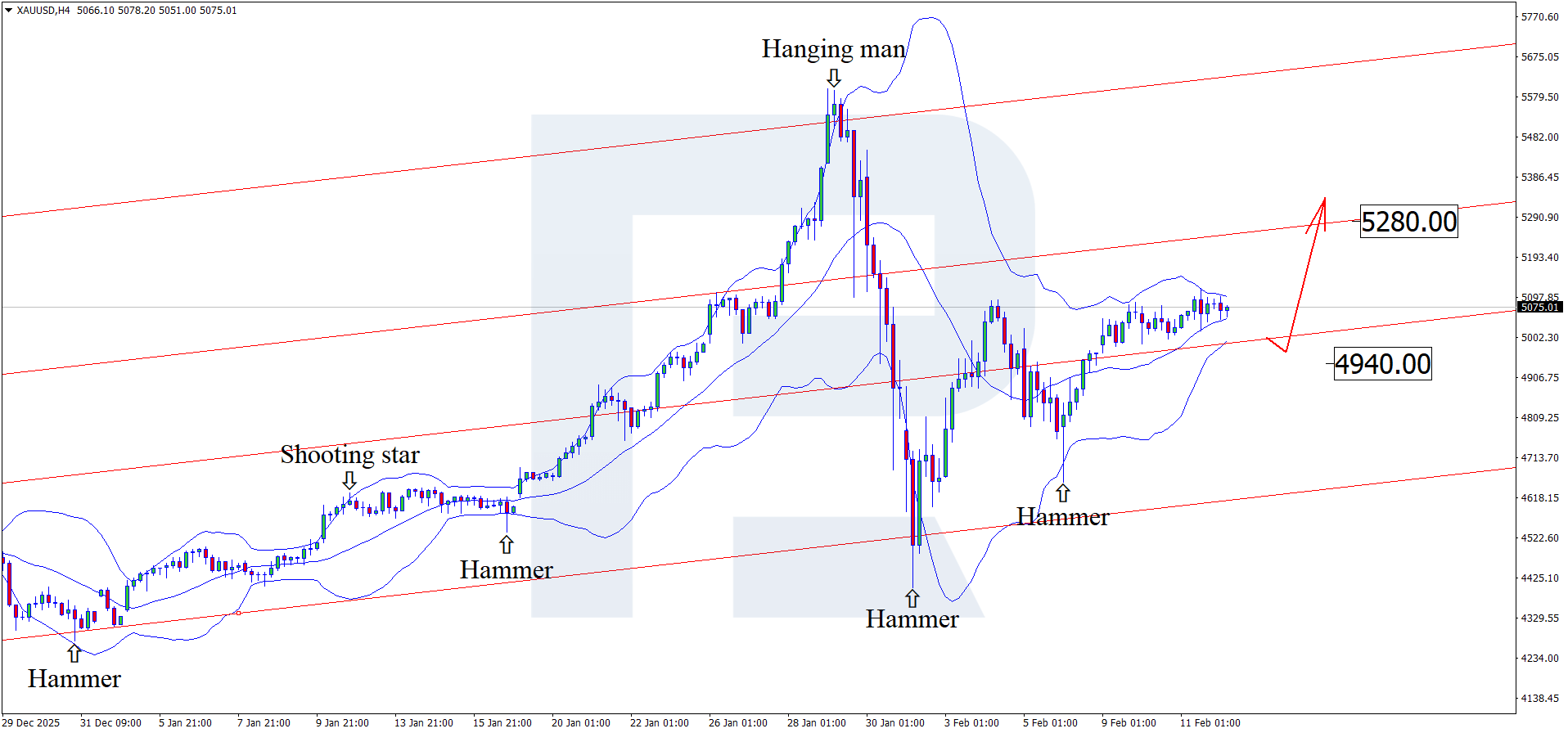

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the lower Bollinger Band and may continue their upward momentum following the pattern’s signal. Since XAUUSD quotes remain within an ascending channel, the next upside target could be 5,280 USD.

However, today’s XAUUSD technical analysis also considers an alternative scenario involving a correction towards 4,940 USD before further growth.

The uptrend is likely to continue, with XAUUSD prices potentially heading towards the next psychological level of 6,000 USD in the near term.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 5,280 and 5,560

- Key support levels: 4,775 and 4,500

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above 5,280 will confirm favourable technical conditions for opening long positions. Further movement may be impulsive, which is typical for the market after prices break out of consolidation. The risk-to-reward ratio exceeds 1:3.

- Buy Stop: 5,290 USD

- Take Profit: 5,560 USD

- Stop Loss: 5,200 USD

Alternative scenario (Sell Stop)

A consolidation below 4,940 will indicate increased selling pressure and a continuation of the corrective wave.

- Take Profit: 4,775 USD

- Stop Loss: 5,010 USD

Risk factors

The main risk to continued growth is the failure of XAUUSD quotes to consolidate above the 5,095–5,105 resistance zone, which could trigger a deeper correction. Additionally, aggressive actions by the Fed aimed at strengthening the USD may weigh on gold prices.

Summary

The actual Nonfarm Payrolls data failed to impress the market and did not help strengthen the USD. XAUUSD technical analysis suggests growth towards the 5,280 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.